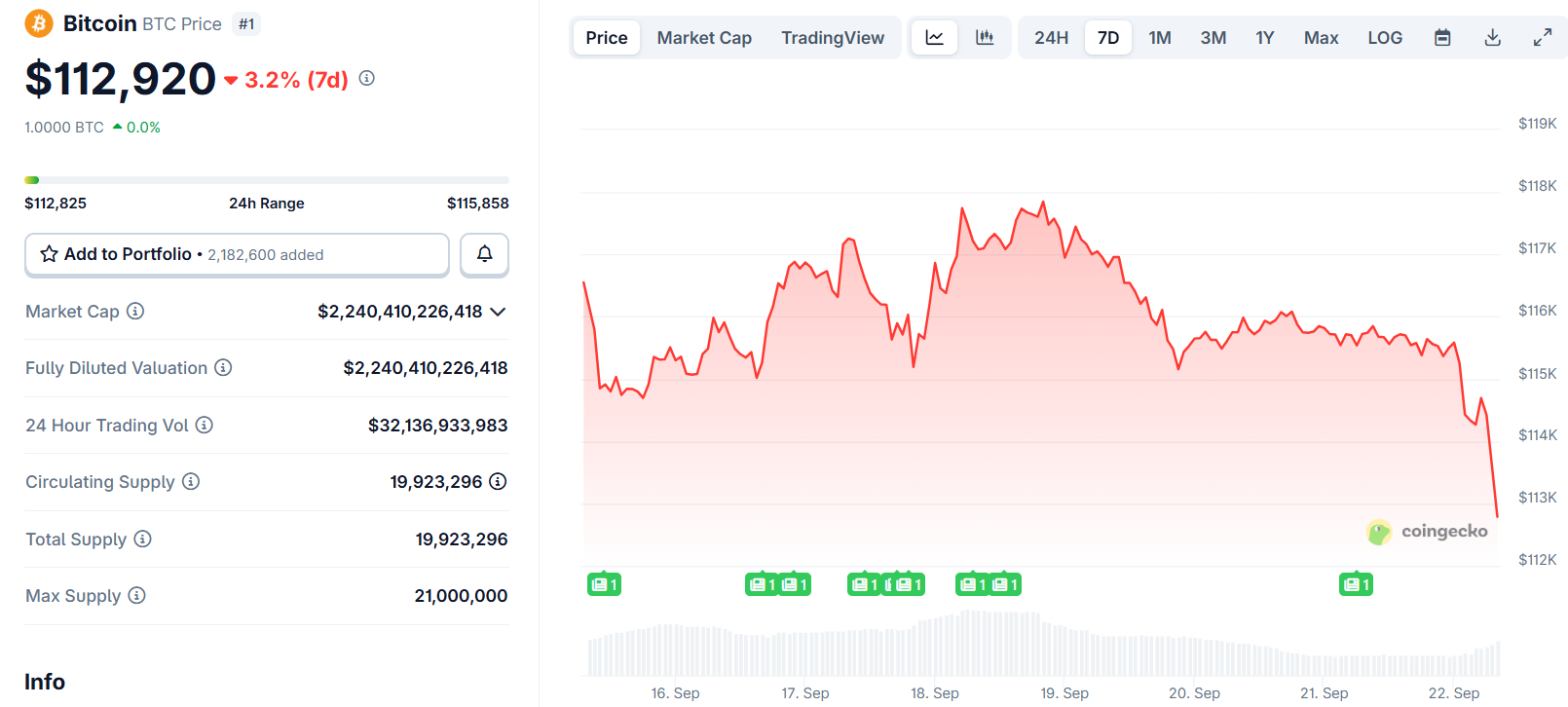

Bitcoin dropped to $111,760 on September 22, 2025, marking a 1.5% decline from previous levels. The world’s largest cryptocurrency broke below the key $115,000 support level that had held during earlier corrections.

The selloff began during evening hours on September 21 and continued into September 22. Bitcoin had reached highs near $117,000 just days earlier before retreating to current levels.

The broader cryptocurrency market experienced severe stress during this period. Total market capitalization fell by $77 billion in a single day. More than 400,000 traders faced liquidations worth $1.7 billion combined.

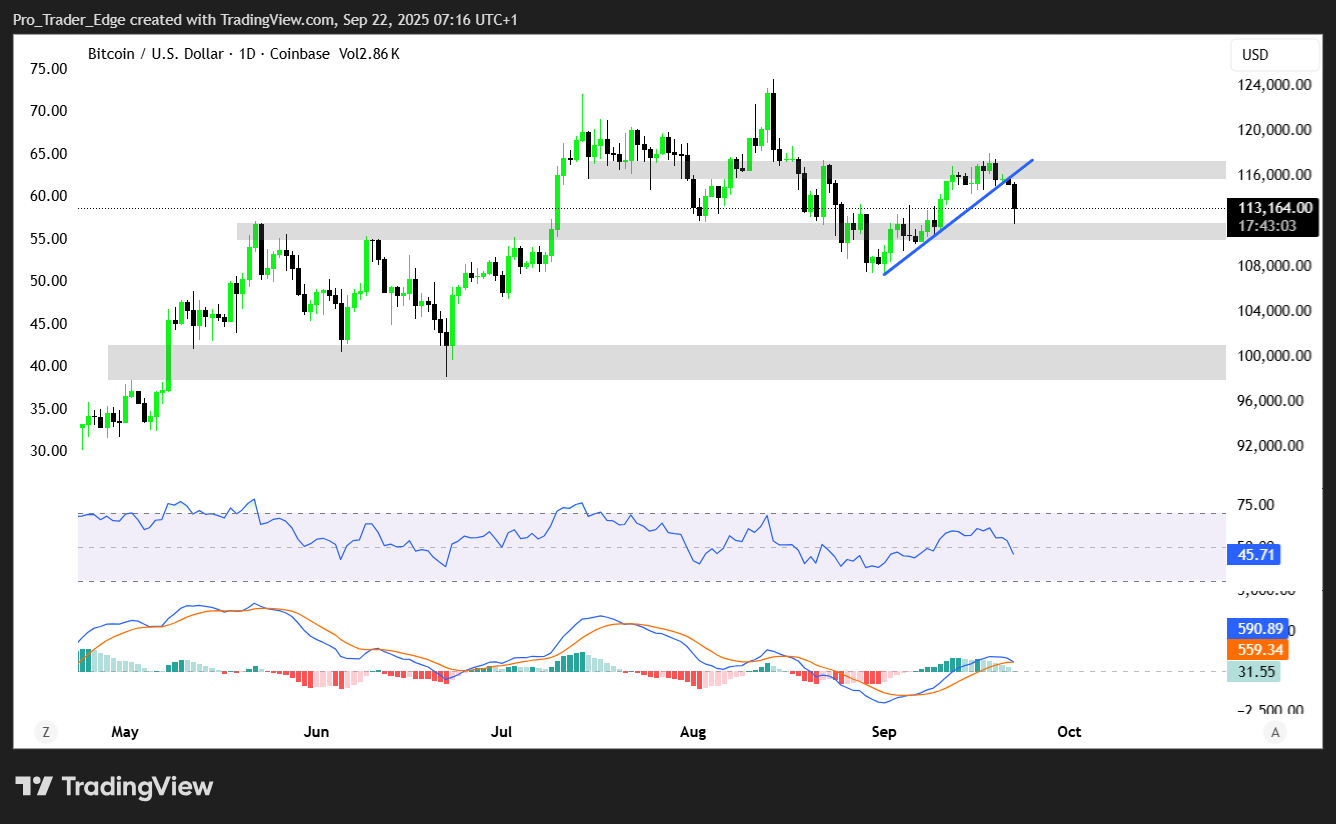

Multiple factors contributed to the market decline. The strengthening US dollar created risk aversion among investors. Bitcoin formed a technical pattern called a Doji candle at a key resistance zone.

Institutional investors took profits after strong gains in August and early September. Spot bitcoin ETF inflows paused during this period. Some large holders reportedly sold their positions into recent strength.

The Fear & Greed Index currently sits at 45, indicating neutral sentiment rather than extreme fear. Over 45% of social media conversations about bitcoin maintain a bullish tone. Only 13% of discussions show outright bearishness.

Supply-demand dynamics continue to favor bitcoin according to on-chain data. Exchange-traded funds still absorb more new bitcoin than miners can produce. This creates what analysts call a supply squeeze.

Historical patterns suggest potential for recovery. Since 2015, bitcoin has finished the year higher than September levels in 70% of cases. Many traders believe odds favor a post-September rally.

The $112,000 level now serves as critical support for bitcoin. A break below this price could lead to a test of $110,000. Recovery above $115,500 could restore bullish momentum quickly.

Traders are watching for movement above $118,000 as a key signal. Such a break could open the path to retesting all-time highs near $123,000 later this quarter.

$BTC Very little happening indeed. It's now the 4th weekend in a row where we have seen little volatility and likely no gap being created.

We'll see where this wants to go next week. Main short term levels for me to watch are $112K & $118K. https://t.co/RQ8cwV6IHd pic.twitter.com/CqPwpQstMb

— Daan Crypto Trades (@DaanCrypto) September 21, 2025

Economic data releases will likely drive bitcoin’s next major move. Federal Reserve commentary and PCE inflation data are scheduled for release soon. ETF activity patterns will also influence price direction.

The current environment shows cautious optimism among long-term holders. Supply constraints remain in place while institutional adoption continues. However, macroeconomic headwinds could extend the current correction.

Bitcoin’s trajectory sits at a critical point heading into October. The cryptocurrency must hold current support levels to maintain its recent uptrend. A failure to do so could trigger deeper selling pressure across the market.

The post Bitcoin (BTC) Price: Crashes Below $112,000 as Liquidations Hit $1.7 Billion. What’s Next appeared first on CoinCentral.

Also read: Regarder une publicité avant de s’essuyer : la nouvelle idée dingue des toilettes chinoises