Solana price has been quietly building strength while compressing inside a tight trading range, and participants are starting to take notice. The chart setup shows momentum is building, with buyers defending key supports and institutions adding confidence through treasury holdings.

Solana price is trading inside a well-defined symmetrical triangle, where the price has been compressing between lower highs and higher lows. On the 4H chart, the $204 zone is acting as the immediate pivot, with resistance clustering around $212 to $216. A decisive break above this range would likely confirm a bullish continuation, potentially setting up a retest of $224 and higher. Structurally, the repeated defenses of support around $196 to $198 highlight that buyers continue to absorb dips, keeping the setup constructive.

Solana price consolidates within a tightening triangle pattern, with $204 acting as the pivot for the next breakout move. Source: Peter_thoc via X

Crypto analyst Peter_thoc notes that despite signs of market fatigue, zooming out shows Solana maintaining its broader uptrend, supported by strong participation across major pairs. With Bitcoin and Ethereum showing stability, the pressure building in SOL’s tightening range suggests momentum could soon shift in favor of the bulls.

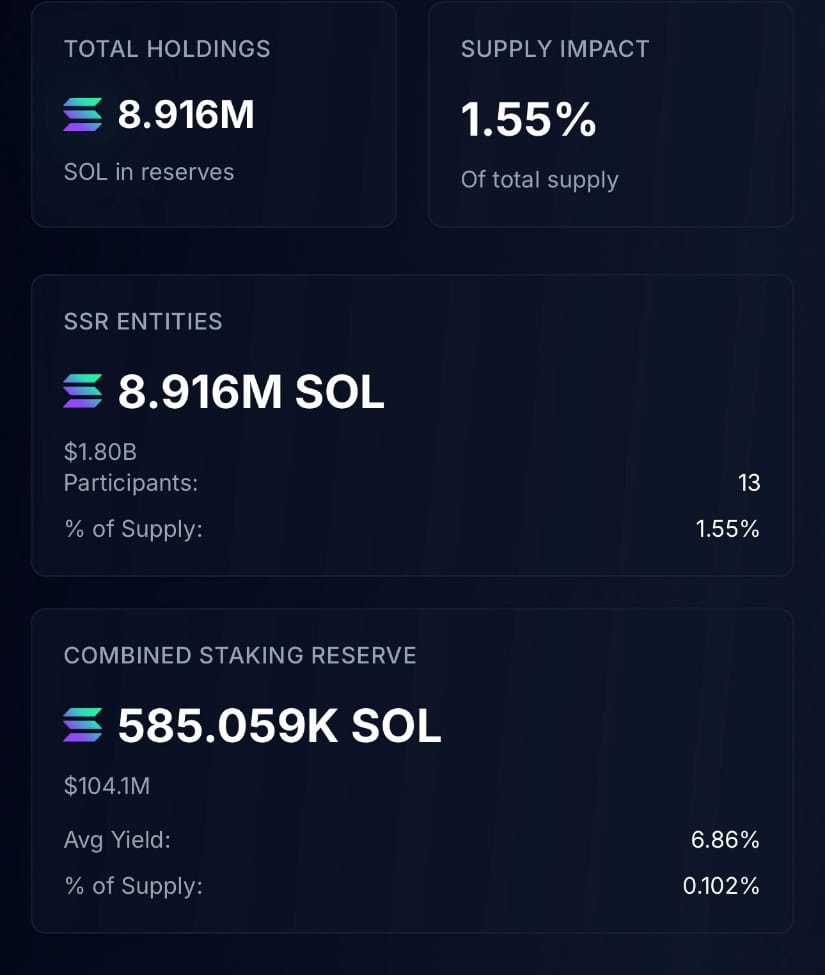

Building on the breakout structure highlighted earlier, new data reveals that thirteen publicly listed companies have already incorporated Solana into their treasury strategy. Their combined holdings now stand at 8.91M SOL, worth about $1.8 billion, equivalent to 1.55% of the total supply.

Thirteen publicly listed companies now hold 8.91M SOL worth $1.8B in treasuries. Source: SolanaFloor via X

The presence of large entities holding SOL helps establish a stronger floor for the price, especially when paired with the ongoing technical compression visible on the charts. With staking reserves also climbing, the supply side pressure continues to ease. If Solana can clear its near-term breakout levels, these fundamentals may serve as the underlying fuel that sustains momentum beyond short-term speculative moves.

SOL Solana price has now closed back above the weekly Ichimoku cloud, a development that often signals a shift in momentum towards a more sustained bullish trend. The cloud, which represents dynamic support and resistance zones, had acted as a barrier in recently, capping upside attempts. Reclaiming this level suggests improving sentiment and gives SOL buyers a stronger technical base to build on.

Solana has reclaimed the weekly Ichimoku cloud, signaling renewed bullish momentum. Source: The Great Mattsby via X

The current setup also shows the indicator lines trending upward, reflecting strengthening short-to-medium-term momentum. Historically, similar moves above the cloud have been followed by multi-week rallies when supported by broader market stability.

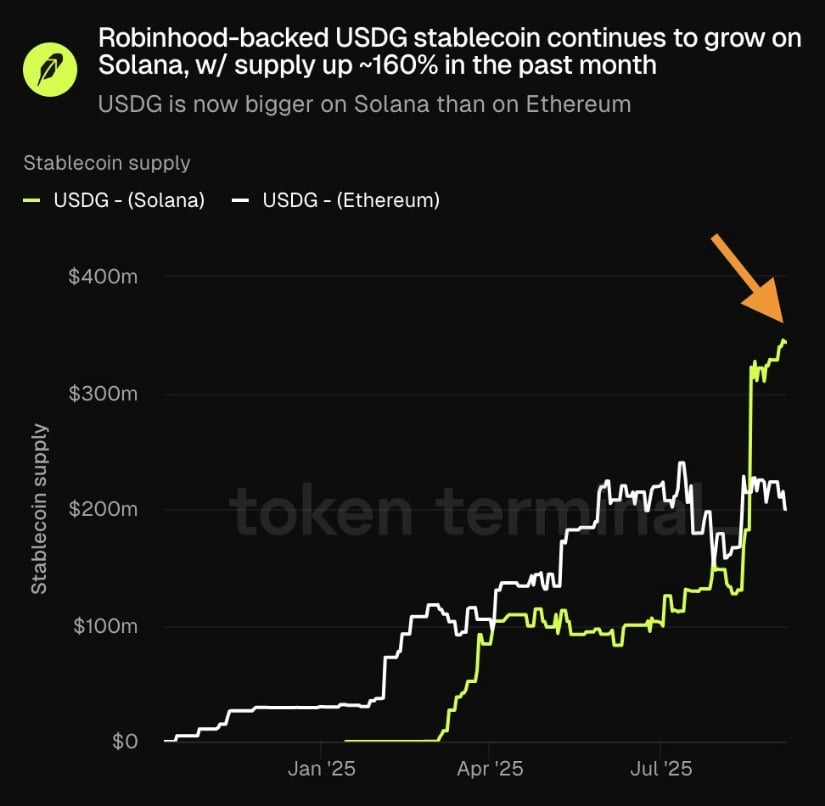

Fresh on-chain data shared by Token Terminal shows that Robinhood-backed USDG has seen explosive growth on Solana, with supply jumping more than 160% in just the past month. What stands out is that USDG issuance on Solana has now surpassed Ethereum, reflecting how the network is capturing real demand for stablecoin activity, and this sort of on-chain strength is likely to leave a positive impact on SOL’s price action.

USDG stablecoin supply on Solana has surged 160% in a month. Source: Token Terminal via X

Adding to the other bullish reports, the chart by Trader Koala shows that the higher time frame still looks constructive for Solana price. Price remains inside a defined range, but the structure suggests that a move toward the $240 to $260 zone is expected as the next logical target.

Solana is targeting $240–$260, with range support keeping the bullish outlook intact. Source: Trader Koala via X

Even if SOL experiences a short-term deviation back towards range support, it would still align with a bullish outlook. Such a move could provide a healthier reset before any push higher, with the overall structure pointing towards continuation rather than reversal. As long as range support holds, Solana Price Prediction is pointing towards $260.

Solana price shows a structure that is trading for the next big move. The combination of a bullish technical setup, strong institutional demand, and on-chain growth makes the $240 to $260 target range a realistic milestone in the near term.

While short-term pullbacks are possible, the structure suggests they may act more as healthy resets rather than signs of weakness. As long as SOL continues to defend its key support levels, the bullish outlook remains intact.

Watching how Solana reacts around its breakout zone and whether momentum aligns with broader market stability will be crucial. If Bitcoin and Ethereum maintain their footing, Solana could be among the leaders in the next leg up.

Also read: Avalanche (AVAX) Price Prediction: ETF Momentum and On-Chain Growth Point Towards $100+ Breakout