Buyers are stepping in cautiously, hinting at the possibility of a gradual recovery. Price action suggests the token is gearing up for a move that could bring renewed momentum. Traders are watching closely as the token teeters between consolidation and a potential breakout.

Analyst Xmen(@Xmen__charts) points out that the asset has been consolidating just above $0.65 on the weekly chart, a key level where buyers have shown resilience.

This support level acts as a crucial base that could set the stage for the next upward leg. The current range between $0.65 and $1.90–$2.00 outlines where the price could dance for some time before a decisive breakout.

Source: X

Right now, OP is hovering around $0.72, showing early signs of a comeback. The expected move is a steady climb toward higher resistance levels as buying pressure builds. However, if the $0.65 support fails, the path may lead down toward $0.39, marking a shift to a more bearish outlook.

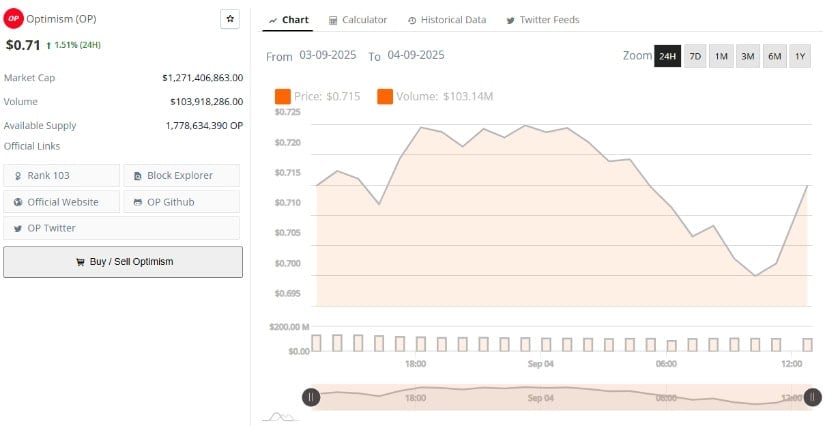

On one hand, BraveNewCoin data reveals OP trading near $0.71 after a 1.5% gain over 24 hours, supported by a market cap of roughly $1.27 billion and an active trading volume of about $104 million. This volume illustrates healthy liquidity, with nearly 1.8 billion tokens in circulation, reflecting vibrant buyer-seller participation.

Source: BraveNewCoin

The token’s intraday price swings—peaking at around $0.725 before settling near $0.71 suggest a market balancing profit-taking and renewed interest. Holding above the psychological $0.70 is encouraging and could clear the way for a push toward $0.75. Conversely, a dip below this could test lower supports.

At the time of writing on the daily TradingView chart, the token trades around $0.70 after slipping 2.6%. The token faces resistance near $0.80 to $0.95 and key support around $0.46, depicting a market in a holding pattern. Momentum indicators like MACD show mild bearish signals, but the bearish strength appears to be slowing.

Source: TradigView

The slightly negative Chaikin Money Flow confirms light selling pressure, though not overwhelmingly so. If the memecoin holds above $0.68–$0.70, it may rebound toward the $0.80 zone; failing that, deeper retests could happen. The coming days will be crucial as traders monitor whether buyers can solidify control and push the price higher.

Optimism stands at an important crossroads, with support holding steady and momentum cautiously building. How the token performs around $0.65 and $0.70 will likely dictate whether a broader recovery unfolds or if pressures mount for another leg down. Traders should watch volume and momentum closely to catch early signs of direction.

Also read: Stablecoin Adoption Explodes: Fireblocks Unveils Payment Network With Stripe Bridge, Circle, 40+ Firms