Imagine you’re sipping coffee in a cozy office, but the AC suddenly fails-sweat beads, productivity tanks. Now picture Trane Technologies’ HVAC systems saving the day, keeping buildings cool and businesses humming. As an investor, you’re not just betting on climate control-you’re tapping into a $200B market leader riding AI and sustainability waves. Whether you’re a retail investor dreaming of steady gains or an institutional pro diversifying your portfolio, Trane Technologies (TT) offers a sizzling opportunity to profit from a greener future.

Trane Technologies plc is a global leader in HVAC (Heating, Ventilation, and Air Conditioning) and refrigeration, crafting sustainable solutions via brands like Trane and Thermo King. Based in Ireland, it serves buildings, homes, and transport, riding the wave of energy efficiency and AI-driven demand. Here’s a crisp dive into why TT is a must-watch for institutional and retail investors.

Trane Technologies operates in Americas ( 80% of revenue), EMEA, and Asia Pacific, delivering HVAC and transport refrigeration. Its systems cut energy use by up to 30%, cooling data centers and securing supply chains. With 45 000 employees and 28 countries, its service model ensures steady cash flow.

Q2 2025 saw record $5.6B bookings and $5.75B revenue, beating EPS estimates at $3.88. Free cash flow hit $841M, with a 20.3% margin. Key ratios: 39% ROE, 18% ROIC, 0.59 debt/equity. Upgraded 2025 guidance (7–8% growth, $12.70-$12.90 EPS) signals resilience.

TT’s stock (NYSE: TT) rose 21% in 2025, hitting a 52-week high of $476 (average $391). Strong Americas HVAC demand (+60% bookings) drives growth despite Asia’s dip (-16%). Beta of 1.09 and a $452 target (7.9% upside) make it a solid pick for dip buyers.

The stock price has risen by more than 18 184% since the IPO.

In the $200B HVAC market (5.3% CAGR to 2030), TT holds 10–15% share, outshining Carrier, Johnson Controls, Lennox, and Daikin with AI-driven systems. Its $7.1B backlog ensures stability, though Asia’s weakness is a watchpoint.

Competitor Comparison Table

TT’s higher P/E reflects growth premium; Carrier offers higher yield for income seekers.

Trane Technologies is a market leader, generating robust cash flows that fuel its dominance. Its Net operating cash flow grows at an impressive 12.45% annually, showcasing financial strength. However, this success comes in a fiercely competitive HVAC market, requiring hefty investments to stay ahead. Trane smartly leverages debt to fund innovation, yet its low debt burden- 0.59 debt-to-equity ratio -sets it apart, with enough liquidity to cover long-term obligations swiftly if needed.

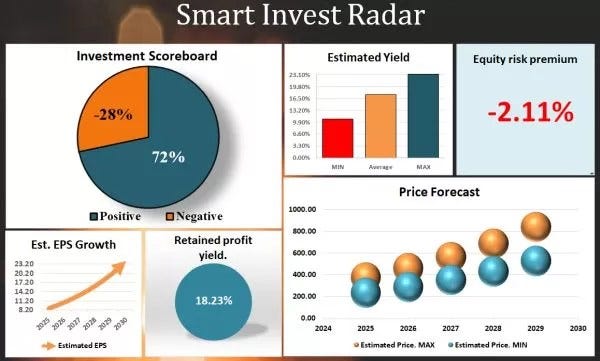

This is a high-growth stock, boasting an Investment Scoreboard rating of 72, making it a must-have for portfolios. While the dividend yield is modest at 0.9%, payouts grow 13% annually, promising strong future cash flow for long-term investors who reinvest. Currently, the stock appears overvalued, with signs of a potential correction after a stellar 25%+ average annual price surge. A dip could be the perfect entry point for savvy investors looking to buy or add to their position.

2025–2029 Price Targets:

*Theoretical calculation. Actual results may differ significantly due to market conditions as well as your investment strategy and tactics.

As of now, Trane Technologies’ stock price has dropped 14% from its all-time high in July, entering bear market territory. This dip is a golden opportunity for investors, as Technical analysis suggests further declines could allow us to buy shares at even lower prices, boosting potential returns. For current shareholders, this is a prime moment to add to your position.

If you’d like help identifying optimal entry points, simply contact us at info at aipt.lt.

TT pays a $0.94 quarterly dividend ($3.76 annual, 0.9% yield), up 12% in 2025. With a 29% payout ratio and $1.3B in 2024 buybacks, it balances growth and returns. This attracts long-term investors seeking steady income.

TT’s Morgan Stanley Laguna Conference appearance and BrainBox AI Lab launch signal leadership in sustainability. These drove a 3% stock spike, with ESG appeal boosting its edge. Q2 strength (+5% bookings) offsets Asia risks, promising 10–15% upside.

Trane Technologies is your ticket to ride the HVAC boom with a side of green swagger. With a 14% dip from its peak, now’s the time to scoop up shares before they heat up again-don’t get left out in the cold! Contact info@aipt.lt for entry tips, and let’s make your portfolio as cool as a Trane-chilled data center.

Or Donate:

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on September 3, 2025.

Trane Technologies: Is the 14% Drop a Hidden Gem for Smart Investors? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Also read: Make-it Capital Edition #51