Next Technology Holding (NASDAQ: NXTT) said it filed for a shelf registration that would let the company offer up to $500 million of common stock, and reports say some of the money could be used to buy more Bitcoin. According to the filing, the move gives the company flexibility to raise cash over time.

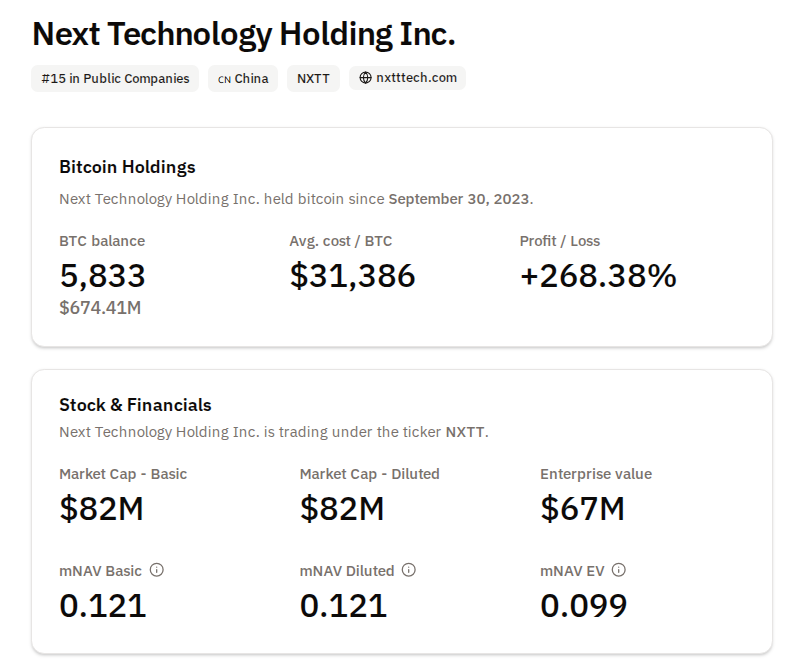

Based on reports and regulatory filings, Next Technology records show it holds 5,833 BTC. The company’s March 2025 10-Q lists a book value for its Bitcoin holdings of roughly $480 million.

The shelf registration itself does not force an immediate sale of shares, but it does allow NXTT to sell stock when management chooses and market conditions look right.

NXTT’s strategy of using corporate cash to build a Bitcoin treasury has moved its share price before. When the company disclosed large purchases earlier this year — including a buy of 5,000 BTC that was reported in filings — the stock experienced sharp swings.

Some traders see new share sales tied to Bitcoin buys as a way to accelerate the company’s asset-growth plan, while other shareholders warn about dilution if a large offering is completed.

Regulatory And Funding DetailsAccording to the documents from the Securities and Exchange Commission, the registration appears to be a standard S-3 shelf filing.

A shelf lets a firm register securities in advance and then sell them in one or more offerings without repeating the full registration process each time.

If Next Technology were to sell shares and use the proceeds to buy more BTC, the company’s purchases could add to demand in the spot market.

That said, the scale matters. At 5,833 BTC on the books now, a follow-on buy funded by equity could be meaningful but would still be a small fraction of daily global trading volumes.

Analysts say market moves depend on timing, the size of any buy, and whether other large holders act at the same time.

Based on the filing language, Next Technology can move slowly or act fast — it will be up to management. Risks include share dilution, price volatility for NXTT stock, and the mechanics of custody and accounting for additional Bitcoin. Any plan to spend capital on crypto will be judged by investors against those trade-offs.

Featured image from Anne Connelly – Medium, chart from TradingView

Also read: EA Sports FC 26 : Comment jouer au nouveau FIFA une semaine avant tout le monde ?