The recent breakout above resistance has brought renewed optimism, pushing the price higher before cooling back into consolidation. At $0.75, the asset sits just above key support, where the next move could determine whether momentum extends further or fades into correction.

According to analyst Lyx on X, the descending wedge structure for TROLL has already produced a breakout, with volume expansion confirming strong participation. Historically, this pattern has marked turning points where selling pressure fades and bulls regain control.

The analyst highlighted that such setups often retrace a significant share of the prior decline, with current projections suggesting possible continuation toward the $0.35–$0.50 region if momentum remains intact.

Source: X

This bullish context underscores that traders are eyeing higher levels in anticipation of a sustained recovery. The breakout has also shifted sentiment across shorter timeframes, with higher highs and higher lows forming consistently. While short-term pullbacks remain possible, the overall wedge resolution continues to support optimism for further advances in the sessions ahead.

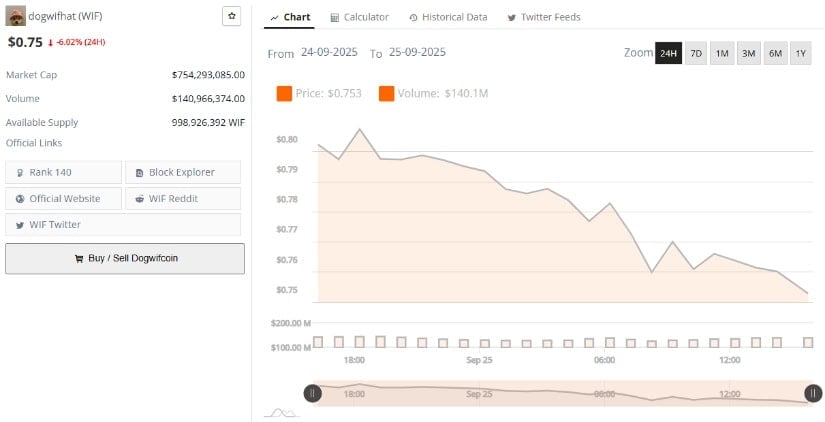

ON one hand, data from BraveNewCoin highlights a solid backdrop for the asset despite short-term volatility. Dogwifhat currently trades at $0.75 with a market cap of approximately $754.2 million and a 24-hour trading volume of $141 million. Daily fluctuations remain active, but liquidity levels show consistent participation across exchanges.

Source: BraveNewCoin

The circulating supply sits near 998 million tokens, supporting transparent tokenomics and deep liquidity for trading. Market forecasts suggest continued stability within the $0.70–$0.80 corridor as buyers and sellers contest direction. If inflows strengthen into the end of September, averages could lift toward $0.82, supported by broader market interest and recovering sentiment.

These figures point to resilience even as the asset consolidates under resistance. With liquidity intact and network activity consistent, the coin appears structurally positioned to sustain higher participation in the next phase of trading.

Despite the wedge breakout, short-term indicators reveal continued weakness. The MACD remains below zero, with the histogram trending negative, signaling that bearish momentum still outweighs buying pressure.

Unless a bullish crossover develops soon, consolidation could extend or test lower supports at $0.70 and $0.65.

Source: TradingView

The Relative Vigor Index (RVI) sits at 34.16 against its moving average at 51.85, further highlighting limited strength from buyers. Readings below 50 generally indicate sellers remain in control, and the declining slope of the RVI suggests caution is warranted.

Still, with the indicator nearing oversold conditions, a rebound from current levels cannot be ruled out. Confirmation above resistance would be the clearest signal of renewed upside potential.

Also read: Hyperliquid (HYPE) Price Prediction: Can Bulls Defend $35 Support or Will Sellers Push Lower?