Ethereum is attracting serious liquidity. Over the past week alone, the network absorbed $6.7 billion in stablecoin inflows, a larger amount than many chains manage in years. That brings Ethereum’s total stablecoin base to $145B+, more than half of the entire market, solidifying its position as crypto’s settlement layer for dollar-backed tokens.

This matters because stablecoin inflows often act as dry powder, ready to rotate into ETH or other assets once sentiment shifts.

At the same time, institutional demand is picking up. Ether ETFs, particularly BlackRock’s spot product, have seen steady growth in assets under management, showing that regulated structures are becoming a gateway for professional investors.

On the macro side, the U.S. economy is slowing, and expectations for Fed rate cuts later this year are rising. Looser financial conditions tend to benefit crypto, while stablecoin policy momentum in Washington is adding legitimacy to Ethereum’s role as the backbone of tokenized dollars.

Layer-2 networks are also expanding throughput and reducing costs, which continues to strengthen ETH’s long-term adoption case.

Key highlights:

At the time of writing, Ethereum price prediction is neutral as ETH trades near $4,305, consolidating inside a descending triangle that has capped upside since late August. Sellers lean on resistance at $4,490, while buyers defend a triple-bottom support near $4,250.

The 50-SMA ($4,363) is acting as immediate resistance, with the 200-SMA ($3,885) anchoring the broader trend. The RSI at 47 is neutral but not oversold, leaving room for a breakout.

If ETH clears $4,490 with conviction, the path opens toward $4,665 and the $4,865 zone, which aligns with its all-time highs.

A bullish engulfing or three white soldiers formation would confirm momentum. On the downside, losing $4,250 risks a drop to $4,070 and potentially $3,940–$3,785.

For traders, the setup is clear: a long entry above $4,490 with stops under $4,250 could target $4,665–$4,865 in the near term. With record stablecoin inflows, ETF demand, and improving macro conditions, Ethereum’s case for a $5,000 breakout this cycle looks stronger than ever.

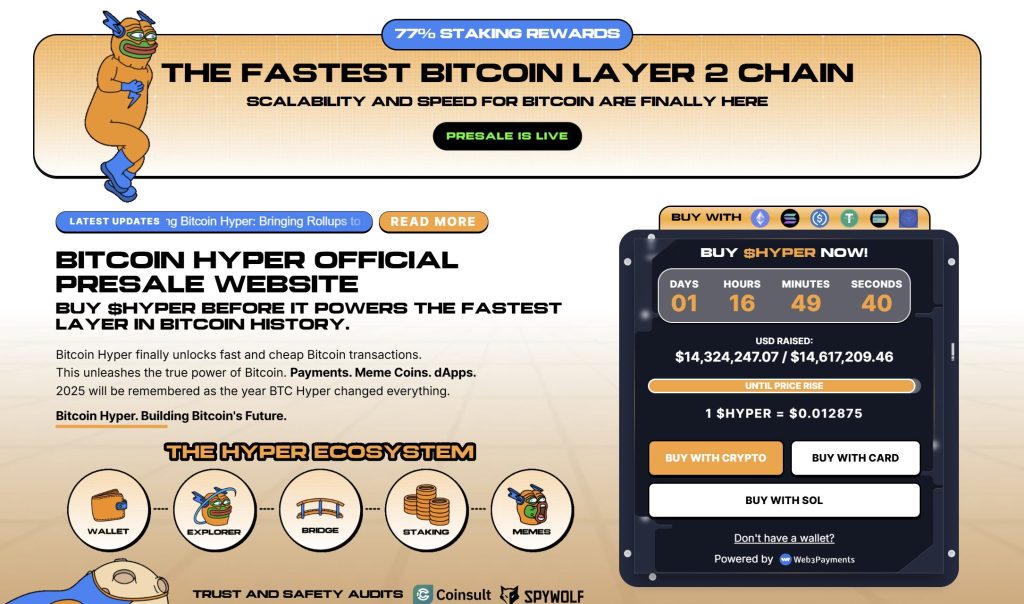

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $14.3 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012875—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: Record Stablecoin Inflow Puts $5,000 ETH Price Target in Play appeared first on Cryptonews.

Also read: Cronos (CRO) Price: Trump Media Completes $105 Million Token Purchase Deal