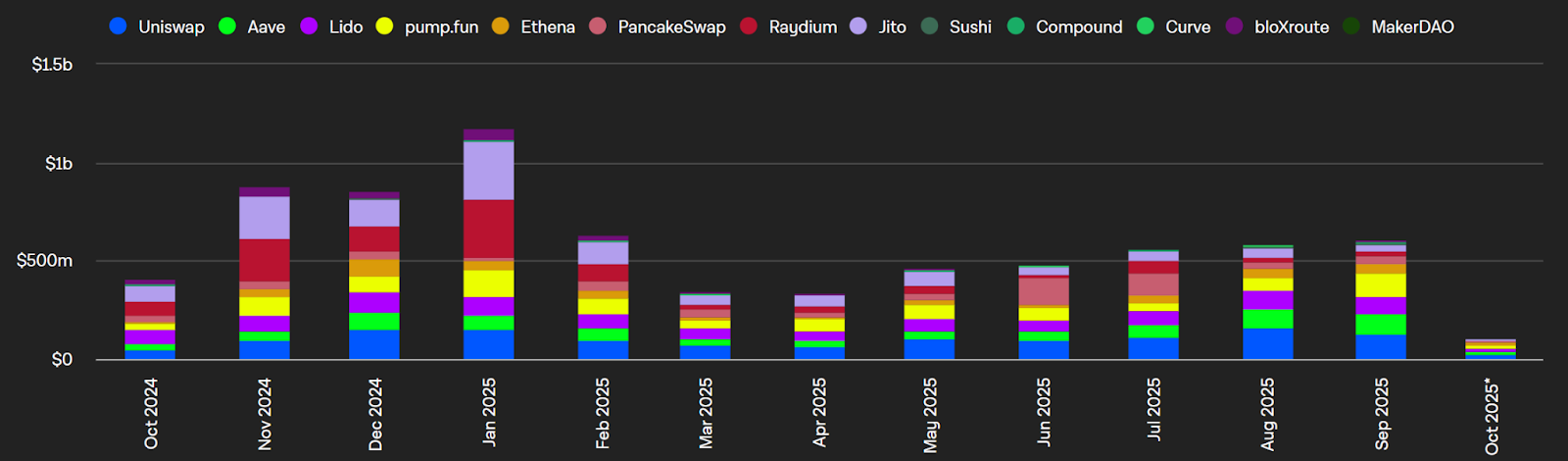

DeFi fee revenue rebounded in September to roughly US$600 million (AU$918 million), up from a 12-month low of US$340 million (AU$520 million) in March.

The six-month gain is 76%, with Uniswap, Aave, and Ethena leading in fee and revenue generation (excluding stablecoins), according to data from The Block.

As shown in the graphic above, the gains have been steady monthly, mostly due to protocols realising that maybe it’s best to shift tokenomics from speculative narratives like memes toward revenue-linked mechanics that have more long-term sustainability.

For instance, buyback programs are being adopted to align with metrics familiar to traditional investors amid rising institutional participation. Ethena, Ether.fi, and Maple are piloting similar value-accrual schemes as buyback proposals clear tokenholder votes, indicating wider uptake across DeFi.

Yet tokens remain distinct from equity. They can carry governance rights, access, and network utility in addition to value-accrual features. If revenue-based tokenomics continue to spread, fundamental metrics are set to play a larger role in valuation than in prior cycles.

Related: New York Lawmakers Push Tax on Bitcoin Miners Over Energy Use

Data from DefiLlama shows the total value locked (TVL) in DeFi is almost at its 2021 peak, currently at US$174 billion (AU$262 billion). This surge is driven by on-going traction across multiple ecosystems, including Solana and Aave, which will soon launch its V4 upgrade, bringing new market and liquidation mechanics.

Meanwhile, Solana is moving forward with several proposals following the network’s Alpenglow upgrade, which will bring a much higher performance and user experience (more Web2-like).

Another catalyst for DeFi’s recent surge is the amount of capital moving into decentralised perpetuals, with giants like Hyperliquid dominating the market share with over US$272 billion (AU$411 billion) in volume in the last 30 days.

It should be noted that Hyperliquid has a new rival, Aster, the new decentralised exchange (DEX) that had an astronomical rise in a short time. However, its native token recently plunged after DefiLlama’s founder questioned the protocol’s reliability of its reported volumes, as Crypto News Australia reported.

Related: Bitcoin Makes New All-Time High at $125k, Amid Record ETF Flows

The post DeFi Fees Surge 76% to $600M as Protocols Pivot Toward Sustainable Tokenomics appeared first on Crypto News Australia.

Also read: BlackRock's IBIT Bitcoin ETF Hits $100B in 435 Days — Unstoppable