The post Top Reasons Why XRP Price is Down Today appeared first on Coinpedia Fintech News

The crypto market is flashing red once again. As of September 26, global market cap sits at $3.74 trillion, down 2.27% in 24 hours. The Fear & Greed Index has slipped to 32 (Fear), showing clear risk-off sentiment. Altcoins are particularly hit, with the average RSI at 35.85 indicating oversold conditions. XRP is no exception, falling to $2.76, down 3.3% in a day and over 9% in a week. So why exactly is XRP under pressure today? Let’s break it down.

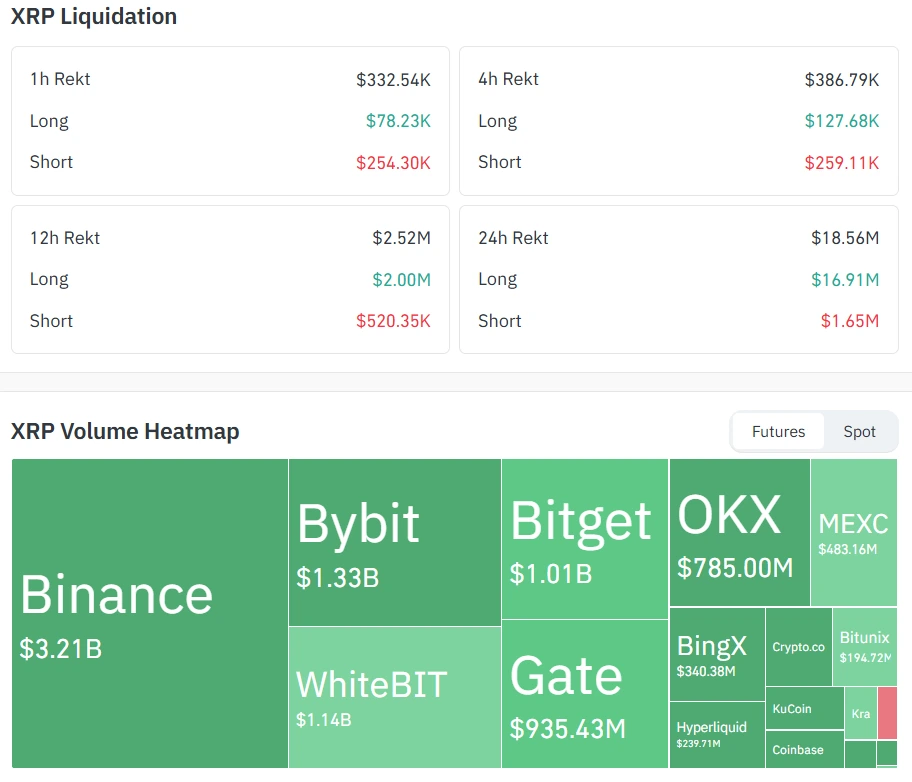

1. Macro Liquidation Cascade

The broader crypto market just faced a $1.5 billion liquidation wave after Ethereum dropped below $4,000. With XRP closely tied to market sentiment, it suffered sharp outflows as leveraged positions unwound. XRP’s 24-hour volume spiked 30.7% to $8.73B, signaling panic-driven selling. Adding to the pain, open interest rose 7.92% to $1.11T, suggesting traders were caught on the wrong side of the move.

2. Technical Support Failure

On charts, XRP broke down below the $2.81 Fibonacci retracement and its 100-hour moving average. This invalidated a bullish setup that had defended the $2.71 floor since July 2025. The RSI dipped to 29.24 (oversold) while the MACD flipped negative, showing clear bearish momentum. Analysts now warn that a decisive close below $2.71 could drag XRP toward the $2.50–$2.55 zone.

3. ETF Approval Profit-Taking

Ironically, positive news also played a role in the drop. The SEC approved a Hashdex ETF holding XRP/SOL/XLM on September 25, but instead of a rally, XRP saw heavy selling. Traders had already priced in the event after an 8% run-up earlier in the week and rushed to “sell the news.” While the ETF drew $37.75M in spot volume on its launch day, it was modest compared to BTC and ETH products, muting optimism.

At the time of writing, XRP price is at $2.76, with a market cap of $165.21B. It has posted a daily low of $2.74 and a high of $2.87. Trading volumes remain elevated, which highlights both panic selling and speculative positioning.

The $2.71 level is now the key short-term support. A bounce here could stabilize XRP, especially if broader market sentiment recovers. However, a clean break below $2.71 opens the door to $2.55, a level last tested in June. On the upside, reclaiming $2.81 on a daily close would be an early sign of strength, while a move above $2.99 could neutralize bearish momentum.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.