Bitcoin is at $112,870, down 2.46% in the last 24 hours, with a market cap of $2.24 trillion. Despite the pullback, people are starting to think US banks will open the floodgates to mainstream adoption soon. Alessio Quaglini, CEO of Hong Kong-based Hex Trust, says regulation is the last hurdle to full institutional participation.

“Give it a few months, every single bank in the U.S. will provide custody services for Bitcoin,” Quaglini said in a recent interview. “That’s when we’ll have real adoption—when banks start offering Bitcoin deposits, trading, and structured products.”

His view reflects a growing belief that once U.S. regulators finalize rules, the banking sector will follow swiftly. While banks worldwide have run pilots, few have gone live without clear U.S. approval. Quaglini calls American oversight the “global benchmark” that sets the tone for financial markets everywhere.

Founded in 2018, Hex Trust offers custody, trading, lending, and staking services to large institutions. Licensed in Hong Kong, Singapore, Dubai, and Europe, the firm has scaled rapidly—growing from $300,000 in seed funding to more than 200 employees and over a million end-users via institutional partnerships.

The company raised $6 million in Series A funding in 2021 and aims to hit $20 million in revenue by 2025, with long-term ambitions of hundreds of millions and a potential IPO. “We want to be the J.P. Morgan of Asia in crypto,” Quaglini said.

He also sees stablecoins as a parallel disruptor, predicting they will replace the SWIFT network for cross-border payments. “They’re faster, cheaper, programmable money,” he added, warning that traditional remittance firms like Western Union could struggle as adoption accelerates.

Hex Trust’s strategy contrasts with U.S.-listed peers such as Coinbase and Galaxy Digital. While those firms rely heavily on retail trading fees or proprietary trading income, Hex Trust focuses on institutional custody to limit exposure to volatility.

Technically, Bitcoin has broken down from the channel, below $116,000 support and now at $112,900, close to the 200-EMA at $113,450. The decline produced long red candles like a three black crows pattern, which often means more weakness to come.

The RSI is 26, oversold, but we need confirmation via bullish engulfing or hammer candles before calling a reversal. Immediate support is at $113,450, then $110,820 and $108,770. Resistance is at $115,000-$116,200, where a breakout could propel us to $117,900 and $119,300.

For now, aggressive traders can short below $115,000 with stops above $116,200. More cautious traders can wait for a confirmed reversal at $110,800 before getting long. Despite the near-term bearish pressure, the longer term trend of higher lows since summer is still intact, so we could see a bounce to $120,000.

As Quaglini says, US regulatory clarity will be the ultimate catalyst. Once banks add Bitcoin to mainstream finance, Wall Street will enter the party and drive the next big move. For investors, the message is clear: the window to position before banks and institutions pile in is closing.

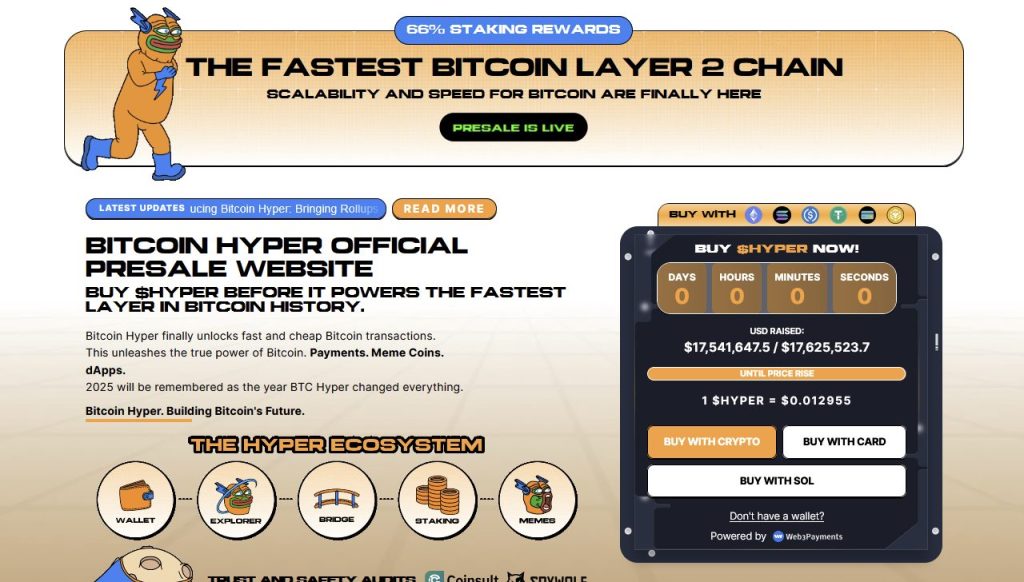

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.5 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012955—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: Crypto CEO Says Every US Bank Will Soon Hold BTC – Get In Before Wall Street Does appeared first on Cryptonews.

Also read: Binance delists NEIRO: Panic selling causes 25% crash