Bitcoin (BTC) is positioned for significant growth as the global financial system faces a potential reset. With increasing distrust in traditional institutions and a rising demand for alternatives, Bitcoin may play a central role in a changing financial landscape. Analyst Jordi Visser predicts that Bitcoin’s adoption will accelerate in the coming years, driven by a shift in the way individuals view money and trust in financial systems.

Jordi Visser, a prominent market analyst, has pointed out that growing skepticism toward traditional financial institutions is fueling Bitcoin’s potential for increased adoption. As global uncertainty rises, more individuals are losing faith in banks, governments, and traditional currencies. “Bitcoin is a trustless thing,” Visser explained. “It was set up first to deal with the fact that I don’t trust the banks. Well, now we’re past the banks.”

Visser’s statement highlights a broader shift in how people view trust and finance. Many individuals no longer feel that legacy institutions can protect their interests, especially amid increasing debt and inflation. The disillusionment with established systems is seen as a driving factor for Bitcoin’s appeal as a neutral, permissionless, and global asset that operates outside the control of governments or financial institutions.

Visser’s comments come as the world approaches a period of potential change, akin to the concept of the “Fourth Turning.” This term, popularized by historians William Strauss and Neil Howe, describes a cyclical pattern in which societal structures face a major reset, often marked by financial turmoil, generational shifts, and the rise of new systems. Visser believes that Bitcoin will be central to the upcoming reset, especially as the financial system faces growing challenges like geopolitical tensions, rising debt, and inflation.

As governments struggle with increasing debt, which impacts the purchasing power of citizens, Bitcoin offers an alternative store of value. Visser’s analysis suggests that as individuals become increasingly disconnected from traditional financial institutions, Bitcoin will gain ground as a trusted and decentralized option. The growing lack of confidence in central banks and fiat currencies makes Bitcoin an attractive alternative for those looking for stability.

The current economic landscape also contributes to Bitcoin’s increasing relevance. Visser refers to the K-shaped economy, a term used to describe a situation where different segments of the population experience vastly different economic outcomes. While wealthy individuals and those who hold assets continue to see their wealth grow, many others struggle with inflation and job insecurity.

According to Visser, the gap between these two groups is widening, leading to increased frustration among those at the bottom of the K-shape. “The growing number of people on the bottom end of the K do not feel like they’re part of the system,” he noted. This division in the economy only heightens the desire for alternatives like Bitcoin, which is viewed as a more inclusive and independent financial system that doesn’t rely on traditional institutions.

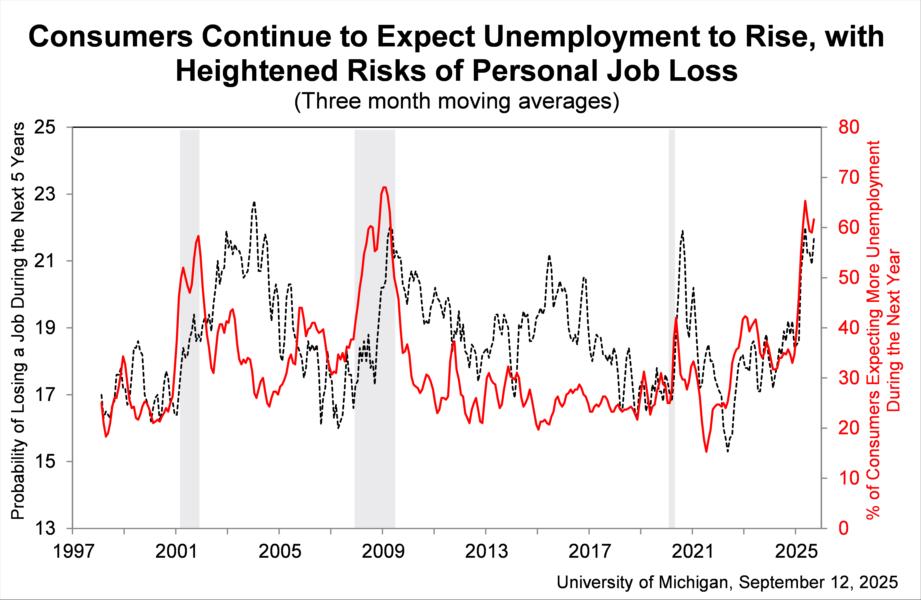

Recent surveys, including the University of Michigan’s consumer sentiment report, show a sharp decline in confidence. Only 24% of respondents expect their spending habits to remain the same by 2026, with most anticipating higher prices due to inflation. Additionally, a majority of those surveyed expect unemployment to rise in the coming years.

Visser’s analysis aligns with this sentiment, suggesting that as consumer confidence wanes, Bitcoin may become increasingly attractive as a store of value. With the potential for rising unemployment and economic instability, many individuals are seeking assets that offer protection from inflation and currency devaluation. Bitcoin, as a decentralized asset with a fixed supply, is seen by some as a hedge against these risks.

In summary, Bitcoin’s role in the evolving financial landscape is expected to grow as trust in traditional systems declines. Analyst Jordi Visser predicts that as the world faces a potential Fourth Turning, Bitcoin will accelerate in adoption, driven by economic uncertainty, rising inequality, and the need for a neutral and reliable financial system.

The post Analyst Predicts Bitcoin Adoption to Surge Amid Financial System Reset appeared first on CoinCentral.

Also read: Hyperliquid Aster Faces Risks as OKX Founder Warns on Regulation