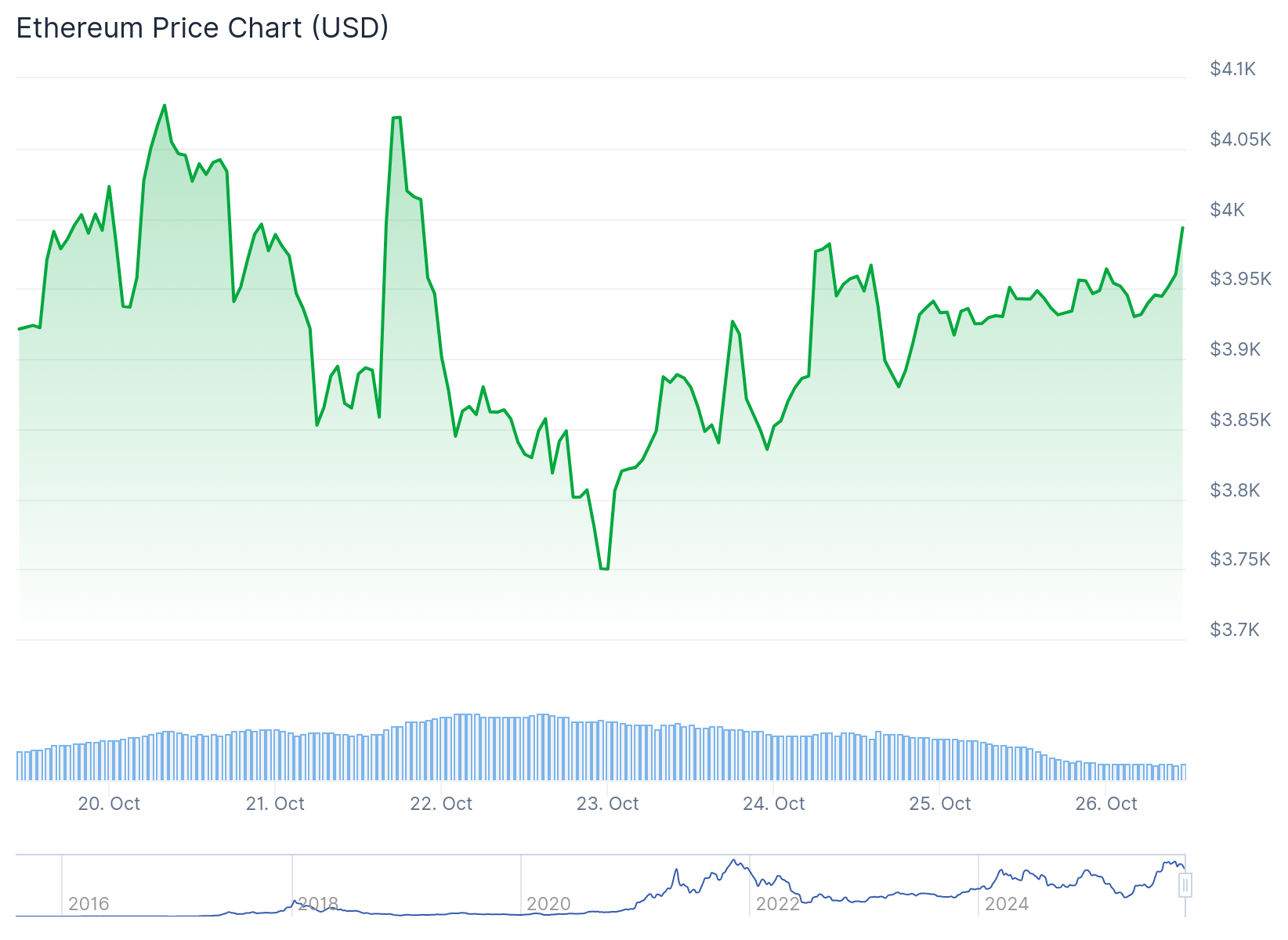

Ethereum is trading near $3,900 as it continues to test the $4,000 resistance level. The price has attempted multiple times to break through this barrier but has not been able to hold above it.

Analyst Ted Pillows believes ETH might drop to the $3,800 region before moving higher. He identifies this level as a strong support zone based on historical price action. His chart shows multiple potential recovery paths from this level.

$ETH is still consolidating around $3,900 level.

Yesterday, Ethereum tried to reclaim the $4,000 level but failed.

I think ETH could now retest the $3,800 support zone again before reversal. pic.twitter.com/8fq4eBkRXU

— Ted (@TedPillows) October 25, 2025

The cryptocurrency previously respected the $3,800 zone during past corrections. This makes it an important level to watch in the coming days.

ETH is currently trading at $3,926.50 with a market cap of $473.75 billion. Trading volume over the last 24 hours reached $34.58 billion.

Ethereum ETFs experienced outflows of approximately $93 million recently. BlackRock sold $101 million worth of ETH during this period. These institutional exits suggest reduced short-term confidence among large investors.

On October 24, Ethereum spot ETFs recorded a total net outflow of $93.6 million, marking three consecutive days of outflows, while Bitcoin spot ETFs saw a net inflow of $90.6 million, with no outflows among the twelve funds. https://t.co/Hj2Gs49bWa pic.twitter.com/ajJL9i7tvO

— Wu Blockchain (@WuBlockchain) October 25, 2025

The outflows occurred as Ethereum struggled to maintain prices above $3,900. ETF redemptions typically indicate bearish sentiment as institutions reduce exposure during consolidation phases.

Analyst Ali Martinez projects Ethereum could climb toward $10,000 over the next few years. His chart shows a steady ascending trendline that could guide the price to that level by 2027.

Ethereum $ETH will hit $10,000… Just not as soon as you think! pic.twitter.com/WVkjF8bKdl

— Ali (@ali_charts) October 25, 2025

Martinez identifies $4,250 as a key breakout point for the next bullish phase. Arthur Hayes shares similar optimism and maintains his $10,000 target for Ethereum.

Hayes dismissed current market fluctuations as normal volatility within a broader upward trend. He appeared on the Bankless podcast to reaffirm his long-term conviction.

Tom Lee estimates Ethereum’s actual value is between $12,000 and $22,000. Analyst Merlijn The Trader referenced this estimate while calling current prices a bargain.

The next resistance level sits at $4,140 while support holds at $3,890 on the daily chart. Breaking above $4,000 could open the path toward $5,000 as the next target.

The major support level remains at $3,550 if selling pressure increases. Analyst CRYPROWZRD noted that more positive daily closes are needed to establish a strong upward trend above $4,000.

The ETH/BTC pair needs to breach its lower high trendline on the daily chart. This would signal a strong bullish shift in momentum.

Ethereum’s price movements often follow Bitcoin’s overall market trend. Many traders are watching Bitcoin for clues about Ethereum’s next move.

The derivatives market has not shown renewed buying pressure yet. On-chain fundamentals remain strong despite short-term weakness.

The cryptocurrency is testing the $4,000 resistance level while maintaining support above $3,800. BlackRock’s $101 million sale and the $93 million in ETF outflows have added caution to the market.

The post Ethereum (ETH) Price: Testing $4,000 Key Level Despite $93 Million in ETF Outflows appeared first on CoinCentral.

Also read: Bitcoin Mining Shares Surge Following Jane Street’s Strategic Entry