HBAR price has gained attention in recent weeks as Hedera price continues to attract both analysts and investors. The asset has formed strong technical structures on higher timeframes, pointing toward possible significant movement ahead. However, broader market sentiment and institutional news may shape how HBAR performs in the coming weeks.

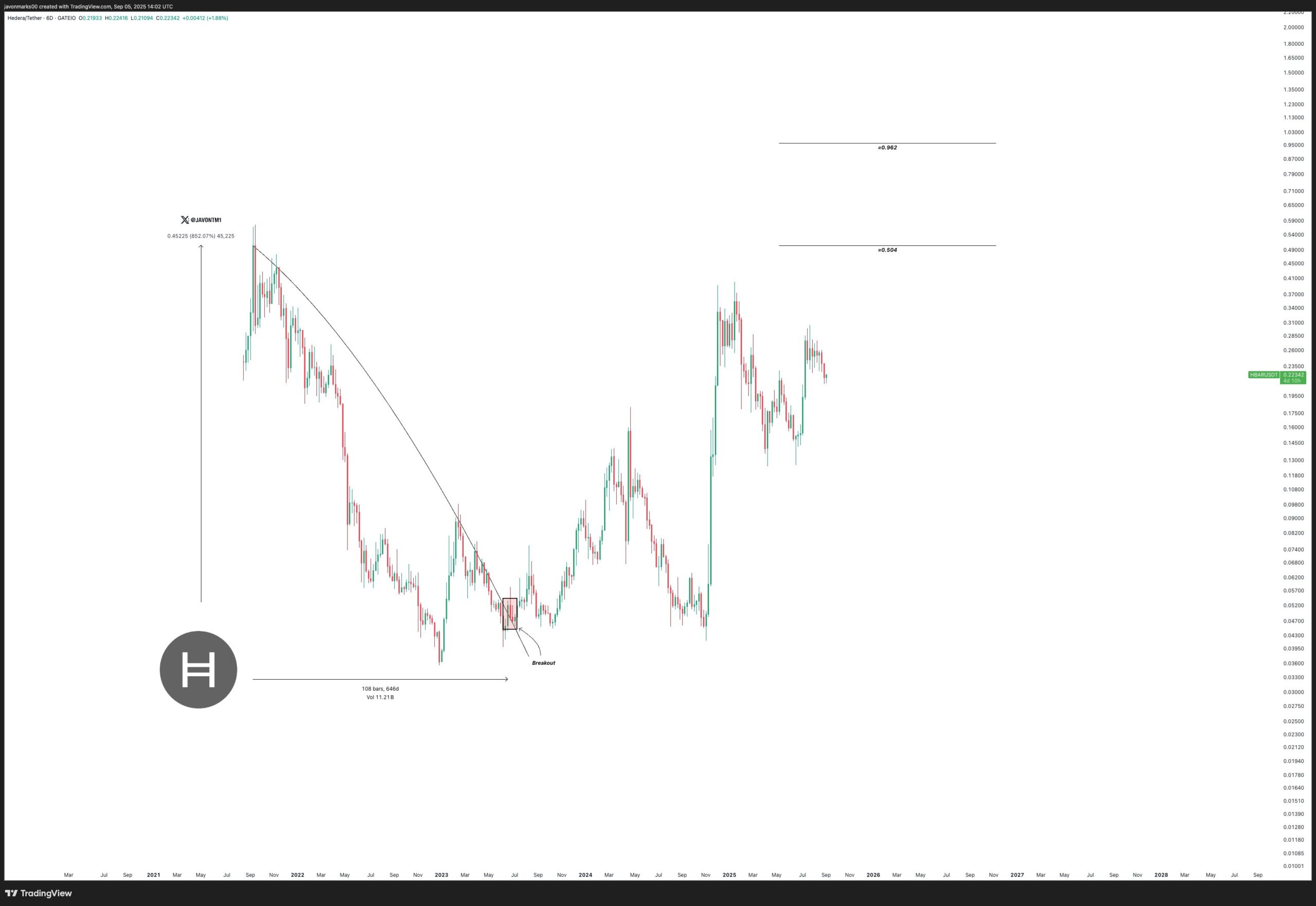

According to analyst Javon Marks, HBAR price is positioned for another major upward leg after clearing earlier resistance levels. His chart highlights a projected 123% rally, with the first major target around $0.504, followed by a secondary level just under $1.

The breakout structure suggests Hedera price has already carved out a reversal zone that supports this outlook. Importantly, the asset has consistently held higher lows, signaling strong market conviction.

The analyst emphasizes that a break above $0.504 could unlock a stronger continuation pattern. Therefore, this projection underlines the long-term HBAR price forecast as increasingly constructive.

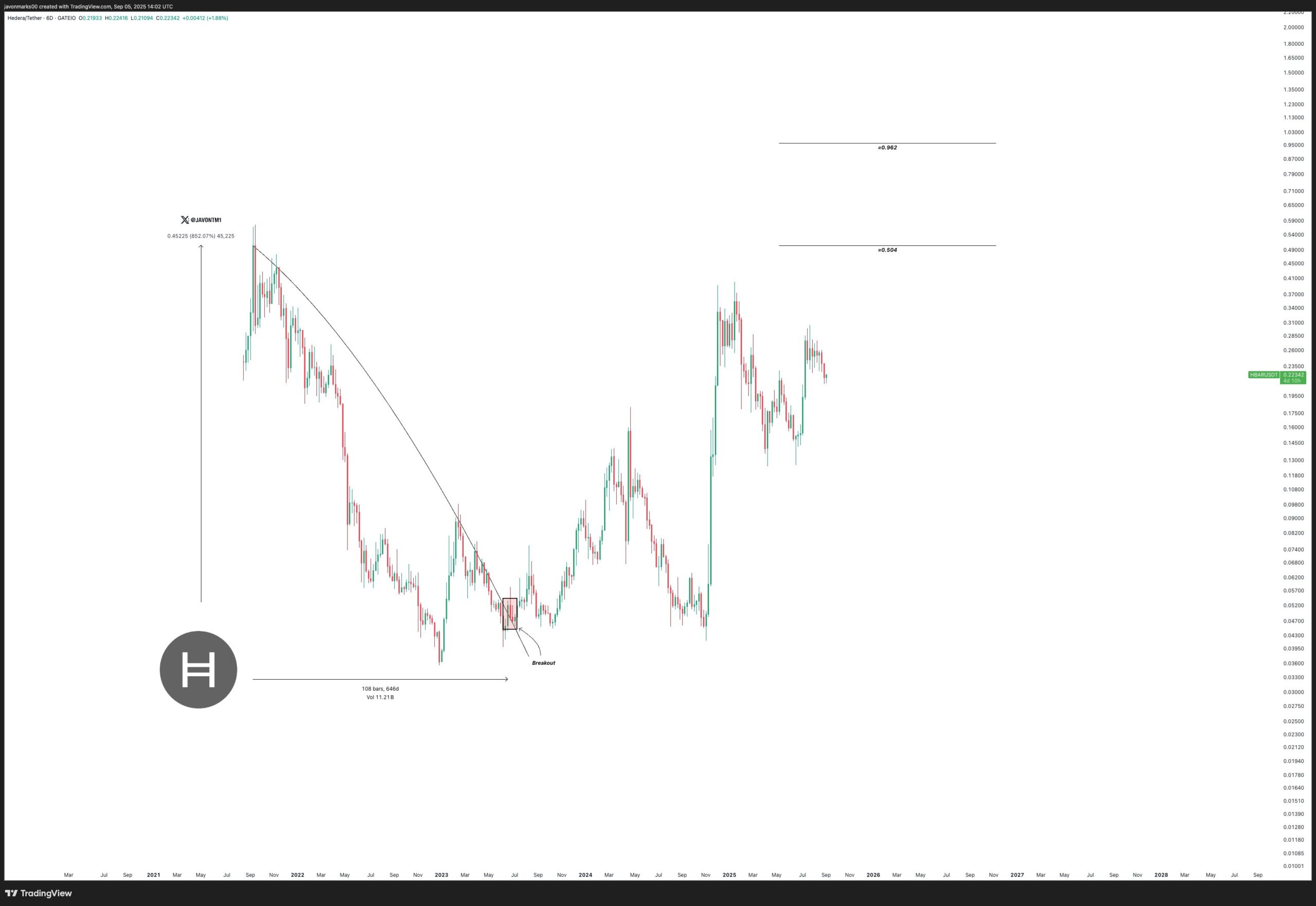

On the one-week chart, HBAR price shows a bullish pennant flag structure that has formed following an explosive rally. The HBAR current value trades at $0.214, showing mild volatility after a sharp run-up earlier in the year.

The pattern is defined by converging trendlines, trapping price action between resistance near $0.292 and support levels around $0.187. Price currently trades in the mid-range, with visible attempts to hold above $0.21, supported by the Parabolic SAR indicator.

If buyers regain strength, a breakout toward $0.400 may be realistic, aligning with longer-term projections. However, rejection from the upper boundary could prolong consolidation. Ultimately, this setup reinforces the long-term HBAR price forecast as technically optimistic despite short-term pullbacks.

Beyond charts, institutional interest adds further weight to the bullish outlook on HBAR price. Bloomberg Terminal reports place Hedera’s ETF applications from Grayscale and Canary with a 90% chance of approval.

The SEC’s final decision date is scheduled for November 11, 2025, marking a pivotal milestone. Analysts suggest that approval could unlock significant institutional inflows, mirroring patterns seen with Bitcoin and Ethereum ETFs.

Such a regulatory green light may boost Hedera price visibility across global markets, encouraging greater liquidity. Additionally, ETF approval would strengthen Hedera’s positioning as a credible asset for mainstream adoption. This convergence of technical and institutional factors leaves HBAR in a compelling spot.

Conclusively, HBAR price remains at a decisive crossroads, balancing strong technical signals with regulatory catalysts. The charts suggest room for a powerful rally, with analyst targets highlighting significant upside. ETF approval odds create an added layer of optimism, aligning investor focus on the coming months. Altogether, Hedera price continues to build its case for major growth potential.

Analyst highlight $0.504 as the first major target, with a potential move toward $1.

The weekly chart indicates a bullish pennant flag pattern, suggesting potential continuation upward.

ETF approval could drive institutional adoption, boost liquidity, and provide long-term stability for HBAR.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.