The recent setup has placed Dogecoin back in the spotlight, supported by institutional ETF developments, increased network activity, and renewed market interest. Analysts suggest that DOGE’s ability to maintain key support zones could determine whether the meme coin can extend its rally in the near term.

Beyond technicals, Dogecoin’s latest news has been shaped by growing institutional interest. Grayscale, a leading digital asset manager, recently filed an amended S-1 with the U.S. Securities and Exchange Commission (SEC) to convert its Dogecoin Trust into a spot Dogecoin ETF. If approved, the fund would be listed on the NYSE Arca under the ticker symbol GDOG.

Grayscale files an amended S‑1 to convert its Dogecoin Trust into a spot ETF under the ticker GDOG. Source: Crypto Rover via X

The proposal follows the launch of the Rex-Osprey DOGE ETF (ticker DOGE), which has already boosted market sentiment. Analysts argue that regulated investment products could open new liquidity channels for DOGE, giving the meme coin a stronger footing in traditional markets. According to trader Cantonese Cat, Dogecoin’s attempt to climb above the Ichimoku cloud on the weekly chart mirrors previous rallies that triggered significant price surges.

Large holders, commonly referred to as whales, have also been accumulating aggressively. On-chain data reveals that more than 280 million DOGE have been added to whale wallets in recent weeks, valued at tens of millions of dollars at current market rates.

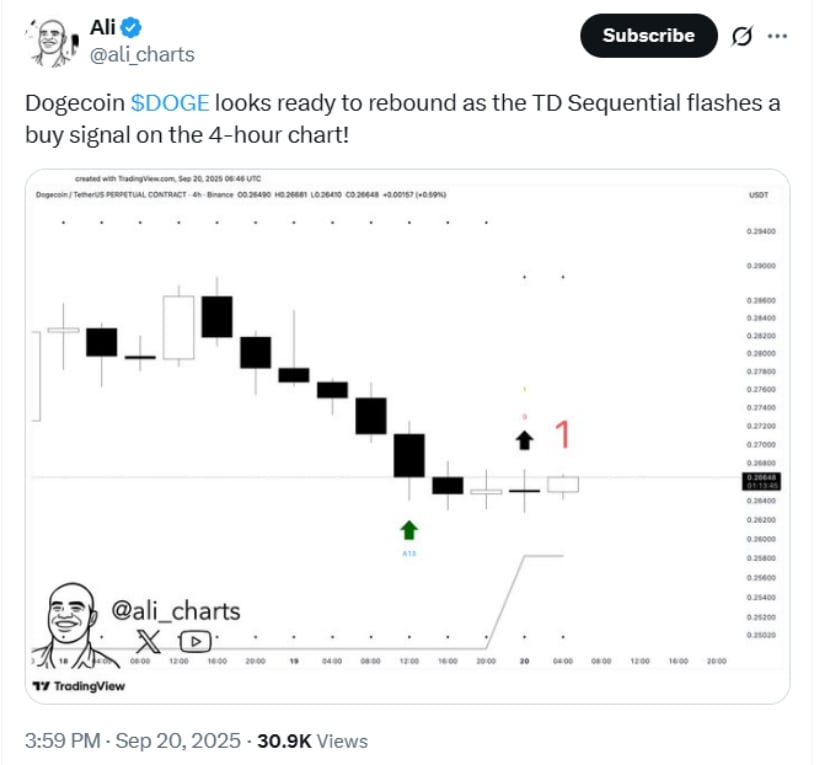

Dogecoin (DOGE) shows signs of a rebound as the TD Sequential flashes a 4-hour buy signal, targeting near-term resistance around $0.28–$0.30. Source: Ali Martinez via X

Analysts view this as a vote of confidence in Dogecoin’s future. The buying spree coincides with speculation around ETF approval while also highlighting growing activity on the network. Rising transaction volumes and ongoing development updates indicate a maturing ecosystem that has transcended meme-driven hype.

Technically, Dogecoin levels of support remain strong at $0.25–$0.26. If bulls can defend this zone and advance on up to above $0.30, the subsequent dogecoin target price stands at about $0.38, while $0.40 works as a more intermediate-term benchmark. Beyond that, the psychological barrier of $1 remains in the background over Dogecoin forecasts, a benchmark originally floated during the 2021 bull run.

Technically, DOGE/USDT holds key support—a potential 18% upside to $0.315. Source: MadWhale on TradingView

But danger remains. A breakdown below the $0.25–$0.26 range could see Dogecoin retest $0.20, a level that has been a reliable support previously. Traders caution that meme coins can spring with sudden volatility, with whale behavior, sentiment shift, or prevailing crypto trends reversing momentum at whim.

The million-dollar question—whether or not Dogecoin will reach $1 — is a much-debated topic. With ETF filings, whale buying, and investor interest, the case for higher prices is stronger than ever. That said, experts also note that slow approvals, regulatory concerns, and fickle sentiment continue to get in the way.

For now, the Dogecoin price prediction today is optimistic with caution. Given increasing institutional inflows and technical breakouts confirmation, DOGE can sustain upbeat trends. Long term, Dogecoin price prediction 2025 scenarios range widely from conservative prices near $0.50 to bullish projections of $1 or higher, depending on adoption and regulatory guidance.

Dogecoin’s short-term outlook is optimistically guarded as it remains above the $0.26 support line. Technical purchasing indicators, whale accumulation, and attempts to initiate a spot Dogecoin ETF have all fueled renewed optimism in the market. With meme coins renowned for violent volatility, however, traders are cautioned to watch closely at the resistance points of $0.30 and $0.38.

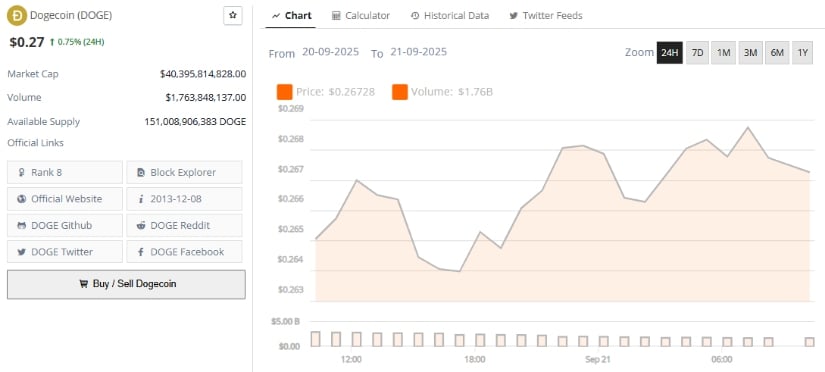

Dogecoin was trading at around $0.27, up 0.75% in the last 24 hours at press time. Source: Brave New Coin

Whether or not Dogecoin reaches $1 remains to be seen, but the combination of institutional inflows, sentiment, and increasing network usage supports its long-term argument. Currently, the path of least resistance is contingent upon DOGE maintaining critical levels of support while climbing on momentum from retail speculation and institutional investment.

Also read: Solana Price Prediction: SOL Battles $250 Resistance as Bulls Eye Breakout Towards $300