Staking and strategizing for profit in crypto is one thing. Keeping tabs on crypto tax laws is another game entirely. Cryptocurrency has been gaining more recognition among adults, with over 6.3 million UK adults now owning it. Consequently, if you are one of these adults, knowing all applicable crypto tax laws becomes logical so you don’t lose what you’ve already gained.

However, many are confused about prevailing crypto tax laws, while some have even paid huge sums to tax consultants, which would have been unnecessary if proper planning had been in place. While European tax laws might seem complex at first glance, you’ll soon find out they follow a predictable pattern if scrutinized. And just as clarity is essential in taxation, platforms like 8lends bring the same transparency and structure to the world of decentralized lending.

So, without further ado, let’s dive in.

Imagine that you bought £500 worth of Ethereum in 2023, which then grew into £4,200 in 2024.

If you then decide to sell it and pay for a holiday, you are immediately faced with the new reality: Any crypto investor who made more than £1,000 in crypto income or more than £3,000 in capital gains for the 2024-2025 financial year must submit a Self-Assessment Tax Return to HMRC.

While this is a drop in yearly tax allowance of £6,000 in 2023-24 to £3,000 for 2024-25, you’ll still be owing tax on £700 of your gain.

Estimation of crypto cost follows three fundamental rules using the Section 104 Pool System. This adds each crypto purchase, and an average cost is taken to value the unit cost of the total volume of crypto present at any given time in a wallet.

Example:

According to the Section 104 pool system, you have 1 BTC costing £25,000. However, selling 0.3BTC reveals your cost price as £7,500 (0.3 x £25,000) and your profit as £3,000 (£10,500 - £7,500), which is the allowance for zero tax annually.

Here are some shrewd strategies to reduce crypto taxes in the UK.

Again, you can donate crypto for charity, use crypto as a pension contribution, and spread your gains across multiple tax years for effective tax reduction. Lastly, utilize the bed and ISA to reduce tax on future crypto growth.

At this point, it becomes clear that meticulous record-keeping is essential. Many investors simplify the process by using platforms like Blockpit, which consolidate trades across wallets and exchanges, apply the correct tax rules, and generate compliant reports. Tools like this can save hours of manual calculations and reduce the risk of errors when filing with HMRC.

Receiving LP tokens, depositing tokens, and earning governance tokens are some of the common DeFi events that can be attributed to the boom in decentralized finance. However, these events are not only taxable but have also contributed new complexities to the already slippery tax landscape.

If, for instance, you decide to stake 10 ETH for a 0.4 ETH reward, which then amounts to £800 in worth. You will be required to pay income tax on this profit. Also, selling it at a differential price to your cost constitutes a profit or loss depending on the selling price, which results in another tax if the differential is positive.

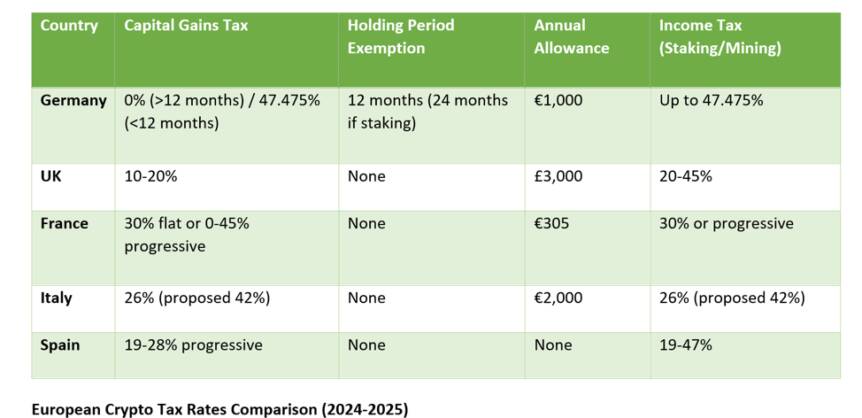

Here, there’s a one-year holding rule. Let’s say you invested €25,000 in January 2024 and decided to hold for 13 months to sell in February of 2025, by which time it has increased in worth to €75,000. The one-year tax laws exempt you from a tax since you’ve held it for over 12 months.

While crypto tax laws in Germany may seem simple and straightforward, it is still important to understand the nitty-gritty. For instance, once you sell your crypto before the 12-month mark, then you will be required to pay up to 47.475% on every €1,000 gained.

This now becomes even trickier for staking. The holding period is extended to two years if you decide to stake your token, given the potential to make more profit with staking.

From tax year 2024, all profits below €1,000 from trading your crypto are exempt from tax, even when they are held for less than the 12+ months stipulated.

All crypto sales and profits must be declared before the July 31st deadline after the tax year using the Anlage SO form. All sales and income from crypto will be declared on this form.

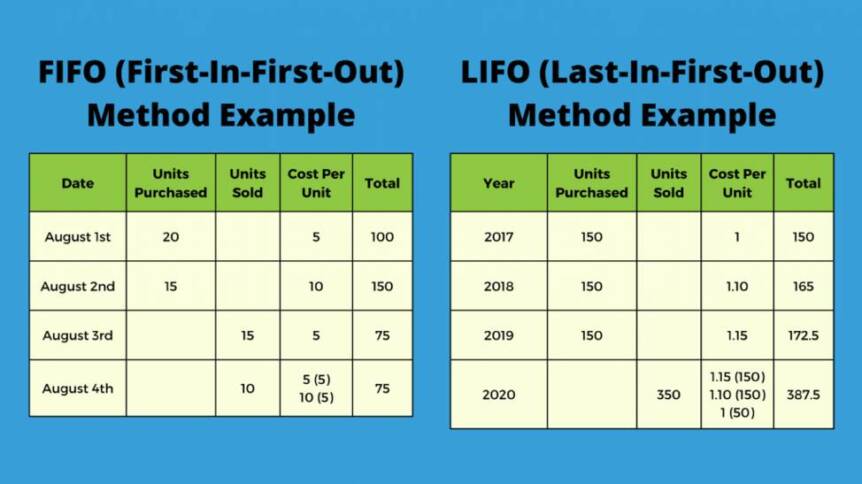

Calculating the crypto profits uses a chronological order, starting with your first purchase and continuing sequentially to the time of sales. This is known as the First-in First-out method. Hence, ensure to keep a linear record of purchases to help you determine the correct holding period from your first crypto purchases.

Utilizing battle-tested strategies in the German cryptocurrency landscape requires knowledge of only four avenues.

Here are the tax regimens in France.

Think of the former as a tax for an occasional investor, where 30% of your crypto income is calculated as tax. This is divided into income tax and social contribution, split into 12.8% to 17.2% respectively.

The second option progressively calculates your tax based on your crypto income. It splits this rate into 0 – 45% for income tax, while 17.2% is also added as social contributions. The decision for a 30% flat tax rate typically tips to the side of huge crypto investors, while small crypto holders prefer the progressive tax regime.

However, regardless of the tax system you choose, you still get a €305 crypto profit allowance before the tax calculation is applied to your gains. This is generally favorable to very small crypto investors.

The 2042 form collects the general information of your crypto transaction for the tax year ended, stating your net gains after the €305 allowance.

This is where the details of your crypto history are especially taken to calculate gains beyond a stipulated benchmark.

Certain crypto transactions might have some complexity, and this form treats all and clears all the complexity.

You are required to declare every crypto account outside of France once it exceeds 1,000 using the 3916-bis form. Stiff penalties include a fine of 1,500 for every undeclared account, with an additional 5% of the undeclared amount.

For Italy, the tax allowance is €2,000 for a tax year. That means you pay zero tax if you earn a €1,950 profit from your crypto trading over a period of 12 months. This is a significant improvement over the previous years

Once your crypto profit exceeds the €2,000 exemption mark, you automatically fall into a standard 26% tax rate if your earnings are below €2,000,000. Otherwise, you are taxed at 18% if your investment portfolios surpass €2,000,000.

Italy’s 2025 crypto law change saw the improved crypto tax laws change from €51.65 to €2,000 tax allowance, further encouraging crypto investing for residents.

In contrast to many European countries, Italy’s Last-in, First-out tax calculation, which considers the most recent higher-cost purchase, further reduces the taxable profit for investors.

Modello 730 is suitable for simple cases of cryptocurrency taxes, especially for pensioners and employees, and must be submitted by the 31st of July. However, complex tax cases or self-employed individual utilizes Modello Redditi PF, submitted by October 31st.

Here are 5 legal tax reduction methods to take advantage of:

With a capital gains tax of 19-28%, Spain employs progressive laws as follows:

Furthermore, Spain treats DeFi activities, including staking and mining, as income tax rather than capital gains with rates of 19-47%. reflecting.

As a crypto-trading resident of Spain, all your crypto activities, including capital gains, must be submitted using the G1 section on Modelo 100 by June 30th.

The first-in, first-out formula is also employed in Spain’s tax system, and Article 37.2 of its income tax laws backs a sequential listing to match the oldest purchase and newest sales.

Reducing taxes in Spain is mainly achieved by leveraging the provision for a four-year loss carryforward provision, using losses to offset future profits.

This article was originally published as European Cryptocurrency Tax Declaration Guide on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Also read: Grayscale Receives SEC Approval to List Digital Large-Cap Fund as ETF