BitMine Immersion Technologies has raised $365 million to expand its ETH holdings, and is now controlling over 2% of the Ethereum supply.

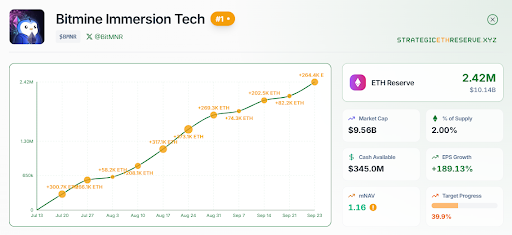

BitMine Immersion Technologies, chaired by Tom Lee, now controls more than 2% of Ethereum’s total supply. The company disclosed 2,416,054 ETH in its treasury, worth $10.9 billion at current prices.

This makes BitMine the largest public holder of Ethereum globally, as it inches closer to controlling 5% of the total ETH supply.

BitMine announced a securities purchase agreement with an institutional investor. The deal included 5.22 million shares of common stock at $70 per share, about 14% above the September 19 closing price.

It also included warrants for 10.4 million additional shares at $87.50.

UPDATE:

BITMINE JUST BOUGHT OVER $1 BILLION IN ETHEREUM LAST WEEK.

THEY NOW OWN MORE THAN 2% OF THE ENTIRE SUPPLY.

ARE YOU STILL FADING $ETH? pic.twitter.com/fJDxC4W5Li

— Merlijn The Trader (@MerlijnTrader) September 22, 2025

The stock sale raised $365 million in immediate proceeds. Warrants could bring another $913 million, and could possibly generate $1.28 billion in total funding.

Lee said the funds would mostly be used to expand Ethereum holdings. He described the premium pricing as “materially accretive” to existing shareholders.

Institutional investors showed strong demand for BitMine shares. Lee noted that Wall Street’s adoption of blockchain is creating a new growth cycle for Ethereum.

Cathie Wood’s ARK Invest also acquired 101,950 shares of BitMine earlier in September. This came after previous ETH purchases by BitMine, including a $200 million acquisition earlier in the month and a $65 million buy earlier in September.

Lee pointed out that these actions show confidence in Ethereum as a long-term corporate treasury asset.

BitMine’s ETH holdings make it the top corporate Ether treasury around the world. Strategic ETH Reserve data shows that the company leads the market, with SharpLink Gaming’s 838,150 ETH second in line.

Combined crypto, cash and equity assets of $11.4 billion now set BitMine up as one of the largest crypto treasury firms around the world.

On the other hand, Strategy Inc., led by Michael Saylor, continues to hold the largest corporate crypto treasury, focused mainly on Bitcoin.

BitMine has steadily increased its Ethereum holdings throughout September. The company bought 46,255 ETH after a $200 million purchase. By September 2, it held 1.5% of all Ether supply.

The new stock sale allows BitMine to continue building its position.

Lee pointed out Ethereum’s role as the main platform for defi, smart contracts, and AI-powered blockchain initiatives, and this strategy targets corporate treasury diversification.

At this point, even a small increase in BitMine’s ETH holdings can affect market sentiment. Analysts say that this rate of corporate accumulation of Ethereum shows investor confidence in the asset.

$BMNR Bitmine Immersion Technologies (BMNR): Assessing Valuation as Ethereum Treasury and Share Buyback Spark Investor Interest – Yahoo Finance #stocks #news pic.twitter.com/MJC0BndK30

— Stock Ticker ZONE (@StockTickerZone) September 23, 2025

The premium stock sale also indicates institutional trust. Investors are willing to pay above-market prices to gain exposure to Ether via a regulated, publicly traded company.

Lee believes that combining blockchain adoption, AI, and corporate treasury strategies could create a supercycle for Ethereum.

Such developments may encourage other companies to add crypto to their treasury portfolios.

The post BitMine ETH Holdings Grow with $365M Stock Sale appeared first on Live Bitcoin News.

Also read: Crypto Market Update Sept 24: Fear and Greed Index Signals “Fear”