Bitcoin trades at $112,737, down 2.34% in the last 24 hours, with a market cap of $2.24 trillion and daily turnover above $70 billion. Despite the dip, the narrative around institutional adoption remains strong.

Ethereum briefly stole the spotlight after BitMine Immersion, led by Tom Lee, purchased $1.1 billion worth of ETH, making it the largest public Ethereum holder. That move triggered a 10% dip in BitMine’s shares, as market participents digested both the buying and a new equity raise.

Whereas, Bitcoin (BTC) slipped roughly 2.5% as capital rotated toward ETH. Yet BTC managed to hold above $112,000, a level traders view as a resilience marker.

On the other hand, Japan’s Metaplanet also expanded its Bitcoin treasury with 5,419 BTC worth $633 million. It has raised total to 25,555 BTC valued at nearly $3 billion. That makes it the fifth-largest corporate holder worldwide, even as its stock faces short-term selling pressure.

Meanwhile, Michael Saylor’s Strategy added 850 BTC for $100 million after the Fed’s rate cut, pushing its holdings to 639,835 BTC worth $47.3 billion.

The US Federal Reserve’s 25-basis-point rate cut has once again revived liquidity expectations. It’s encouraging institutional balance sheets to expand crypto allocations. While smaller in scale than past purchases, Strategy’s $100 million buy underscores ongoing conviction.

Saylor argues that Bitcoin’s reduced volatility, far from being a weakness, signals maturity and institutional comfort.

Metaplanet’s rapid accumulation also reflects a broader trend of Asian corporates seeking BTC as a hedge against currency risks. Despite short-term stock pullbacks, the firm’s Bitcoin (BTC) yield has already reached 10.3% in under three months, reinforcing market confidence in crypto treasuries.

On the technical front, the BTC/USD price chart displays a head-and-shoulders reversal after the $115,000 support level was breached and the price slipped from its rising channel. Price is testing the 200-EMA at $113,450, a critical pivot level. Failure to recover it could drag BTC toward $110,850, with deeper support at $108,750 and $107,250.

Momentum indicators lean bearish. The RSI at 31 signals oversold conditions, but without bullish confirmation—such as a hammer or engulfing candle—buyers remain cautious. A clean rebound above $114,750–$116,150 would shift sentiment, opening the path back to $118,000.

For now, aggressive traders may short below $115,000, while patient investors might wait for confirmation near $110,800. The longer-term structure of higher lows since summer remains intact, suggesting the current dip may be an accumulation zone.

With corporate buyers active and regulatory clarity improving, Bitcoin could recover lost ground and position for a renewed rally toward $120,000 and beyond as 2026 approaches.

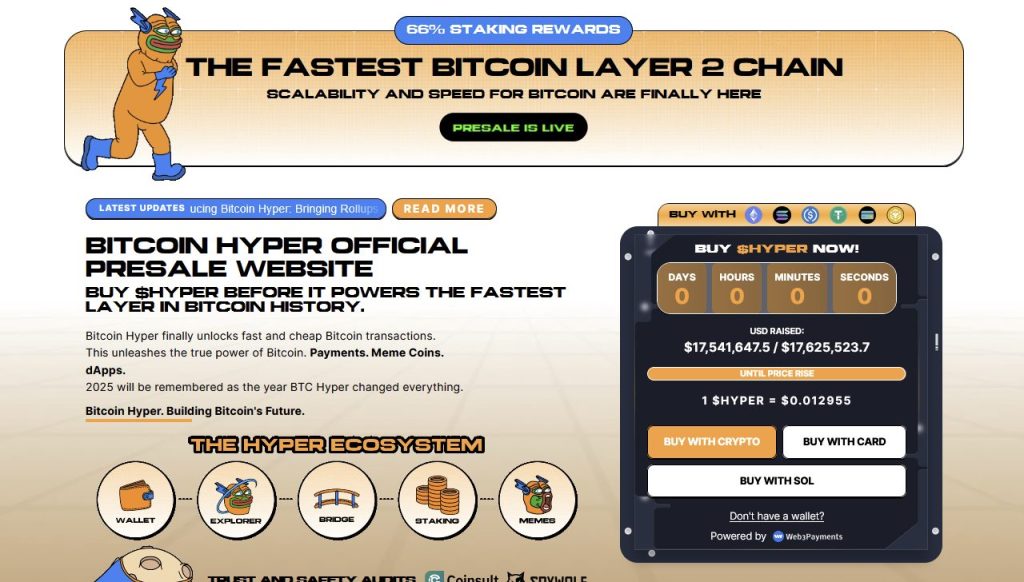

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.5 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012955—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: BTC Hits $112K—Trap for Bears or Buy Signal Ahead? appeared first on Cryptonews.

Also read: Argentina’s Economic Crisis: President Milei Considers Dollarization Amid Peso Collapse