Bitcoin’s performance in November is historically a pivotal period, with the cryptocurrency often experiencing its strongest gains of the year. Since 2013, Bitcoin has averaged a 42.51% increase during this month, opening the possibility that the digital asset could surpass $160,000 if this trend repeats. However, analysts caution that broader macroeconomic factors may influence this potential surge, adding layers of complexity to the market’s trajectory.

As the world’s premier cryptocurrency enters its most volatile and potentially rewarding month, investors are closely monitoring key geopolitical and economic developments. Market sentiment remains bullish, especially if macroeconomic policies favor risk-on assets like Bitcoin and Ethereum, which stand to benefit from lower interest rates and expansive monetary policies.

A high-profile meeting between U.S. President Donald Trump and Chinese President Xi Jinping on Thursday signaled a possible thaw in ongoing trade disputes—an encouraging sign for the global economy. The leaders agreed to reduce tariffs on China, in exchange for Beijing’s crackdown on fentanyl production, a resumption of U.S. soybean imports, and a one-year halt on restrictions of rare earth exports.

Trump expressed optimism about reaching a comprehensive trade deal, stating, “I expect a trade deal with China pretty soon.” Historically, tensions such as threatened tariffs have caused market volatility, including significant crypto liquidations, like the $19 billion wiped out during the October 11 crash. This event highlighted how geopolitical uncertainty can dampen market sentiment, with some experts describing the recent talk as merely a “pause” in the trade war rather than a resolution.

Meanwhile, analysts note that any resolution in trade tensions could serve as a tailwind for the cryptocurrency market, bolstering investor confidence and institutional entry.

Recent decisions by the Federal Reserve to cut interest rates by a quarter point have lowered the benchmark rates to their lowest in three years. The upcoming Fed meeting on December 10 will be crucial, with market expectations of a potential rate cut priced in at 63%. Fed Chair Jerome Powell’s comments signaling uncertainty have kept traders cautious.

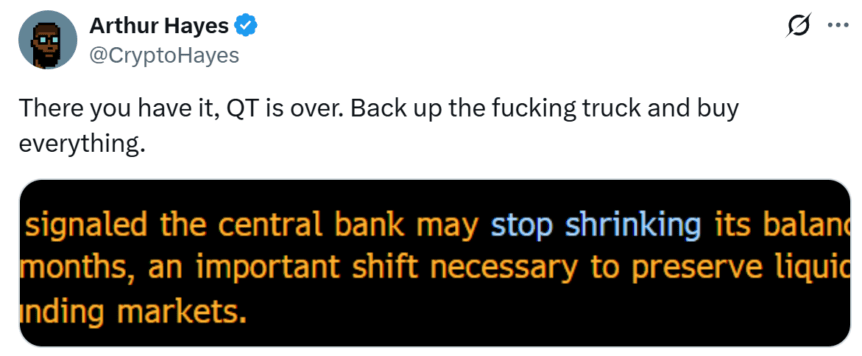

Lower rates typically stimulate risk assets, including cryptocurrencies, by reducing borrowing costs and encouraging investment. Besides rate cuts, the Fed’s planned cessation of its quantitative tightening (QT) program on December 1 could lead to an influx of liquidity into the markets, further supporting crypto prices.

The reversal of quantitative tightening to quantitative easing (QE) injections into the economy could further stimulate crypto markets, as new liquidity often finds its way into alternative assets like Bitcoin and NFTs.

The prolonged government shutdown, approaching its fifth week, continues to weigh on investor sentiment. The deadlock between Democrats and Republicans over spending bills hinders progress on crypto-friendly legislation, including ETF approvals and regulatory clarity measures like the Crypto Law and the CLARITY Act.

Recently, former President Trump called for the abolition of the Senate filibuster, calling attention to political divisions that could delay these critical policy advancements. The resolution of the shutdown could unlock positive momentum for the crypto sector, with increased regulatory clarity expected to attract institutional interest.

This article was originally published as Bitcoin Surges in Its Biggest Month of Growth Following Red October on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Also read: Coinbase Plans $2B Acquisition of a Leading Stablecoin Payments Firm