Bitcoin (CRYPTO: BTC) traded below $73,000 on Wednesday after briefly retesting the $79,500 level the day prior, as a softer tech backdrop ripples into crypto markets. The move mirrors a broader risk-off tilt that has been evident in the Nasdaq, where a weak sales outlook from chipmaker AMD (NASDAQ: AMD) and softer US payroll data turned investors away from high-beta assets. The price action underscores how crypto is not insulated from macro shifts, even as it trades in a market that remains highly sensitive to liquidity and leverage dynamics.

Bitcoin (CRYPTO: BTC) slid below $73,000 on Wednesday after briefly retesting the $79,500 level on Tuesday, a retreat that aligned with a broader risk-off move in equities led by a downbeat tech sector. The downturn followed a slide in the Nasdaq, reflecting weaker near-term demand signals from major tech companies and the spillover into risk assets beyond stocks. The pressure is not purely cyclical; it is reinforced by flows that have kept outflows from spot Bitcoin ETFs elevated in recent weeks.

The persistent outflows from spot Bitcoin ETFs add a layer of complexity to the price action. The daily rhythm of fund flows has remained negative, with an average net outflow running around $243 million since mid-January. That cadence coincided with Bitcoin’s rejection at the $98,000 level earlier in the month and helped set the stage for a roughly 26% correction over three weeks. In practical terms, the cascading effect of outflows has amplified liquidity stress for leveraged traders, and unless new margin is deposited, the most aggressive 4x or higher positions may have already seen their risk exposure largely eroded.

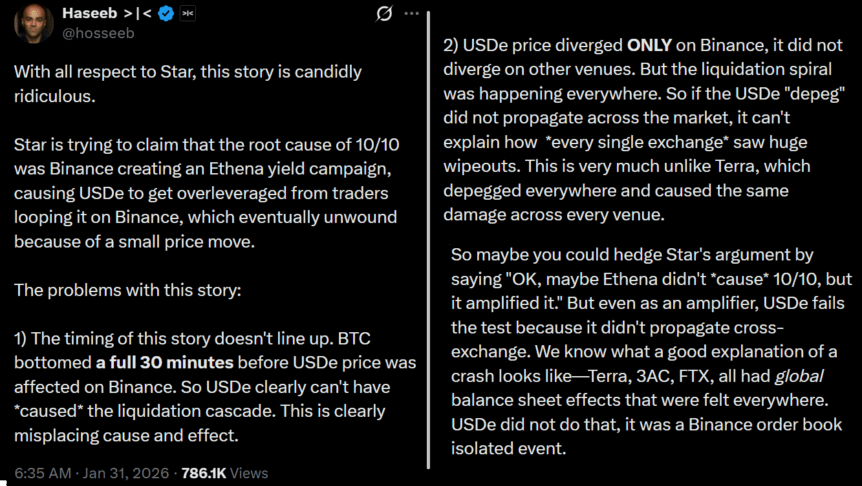

Another thread driving narrative risk is the potential for continued volatility in the broader crypto ecosystem. The market has faced a mix of volatile events and rumors about the health of counterparties. A longstanding concern is the possibility that outsized losses from a single event could cascade through liquidity-providing venues. One notable episode cited by market observers is the $19 billion liquidation tied to a mid-October 2025 incident that reportedly originated from a performance glitch in Binance’s data feeds, which delayed transfers and fed inaccurate price signals. Binance acknowledged fault and subsequently issued compensation, but the episode left a lasting impression on risk controls across the space.

In conversations with industry participants, Haseeb Qureshi, managing partner at Dragonfly, described the October 2025 event as a case study in how liquidations can hit market-makers and liquidity providers. “Liquidation engines kept firing even when liquidity could not be absorbed, wiping out market makers and forcing a protracted recovery,” he noted. He added that while the crash did not permanently break the market, a return to normal functioning would require time and a repricing of risk for market participants who relied on aggressive leverage. The sentiment among traders is one of cautious realism: the market has recovered from prior shocks, but the path remains bumpy and contingent on liquidity and macro conditions.

Beyond pure price action, the options market provides a lens into how professionals are positioning for further downside. The 30-day delta skew for Bitcoin 25% delta puts against calls rose to about 13% on Wednesday, signaling that demand for downside protection remains elevated and that even seasoned traders are not confident a durable bottom has formed around the $72,100 level. In practice, a skew above several percent is interpreted as a signal that informed participants are bracing for additional weakness, rather than a swift reversal. The data point, sourced from Deribit through Laevitas, underlines a market that is hedging against a continued drawdown rather than embracing a V-shaped recovery—at least in the near term.

The broader macro backdrop has not yet clarified the near-term trajectory for crypto markets. A key question remains whether spot ETF outflows will persist or abate in the weeks ahead, and how that will interplay with liquidity conditions across major crypto venues. Onchain noise and counterparty concerns continue to simmer, but the market has shown time and again that it can adapt to shocks—though not without interim pain for those exposed to highly leveraged bets.

The current sequence of ETF outflows, leveraged liquidations and hedging activity paints a portrait of a market in transition. It highlights how entrenched leverage remains in some segments of the Bitcoin ecosystem and how quickly liquidity can tighten when risk appetite cools. For traders, the combination of elevated downside hedges and growing suspicion about the sustainability of rallies underscores the importance of margin discipline and robust risk controls. For market-makers and liquidity providers, the episode serves as a reminder that crypto markets still rely heavily on automated liquidation mechanisms that can amplify short-term moves during stress, even as the broader market has learned to rebound from past crises.

From a broader perspective, these dynamics unfold within a sector that remains highly sensitive to outside forces—tech stock sentiment, central-bank policy expectations, and regulatory developments all feed into crypto liquidity. The outflows from spot Bitcoin ETFs—paired with a demand for downside protection in options markets—suggest a risk-off impulse that could persist if macro data continues to disappoint or if equity sell-offs intensify. Yet the history of Bitcoin and other digital assets shows resilience: even after sharp declines, recovery tends to follow, driven by new demand fundamentals and tail-risk hedging strategies that gradually re-enter the market.

For users and builders, the current environment emphasizes the need for clarity around risk models, improved liquidity infrastructure, and more robust stress-testing across venues. It also underscores the value of transparent communications from major counterparties and a cautious approach to leverage, given how quickly market dynamics can shift in crypto ecosystems.

Bitcoin (CRYPTO: BTC) has faced renewed downward pressure as liquidity constraints and risk-off sentiment took hold. The failure to sustain a breakout near the $80,000 level—and the subsequent retreat to the mid-$70,000s—came amid a familiar pattern: outsized ETF outflows, a sharp squeeze on leveraged long positions, and rising skepticism among professional traders about a rapid bottom. The narrative has shifted away from a straightforward macro-driven rally toward a more nuanced story about risk management, liquidity provisioning, and the mechanics of how markets absorb shocks in a highly interconnected, cross-asset ecosystem.

Two notable developments stand out as the market adjusts: first, the swing in option hedging signals shows that seasoned traders are actively protecting against further declines, not simply chasing a rebound. The delta skew, a gauge of put versus call demand, has moved higher, highlighting the demand for downside protection in a climate where tech equities are under stress. Second, while the rumor mill churns with talk of large liquidations and counterparty concerns, on-chain and public disclosures suggest a more nuanced picture of counterparty health and liquidity at major venues. The market remains attentive to any fresh data about exchange resilience and the speed with which risk controls can recalibrate after a sell-off.

As traders weigh the near-term path, the interplay between ETF flows, derivatives positioning, and counterparty risk continues to be the defining feature of Bitcoin’s price action in the current cycle. The consensus remains unsettled: the market has a history of snapping back after downturns, but the path to normalization can be long and episodic, with interim pain for those positioned for a quick recovery. The coming weeks will be closely watched for changes in liquidity conditions, regulatory guidance, and the pace at which market participants adjust their risk tolerances in response to evolving macro signals and internal risk controls.

This article was originally published as $2.9B Bitcoin ETF Outflow Signals Downside as Bearish Futures Loom on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Also read: Google’s Gemini AI Predicts the Price of XRP, Ethereum and Solana By the End of 2026