Vitalik Buterin challenges DeFi to move away from centralized stablecoins ($USDC/$USDT) toward automated, decentralized models to reduce systemic risk.

Vitalik Buterin challenges DeFi to move away from centralized stablecoins ($USDC/$USDT) toward automated, decentralized models to reduce systemic risk. The computational requirements for these ‘sovereign’ stablecoins favor high-throughput environments like the Solana Virtual Machine (SVM) over congested legacy networks.

The computational requirements for these ‘sovereign’ stablecoins favor high-throughput environments like the Solana Virtual Machine (SVM) over congested legacy networks. Bitcoin Hyper combines Bitcoin’s settlement security with SVM speed, raising over $31M to build the infrastructure needed for next-gen DeFi.

Bitcoin Hyper combines Bitcoin’s settlement security with SVM speed, raising over $31M to build the infrastructure needed for next-gen DeFi.Ethereum co-founder Vitalik Buterin just threw a wrench into the comfortable consensus of decentralized finance (DeFi). His target? The sector’s massive reliance on centralized stablecoins like $USDC and Tether. In recent commentary regarding the future of on-chain stability, Buterin argued that the industry’s heavy dependence on asset-backed models introduces a single point of failure that contradicts the core ethos of crypto.

Instead, he advocates for ‘automated’ or algorithmic alternatives, mechanisms that maintain pegs through math and game theory rather than bank deposits.

That pivot matters. It signals a shift in how institutional capital views DeFi risk. The current model is efficient but fragile. Buterin’s proposed ‘governance-minimized’ future is resilient, sure, but it demands immense computational throughput to manage real-time liquidations and stability mechanisms. Right now, Ethereum struggles to support high-frequency algorithmic stability without pricing out users during volatility spikes. This suggests that the bottleneck for true DeFi innovation isn’t liquidity, but execution speed.

While the market digests what moving away from centralized reliance actually looks like, smart money is quietly rotating. They’re hunting for infrastructure capable of supporting this high-computational future. The focus isn’t just scaling transaction counts; it’s about fundamentally altering execution environments. Leading the pack? Bitcoin Hyper ($HYPER). It’s building the rails for this next generation of decentralized finance by merging Bitcoin’s security with the Solana Virtual Machine’s (SVM) speed.

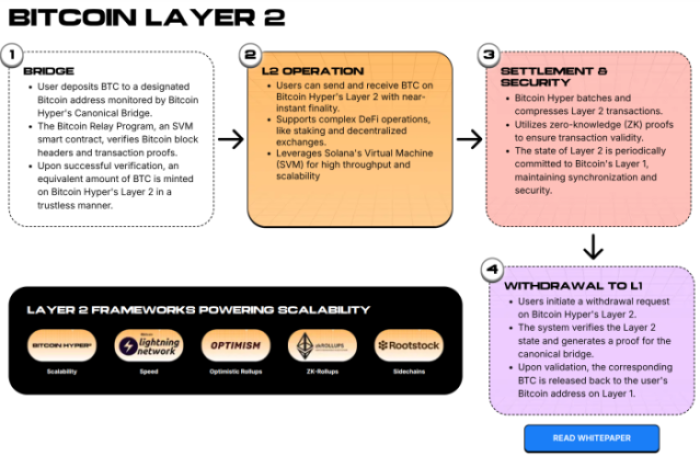

While Ethereum developers debate theoretical frameworks, the necessary infrastructure is being built elsewhere. Bitcoin Hyper has staked its claim as a first-mover in the ‘Bitcoin Renaissance,’ planning to deploy a Layer 2 architecture that directly addresses the latency issues plaguing complex DeFi applications.

By integrating the Solana Virtual Machine (SVM), the protocol delivers transaction speeds that ostensibly outpace Solana itself. And the kicker? It does this while anchoring finality to the Bitcoin network.

That architecture is critical for the ‘alternative models’ Buterin envisions. Algorithmic stablecoins and complex derivatives require sub-second state updates to prevent de-pegging events, a speed that the Ethereum Virtual Machine (EVM) often fails to deliver under load. Bitcoin Hyper’s modular approach separates the execution layer (SVM) from the settlement layer (Bitcoin), allowing for high-frequency trading and lending protocols to operate with low costs.

Using a decentralized Canonical Bridge, the project ensures that while execution is rapid, the underlying asset security remains tied to Bitcoin’s proof-of-work consensus. This mix of ‘Rust-based programmability’ and ‘Bitcoin hardness’ allows developers to build the sovereign financial tools Buterin describes, but on the world’s most secure blockchain rather than a congested general-purpose network.

The market’s appetite for high-performance Bitcoin infrastructure is showing up in the capital flows surrounding Bitcoin Hyper’s early stages. Check the official presale page, and you’ll see the project has successfully raised over $31M. That figure underscores significant demand for Layer 2 solutions that go beyond simple payment channels. With tokens currently priced at $0.0136753, the valuation offers an interesting entry point relative to established L2s like Stacks or Optimism.

Deep-pocketed investors (whales) appear to be positioning themselves ahead of the token generation event (TGE). There have been multiple six-figure purchases throughout the presale, the largest hitting $500K. Now this doesn’t mean success, but it does show smart money sees potential and that’s reassuring.

This accumulation pattern often precedes broader retail interest, particularly when technical catalysts, such as the launch of mainnet staking with high APY incentives, are on the horizon. Bitcoin Hyper confirmed a 7-day vesting period for presale stakers, a mechanism designed to mitigate post-launch volatility while rewarding long-term participants.

If you’re tracking ‘smart money,’ the combination of massive presale volume and specific whale entries suggests a market segment betting heavily on the convergence of Bitcoin security and SVM speed.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies are volatile; invest only what you can afford to lose.

Also read: Discord passe à la vérification d’âge : fini l’anonymat ?