The Federal Reserve has cut interest rates for the first time in nearly a year, setting the stage for potential Bitcoin price gains. The central bank lowered its benchmark rate by 25 basis points to 4%-4.25% on Wednesday.

BREAKING: The Federal Reserve has officially CUT interest rates by 25 basis points in their first rate cut of 2025.

This ends the Fed's 5-straight meeting streak without any change in Fed policy.

— The Kobeissi Letter (@KobeissiLetter) September 17, 2025

Fed Chair Jerome Powell described the move as a “risk management cut” in response to cooling economic conditions. The decision follows mounting signs of labor market weakness and economic uncertainty.

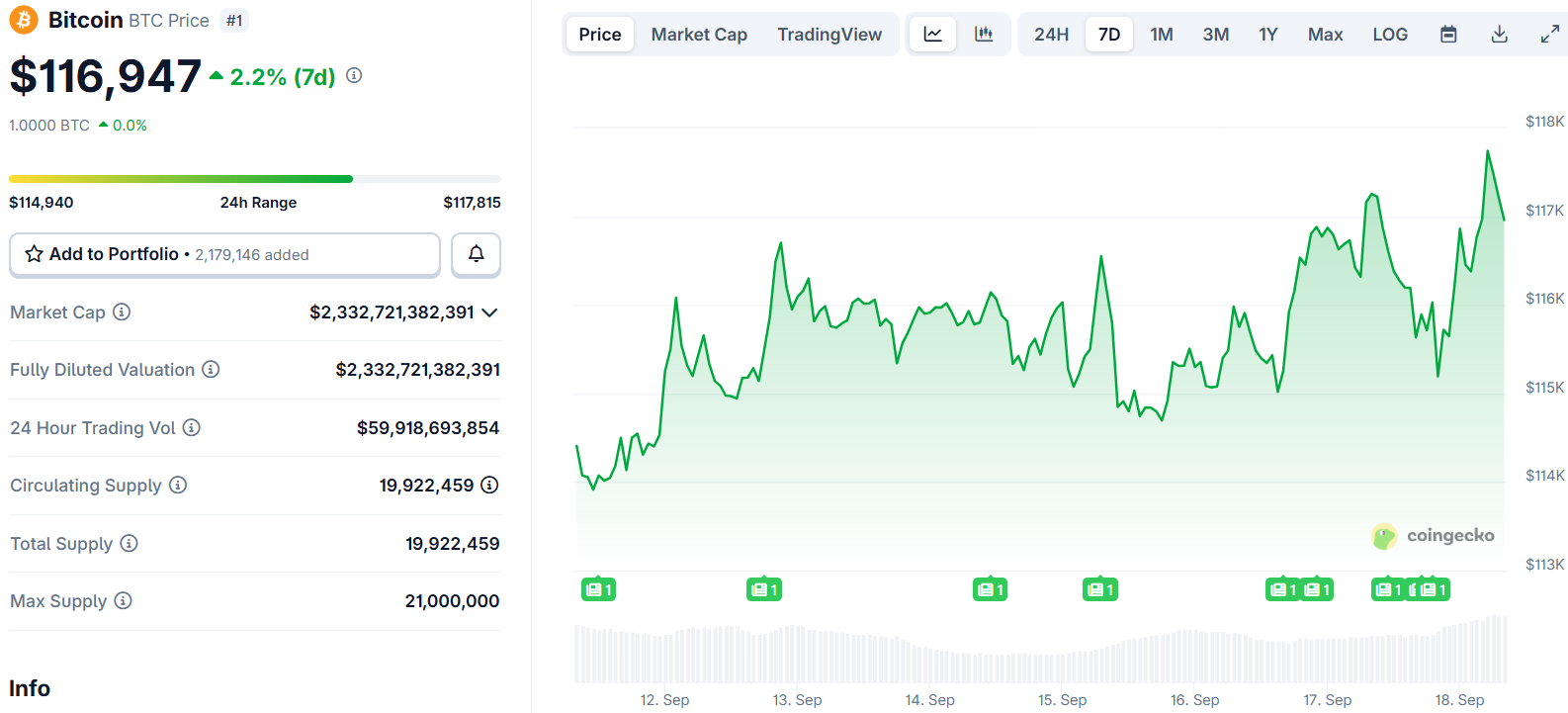

Bitcoin reacted modestly to the news, rising about 1% initially before giving up gains. The cryptocurrency currently trades around $116,325 with analysts watching for larger moves ahead.

Market observers are drawing parallels to September 2024 when Bitcoin rallied 80% following a Fed rate cut. If history repeats, similar momentum could drive BTC toward $210,000 per coin.

In the September 2024's #FED rate cut, $BTC experienced an 80% rally afterwards 📈

Could we see a similar scenario playout this time too?

A similar move would take Bitcoin to $210K per coin. 🔥 pic.twitter.com/ObNN9J78qH

— Bitcoinsensus (@Bitcoinsensus) September 17, 2025

Research from the Kobeissi Letter analyzed 20 rate cut cycles since 1980. The study found stocks typically gained 14% in the year following such decisions.

While Bitcoin isn’t directly tied to equities, it has shown correlations with risk assets during monetary easing periods. This relationship supports the bullish case for crypto in a lower rate environment.

Crypto analyst Lark Davis highlighted Bitcoin’s strong performance during September Federal Open Market Committee meetings since 2020. The cryptocurrency climbed from $10,000 in 2020 to $64,000 in 2024 during post-September windows.

The FOMC meeting is today.

And since 2020, every September FOMC (except during the 2022 bear) has set Bitcoin up for a massive pump.

This is regardless of whether the Fed cut rates or not.

It’s less about the decision itself, and more about seasonality.$BTC thrives in this… pic.twitter.com/JU81yzoz4B

— Lark Davis (@TheCryptoLark) September 17, 2025

The only exception was 2022’s bear market, which Davis noted as an outlier in the pattern.

Large-scale Bitcoin purchases continue to drive institutional adoption narratives. On September 16, a single wallet reportedly acquired $680 million worth of BTC.

This massive purchase signals confidence from deep-pocketed buyers at current price levels. U.S.-listed Bitcoin ETFs have also maintained consistent inflows from traditional finance.

The institutional demand adds momentum to Bitcoin’s bullish outlook as major players accumulate positions. Trading volume has exceeded $41.8 billion, indicating sustained market activity.

However, analysts note that historical volatility following rate decisions remains a consideration. Out of 22 rate cuts studied, 11 were followed by monthly stock declines.

This data highlights that short-term turbulence could still test investor sentiment despite longer-term bullish trends.

October has historically been Bitcoin’s strongest month with average returns of 22.9%. The seasonal “Uptober” effect typically results from year-end liquidity flows and reduced selling pressure.

Market psychology may play a larger role than Fed policy alone. A 2019 study in Finance Research Letters found FOMC announcements had only a modest 0.26% average effect on Bitcoin prices.

The research suggested that market sentiment, cyclical liquidity patterns, and broader adoption trends drive more meaningful price action.

Matt Mena from 21Shares noted the Fed’s dot plot signals openness to accelerating easing if conditions demand it. This creates what he calls an “asymmetric setup for Bitcoin” heading into year-end.

Seven out of 19 Fed participants expect rates to remain steady through the remainder of 2025. However, a slight majority believes two more rate cuts could occur this year.

The post Bitcoin (BTC) Price: Fed Rate Cut Sparks $210K Target as Institutional Buying Surges appeared first on CoinCentral.

Also read: Are the Japanese Really the Loneliest People in the World?