Or don't, because then I could miss out on many more corporate blockchain launches.

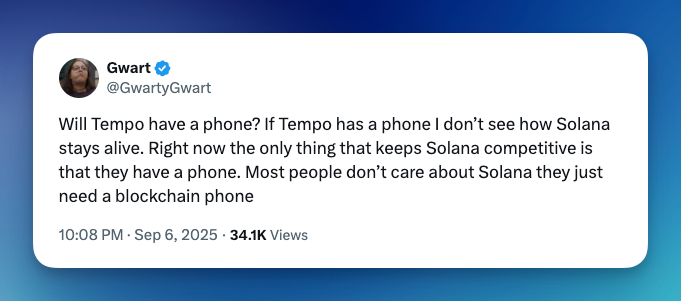

Tempo is a new Layer-1 purpose-built for payments — not to be confused with other blockchains whose primary purpose is to facilitate transfers — that will solve all of stablecoin adoption's problems with their SV-ideology entrenched all-star team.

Currently in private beta, the blockchain is said to have a 100,000 transactions per second throughput, and aims to "bring real-world payment use cases onchain".

Unlike with public blockchains, all the validators on Tempo are a pre-selected crowd, bringing back the good old days of consortium chains, where, leaving aside concerns for decentralization, Corda and Hyperledger would peddle their blockchain-as-a-service offerings with the promise of full control over who gets to add transactions to the chain.

Only fools will fall for their claim of neutrality when the setup is one where just Paradigm & Stripe-approved actors validate transactions.

Anyway, as expected, not all of crypto was thrilled about this move, but it made for a good occasion to rub Paradigm's latest failed investment (Blast, an L2 now dead) under their nose.

Takeaway: Maybe all these new L1s still marketing fictional transaction throughput are our own version of slop.

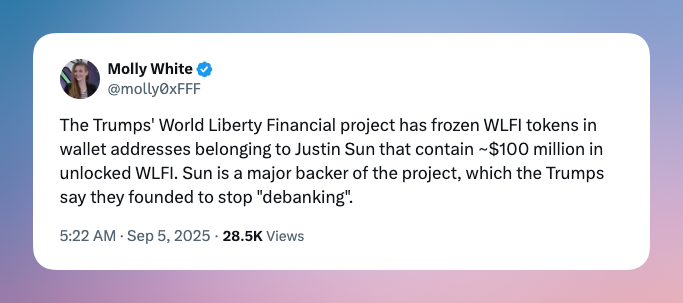

Ancient Greek mythology taught us that it's never a good idea to fly too close to the sun. The same is true for moths that are drawn to light, even if it is their demise. It turns out that crypto billionaires aren't that different. They, too, crave the light, or at least to be on the good side of power. And who represents power better than the current American president?

The figurative moth in this case is Justin Sun, obnoxiously tasteless crypto billionaire and founder of TRON, the stablecoin blockchain for the global south. To buy himself into the Trump dinner, Sun invested heavily in World Liberty Financial, one of those crypto projects run by the Trumps.

When the banana aficionado wanted to transfer $9 million worth of his pre-sale tokens to HTX exchange, he got blacklisted, and his funds were frozen. Pleas to unlock his funds, arguing that such happenings would deter investor confidence, fell on deaf ears.

Anyway, not even this freezing could halt the token's 40% price decrease.

Takeaway: If this is how they treat their major investors, guess how little they will care about small retail traders.

Remember the presidential elections and how everyone was glued to the Polymarket prediction market, trying to find out who'd be the next president? Well, despite our then-misguided assumptions that this would be the highest high for the product, the appetite for speculation extends beyond elections.

In August, Polymarket registered a new high for the number of new markets created, with 13,800 new events on which to wager registered. One of them was Taylor Swift getting engaged, a surprisingly low-volume market considering the number of Swifties in the world, which allowed one individual to cause a doubling of the price.

There's a missed opportunity there, the failure to get women into the market of speculation.

Let's be real, Labubus are nothing but gambling for women, and that's a multi-million dollar revenue company.

The benefit of using prediction markets as an outlet for one's gambling addiction is that it does not require the creation of new tokens that'll live on forever, enshittifying the blockchain. Instead, markets run only until they resolve and then wither.

Takeaway: In a world of financial nihilism and the myth of hard work dying, prediction markets offer an illusion to escape the 9-5 with insider knowledge. And even if you don't make it, at least you can have fun betting on random stuff. If this is how we gain mainstream adoption, it's apt.

Fact of the week: We all know that moths like the light, but did you know that some species are drawn to bananas and beer? So if you want to replace nocturnal doomscrolling with moth watching, stale beer, and overripe bananas are all you need.