European currency is consolidating and retreating slightly from local highs ahead of the ECB meeting. Friday’s weak US labour market data gave the euro a boost, but at the start of the week the market remained undecided on how to interpret the signals: after an attempt to strengthen, a correction followed, and traders returned to a wait-and-see approach. In the coming sessions, attention will be focused on the ECB’s decisions, updated macroeconomic forecasts, and comments from the ECB President, as well as on US releases that could influence expectations for the Fed (mortgage data and producer price indicators). In this environment of uncertainty, trading remains range-bound: a break above Friday’s highs in the euro would require confirmation from ECB rhetoric and weak US data; in the absence of such signals, the base case remains further consolidation with the risk of a deeper correction towards support levels.

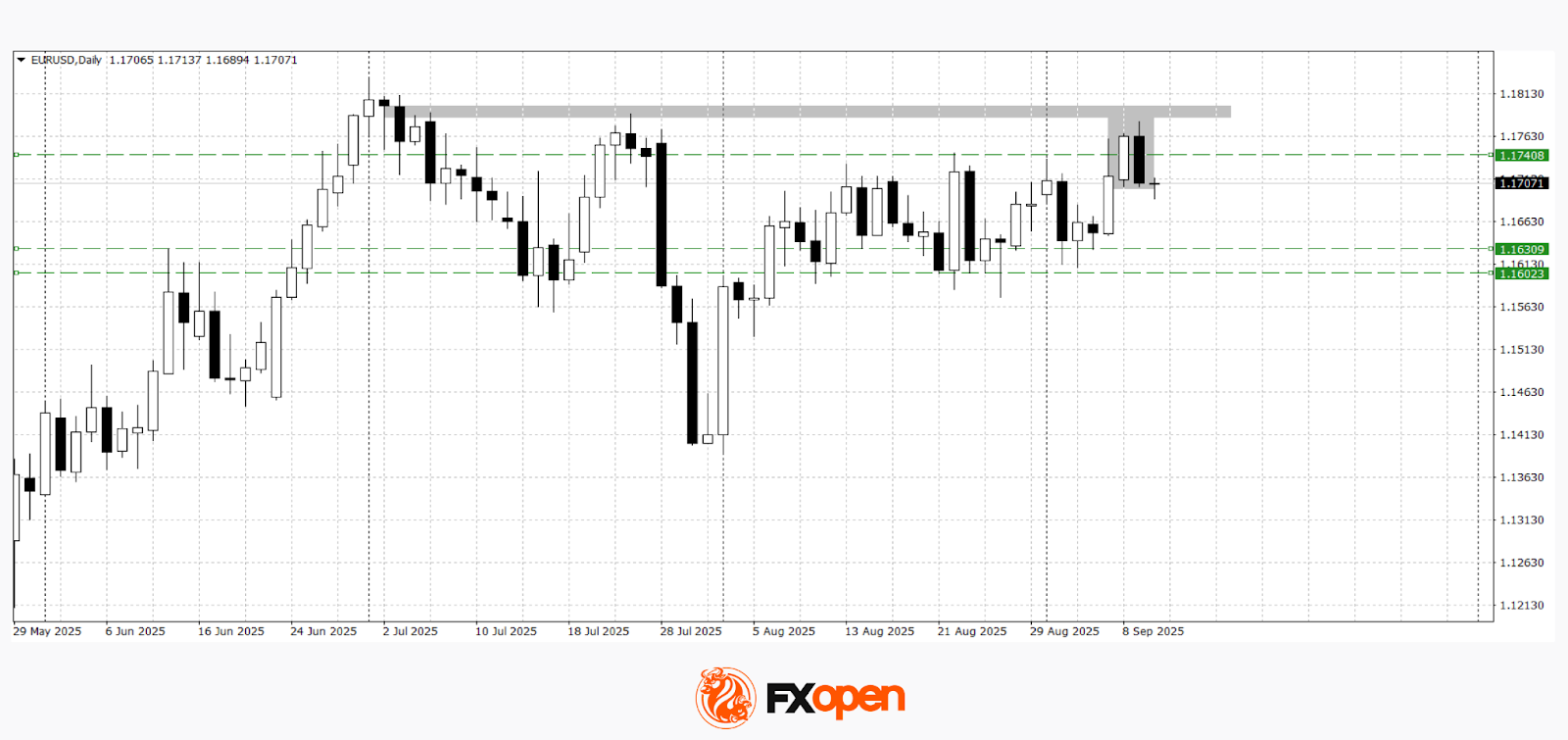

EUR/USD

The pair has pulled back from recent highs and is holding near short-term support, reflecting caution ahead of the European regulator’s rhetoric. Technical analysis of EUR/USD suggests a possible decline towards 1.1600–1.1630, as a bearish engulfing pattern has formed on the daily timeframe. If the price returns above 1.1740, a retest of Friday’s highs near 1.1800 is possible.

Events that could influence EUR/USD movement:

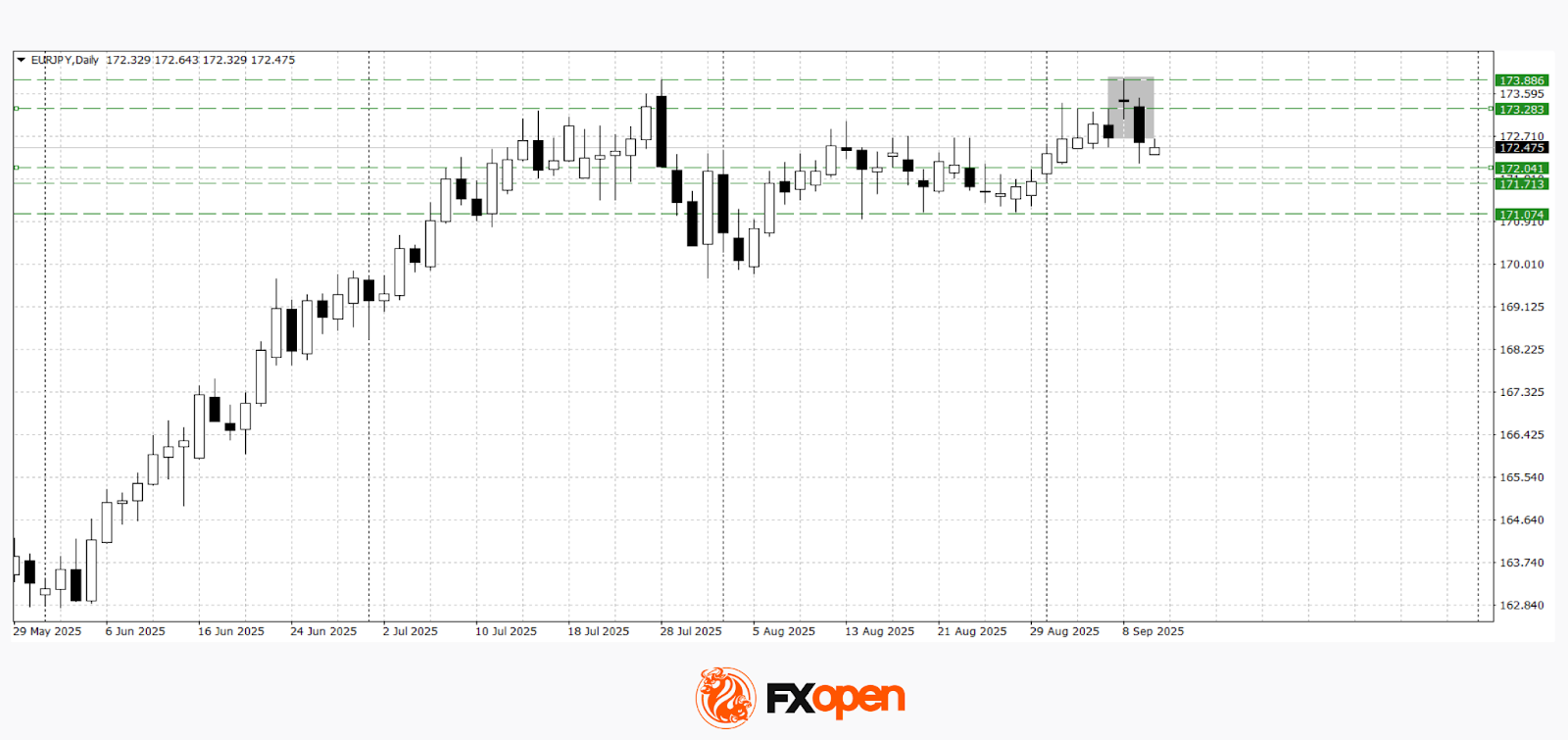

EUR/JPY

On Friday, EUR/JPY buyers managed to update July high near 174.00. However, they failed to consolidate above 173.90 and continue the upward momentum. A sharp rebound from the yearly highs allowed euro sellers to seize the initiative and form a bearish doji pattern, which has already been confirmed. If the downward move continues, the EUR/JPY pair might test the 171.70–172.00 area. A bearish scenario might be cancelled if the price firmly consolidates above 173.30.

Events that could influence EUR/JPY movement: