TL;DR

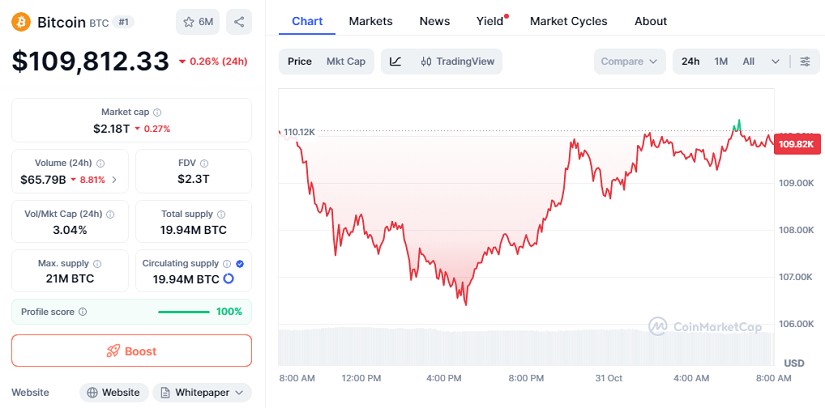

Bitcoin is ending October trading at $109,812.33 with a 24-hour move of -0.26%. Market capitalization stands at $2.18T and daily volume reached $65.79B, showing an -8.81% decline. This marks the first red October since 2018, a break from a pattern that helped define the last quarter of the year as a strong period for digital assets. While some short-term traders reacted with caution, long-term holders remained firm, absorbing supply and keeping selling pressure limited. Retail interest has also remained steady, with increased activity on major exchanges and spot trading volumes showing moderate resilience despite broader market weakness. Analysts note that sentiment indicators suggest cautious optimism.

Analysts highlighted that October’s pullback was influenced by global macro shifts such as central bank decisions and geopolitical tensions. Despite this, Bitcoin’s structural strength remains intact, sustained by institutional demand, ongoing corporate adoption and increasing participation through regulated financial instruments. Several market researchers noted that Bitcoin’s negative October has historically not guaranteed weakness in the following month. November remains the best average performing month for BTC across the last decade, often acting as a springboard for fourth quarter appreciation. Options and futures markets indicate that investor positioning is currently balanced, reducing the likelihood of extreme volatility in early November.

Network metrics also reflect positive internal momentum. Hash rate and mining investment continued to rise, reinforcing confidence in Bitcoin’s long-term security model. Derivatives data shows reduced excessive leverage, which often precedes healthier rebound phases. Some digital asset funds confirmed renewed accumulation near current levels, signaling ongoing interest from sophisticated market participants.

Supporters of a constructive outlook emphasized that Bitcoin is no longer driven solely by speculative trading. Its integration into global macro portfolios, growing retail accessibility and improved regulatory clarity have strengthened its foundation.

Many analysts project that if November maintains moderate inflows and macro conditions stabilize, Bitcoin could resume its path toward six-figure territory, with some forecasts pointing to levels near $150,000 before year-end.

Also read: Tron, Cardano, and BlockchainFX – Which Top Crypto Will Lead Q4 2025 Gains?