Banks have long dictated how money flows, locking many investors out of lending and leaving savings stagnant. Traditional systems have also limited access to financing, exposed investors to rug pulls, and kept next-generation lending opportunities out of reach for average users. Missed bull runs and frustrating delays have driven countless individuals to search for smarter, safer ways to grow their wealth.

Many investors still feel trapped by banks and traditional lending systems, unable to access their own funds when they need them most. Locked assets, slow approvals, and missed bull runs leave users frustrated and anxious about lost opportunities.

Even in DeFi, tokens like stETH or rETH often sit idle, limiting flexibility and keeping users from exploring next-generation lending benefits. On Ethereum alone, over 33 million ETH, around 28% of the total supply, is staked, yet much of it remains locked, unable to generate additional opportunities for holders.

On most lending platforms, users must overcollateralize to borrow, tying up significant funds that earn little extra income. Conventional banks and outdated systems make it difficult to respond quickly to market shifts. In contrast, advanced next-generation lending options remain largely unavailable.

Unlike these legacy institutions that are riddled with problems, the Paydax Protocol (PDP) is emerging as the solution, offering next-generation lending that gives people control over their assets without relying on banks. Early investors can join the presale at the lowest entry point of $0.015, capturing gains before broader adoption hits.

Paydax Protocol (PDP) offers a powerful alternative to rigid banks by letting investors unlock liquidity from staked tokens and governance assets without unstaking. Its next-generation lending system transforms idle LP tokens and staked cryptocurrencies into usable capital, improving capital efficiency in DeFi lending. It enables everyday users to borrow against a wide range of assets, including tokenized real-world assets, rather than leaving opportunities solely for whales or top traders.

Security and reliability underpin this next-generation lending platform, with multi-sig wallets, stress testing, bug bounties, and emergency shutdown mechanisms protecting both borrowers and lenders. Investors can also participate in RWA lending while earning staking rewards, all without depending on centralized banks.

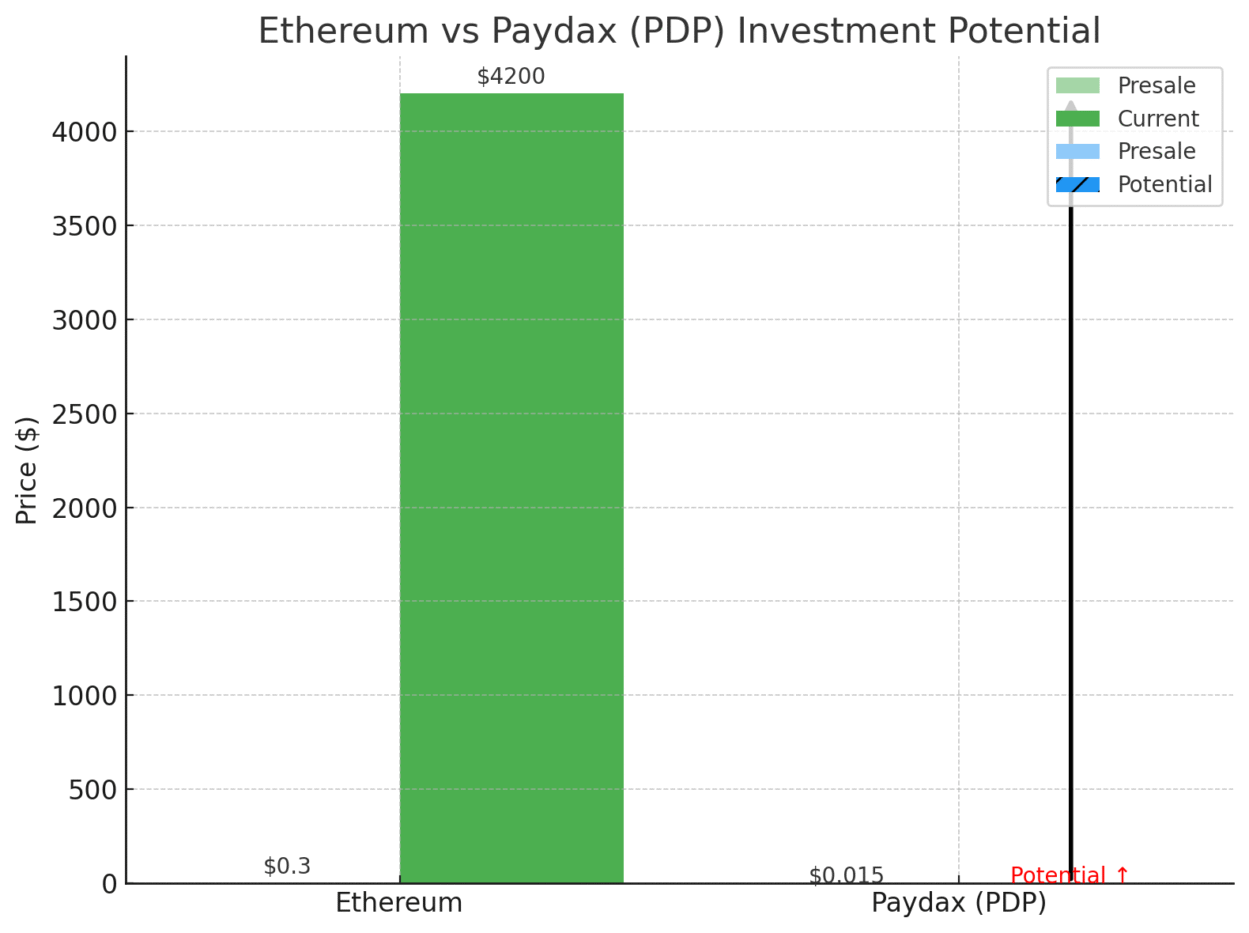

Early investors in crypto know that timing is everything. Just look at Ethereum: Early presale buyers acquired tokens for under $0.3, and today it trades around $4,200, netting over 1,399,900% gains. Paydax offers a similar opportunity, with the presale live at $0.015, giving early participants a chance to secure tokens with potential returns that could even surpass historical success stories.

By joining the presale now, investors position themselves to maximize gains while the project is still gaining traction. Early access also allows them to take advantage of unique features, staking rewards, and strategic opportunities before wider adoption drives up prices.

By joining the presale now, investors position themselves to maximize gains while the project is still gaining traction. Early access also allows them to take advantage of unique features, staking rewards, and strategic opportunities before wider adoption drives up prices.

Imagine holding 2 ETH worth $8,400. Usually, the only way to access that value would be to sell it, losing exposure to future growth. However, with Paydax Protocol (PDP), you can borrow up to $8,000 in stablecoins while keeping ETH securely staked, preserving long-term gains.

Now, picture a collector with a rare vintage car valued at $150,000. Tokenized and verified, it transforms into liquid funds without leaving the garage. Investors can fund these loans through Paydax’s peer-to-peer system, earning up to 15.2% APY from P2P lending, while the Redemption Pool offers insurance rewards up to 20% APY.

Paydax’s smart contract is audited by Assure-DeFi, giving early investors verified security and confidence that their funds are protected at every step. Here’s a breakdown of its key features, what each does, and how it supports next-generation lending solutions while challenging traditional banks.

| Security Layer | Description | Investors Benefit |

| Brinks Custody | Unlike traditional banks, Paydax offers decentralized, secure management of high-value collateral, including tokenized RWAs. | Confidence in asset safety and reduced risk of loss. |

| Sotheby’s Validation | Authentication of collectibles and luxury items, supporting next-generation lending opportunities. | Ensures borrowed assets are genuine and properly valued. |

| KYC Verification | The team is undergoing KYC with a top Web3 auditor. | Reduces risk of rug pulls and fraud. |

| Live Daap | Users can test the platform in real-time. | Transparency and trust in platform execution. |

| Smart Contract Audits | Future Certix audit in progress. | Reinforces code reliability and secure lending operations. |

| Fully Doxxed Team | The CEO, CFO, CMO, and devs are visible with office updates, podcasts, and AMAs. | Builds credibility, transparency, and community trust. |

Presales often define crypto fortunes, Ethereum proved it, and Paydax Protocol (PDP) offers the next opportunity at $0.015. This next-generation lending platform is set to replace traditional banks, offering on-chain banking, lending, and insurance, with Chainlink price oracles for real-time valuations.

Paydax’s work-token model ensures SEC compliance, supporting governance and ID verification rather than speculation. Early entry lets investors maximize significant returns, mitigate risk, and move beyond the limitations of traditional banks while embracing next-generation lending in a completely redefined way.

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

The post Paydax (PDP) Set To Replace Banks With Next-Generation Lending – How To Make The Most By Being An Early Investor appeared first on Blockonomi.

Also read: Lightning Strikes: The Value-For-Value Future of Money and Work