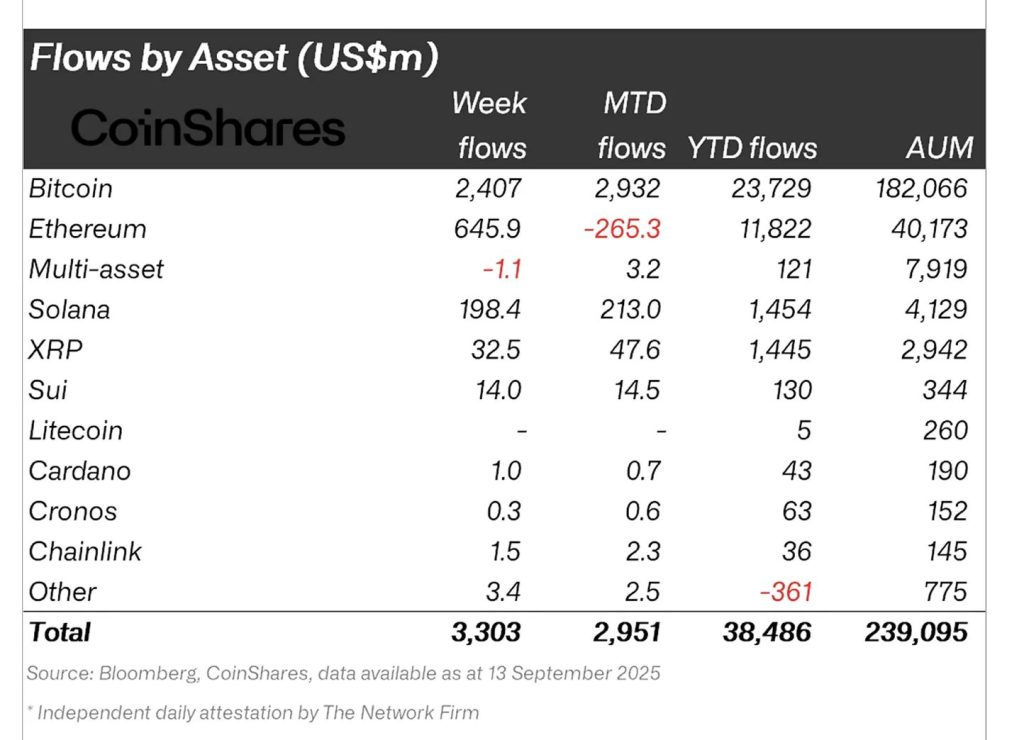

Digital asset investment products returned to strong inflows last week, with $3.3 billion added, according to the latest report from CoinShares.

The renewed appetite came after weaker-than-expected U.S. macroeconomic numbers, which bolstered demand for alternative assets. End-of-week price gains across the sector lifted total assets under management (AuM) to $239 billion, close to August’s all-time high of $244 billion.

The rebound shows growing institutional interest in digital assets after a period of subdued flows, suggesting investors see them as both a hedge and a growth opportunity amid uncertain macroeconomic conditions.

Regionally, the United States led by a wide margin, recording $3.2 billion in inflows. Germany followed with $160 million, reflecting strengthening European investor sentiment toward digital assets. Notably, Germany’s Friday inflows ranked as the second-largest daily inflows on record for the country.

However, not all regions shared the positive momentum. Switzerland saw $92 million in outflows, highlighting that investor sentiment remains mixed across certain European markets despite the broader recovery.

Bitcoin continued to dominate inflows, attracting $2.4 billion, the largest weekly inflow since July. Meanwhile, short-bitcoin products recorded modest outflows, pushing their AuM down to just $86 million, as bearish bets subsided.

Ethereum also staged a notable turnaround. After eight consecutive trading days of outflows earlier this month, the asset recorded four straight days of inflows last week, totaling $646 million. This marked a significant shift in investor sentiment, with Ethereum positioning itself as a key beneficiary of renewed optimism.

Solana delivered one of the week’s standout performances, marking its largest-ever single-day inflow on Friday with $145 million. Across the week, Solana products attracted a total of $198 million, underscoring rising institutional confidence in the blockchain’s growing ecosystem.

While Bitcoin, Ethereum, and Solana led the way, other altcoins experienced more muted activity. Aave saw outflows of $1.08 million, and Avalanche registered $0.66 million in outflows. These figures suggest that investors are consolidating around the larger, more established tokens, at least in the near term.

With total assets under management approaching record highs once again, the latest inflow data highlights a strong shift in sentiment toward digital assets.

If momentum continues, particularly in flagship assets like Bitcoin and Ethereum, the market could surpass its previous peak and usher in a new phase of institutional adoption.

CoinShares International Limited, announced a landmark move to list on the Nasdaq Stock Market in the United States through a $1.2 billion merger with Vine Hill Capital Investment Corp.

The transaction is expected to close by the end of the fourth quarter of 2025. On completion, securities of CoinShares and Vine Hill will be exchanged for shares in a new combined company, Odysseus Holdings Limited.

The post Digital Asset Inflows Hit $3.3B, Lifting AuM to $239B as Bitcoin, Ethereum, and Solana Surge: CoinShares appeared first on Cryptonews.

Also read: BitMEX Launches Alpha Showdown Trading Competition Featuring 3 BTC Prize Pool and Additional Rewards