TL;DR

Hyperliquid (HYPE) has fallen more than 26% in the past week, dropping from recent highs near $59 to around $42 at press time. Trading volume over the last 24 hours is around $907 million, with a daily decline of 4%.

On shorter timeframes, the previous range POC $44–$45 is serving as immediate support. Resistance at $50 corresponds to the last breakdown. A slightly stronger wall forms around $52–$53, aligned with weekly and Monday opens. A failure of the $44–$45 line could rally interest towards the lower levels.

Crypto Bully said HYPE retraced more than expected but is still holding above the range POC.

– Retraced quite a bit more than expected. However the range prior to breakout is holding well so far as we’re trading right at the POC

– Can add here for a move back towards $50 (support that broke through which lead to the breakdown), invalidation is price finding… pic.twitter.com/cC4cyPIwtL

— Crypto Bully (@BullyDCrypto) September 24, 2025

Ali Marinez added that the $42 region aligns with a key retracement level, calling it a “golden buy-the-dip zone.” His chart outlines a potential rebound path that could take HYPE back toward $55, provided the $42 support holds.

Husky pointed to other factors weighing on the market, including buybacks, whale selling, and token unlocks. He remarked, “That last move down is the imbalance that screams at me, though, I’d expect to see some of that filled.” Husky marked support at $38–40, with deeper levels at $30, $28, and $23. Short-term resistance is placed in the $47–50 area.

According to Hyperliquid News, the final draft of HIP-3 is nearly ready. It includes staking requirements for creating decentralized exchanges, fee adjustments for stablecoins, and slashing penalties. HYPE staking benefits would extend to all HIP-3 trading pairs.

The final version of HIP-3 is almost ready.

– Bug bounties now correspond to those on the mainnet.– To create a HIP-3 Dex, you must stake at least 500,000 $HYPE (which will be reduced over time).

– The first three assets will not be auctioned, but subsequent ones will function… pic.twitter.com/sgLxi49bTw

— Hyperliquid News (@HyperliquidNews) September 25, 2025

Separately, investment firm DBA has proposed reducing HYPE’s total supply by 45%, aiming to improve investor appeal. The proposal is under discussion and has not been enacted.

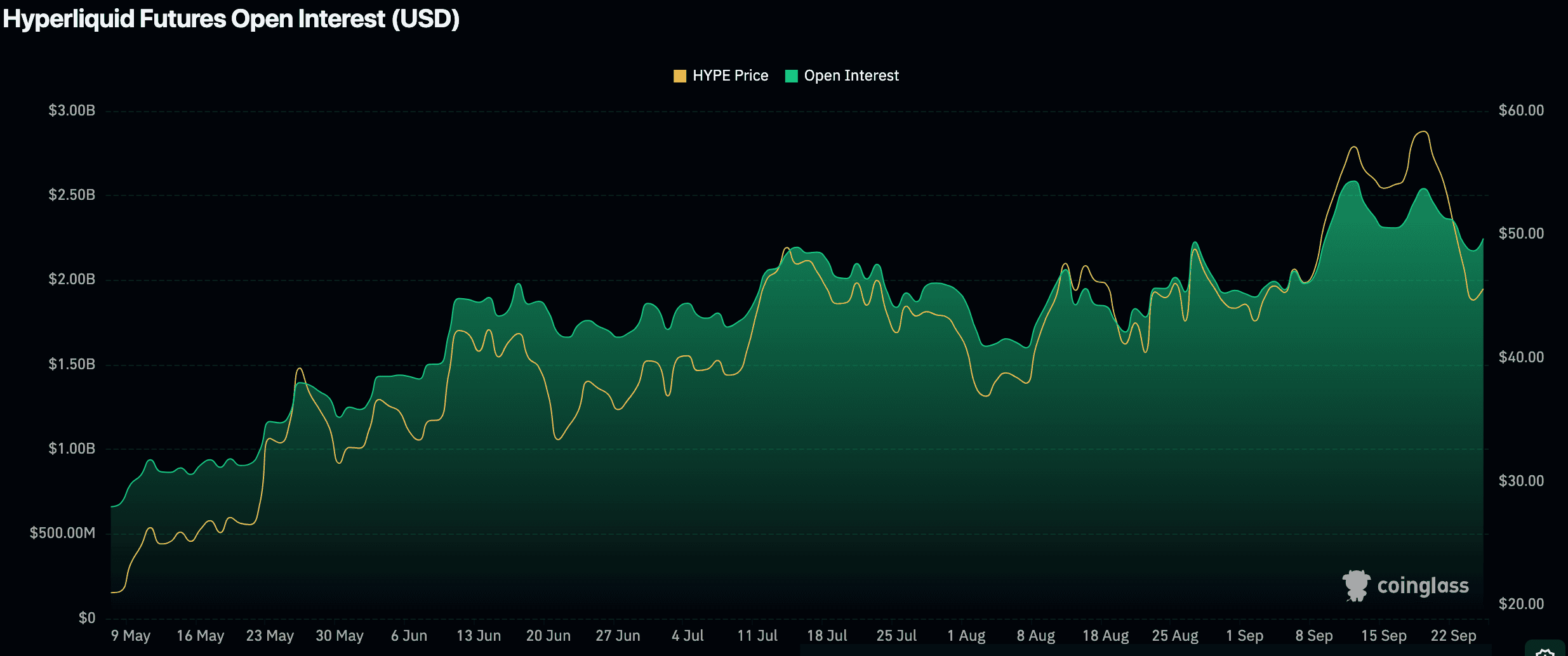

Futures data shows open interest (OI) remains elevated at $2.17 billion. As May rolled in, OI crept slowly upward from less than $1 billion to current levels, suggesting the continued activity in the derivatives market.

July and mid-September saw OI climbing together with price rallies. The recent fall from $59 down to $42 did not even see much of an unwind, meaning a whole lot of positions are still open. These are when high OI on a downtrend leaves markets open to volatility in the event of increasing liquidations.

The post After 26% Weekly Drop, Can HYPE Bounce Back to $50? appeared first on CryptoPotato.

Also read: Bonus écologique, virements bancaires et fast-fashion… voici tout ce qui change en octobre 2025