Brera Holdings PLC has announced a $300 million private placement to establish Solmate, a Solana-based digital asset treasury and crypto infrastructure company.

The offering, which was oversubscribed, is backed by ARK Invest, the Solana Foundation, early Solana backers RockawayX, and prominent UAE investors.

The deal was sponsored by UAE-based Pulsar Group, a blockchain advisory and investment firm.

The rebranded Solmate will pursue a dual listing on Nasdaq and a UAE exchange while continuing to operate Brera’s existing multi-club sports ownership business.

According to the company, Solmate will focus on accumulating and staking Solana’s native token, SOL, alongside building new revenue streams from Solana-based infrastructure.

Marco Santori, former Chief Legal Officer at Kraken and a long-time figure in digital asset law, has been named Solmate’s Chief Executive Officer.

Santori is known as one of the earliest pioneers of digital asset treasury companies, having helped launch the first altcoin treasury listed on Nasdaq.

The Solmate board will include Dr. Arthur Laffer, the economist credited with creating the “Laffer Curve,” and Viktor Fischer, CEO of RockawayX, a digital asset investment firm managing around $2 billion. The Solana Foundation will also have the right to appoint two directors.

The company said its long-term strategy includes building Solana validator infrastructure in Abu Dhabi. This will allow regional investors direct access to Solana’s native yield through a high-performance validator, marking the first of its kind in the Middle East.

Solmate stated that deploying bare metal servers in the UAE will set it apart from traditional digital asset treasuries, which typically rely only on token accumulation.

Solmate emphasized that the $300 million will not only fuel the acquisition of SOL but also drive the establishment of yield-generating projects in the region.

The initiative aligns with the UAE’s broader digital transformation agenda, which has made blockchain technology a strategic priority.

Solana has gained recognition as one of the fastest-growing blockchains globally, with more on-chain revenue and processed transactions than any other network.

Unlike Bitcoin, Solana offers native yield opportunities through staking, a feature Solmate aims to capitalize on as part of its strategy.

Industry forecasts suggest that Solana could outpace both Bitcoin and Ethereum over the next three years as developer activity on the network continues to accelerate.

In a statement, Solmate’s leadership underscored their confidence in Solana’s ecosystem. “Our stakeholders have deep, long-term conviction in Solana and will demand that we accumulate SOL through bull and bear markets alike,” Santori said.

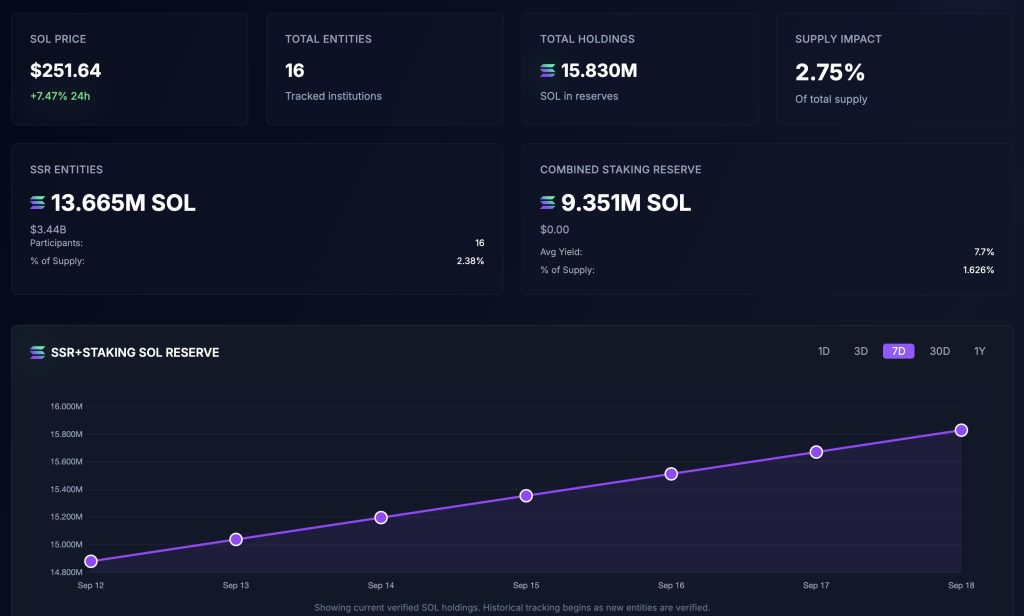

Corporate treasuries holding Solana have crossed the $4 billion mark, according to data from the Strategic Solana Reserve (SSR).

The tracker shows that 16 institutions now hold a combined 15.83 million SOL, representing 2.75% of the token’s circulating supply.

Forward Industries leads with more than 6.8 million SOL, valued at $1.61 billion, positioning itself as the largest Solana treasury holder. Other companies such as Sharps Technology, DeFi Development Corp., and Upexi each hold close to 2 million SOL, worth over $400 million apiece.

The wave of accumulation is being fueled by aggressive moves from major players. On September 15, Galaxy Digital bought $306 million worth of Solana in a single day, acquiring 1.2 million tokens that were transferred to custody provider Fireblocks.

In September, Over five days, Galaxy amassed 6.5 million SOL, valued at $1.55 billion, making it one of the most active corporate buyers.

Forward Industries has doubled down on its Solana strategy, filing a $4 billion at-the-market equity program with the U.S. Securities and Exchange Commission on September 17.

The program, handled by Cantor Fitzgerald, will raise funds for further Solana purchases and general corporate purposes.

Earlier this month, Forward closed a $1.65 billion private placement that funded its initial 6.8 million SOL acquisition.

Other firms are also entering the market. Canada’s SOL Strategies debuted on Nasdaq under the ticker STKE with $94 million in holdings, becoming the first Solana-focused public company in the U.S.

Meanwhile, Helius Medical Technologies announced a $500 million private investment led by Pantera Capital, with warrants potentially lifting its Solana treasury to $1.25 billion.

The post Solmate $300M Bet: UAE to Launch First Solana Validator with Nasdaq Listing appeared first on Cryptonews.

Also read: NEAR protocol price surges as AI Tokens jump on Nvidia’s $5 Billion intel bet