Markets will navigate a compressed trading schedule this week as investors await key earnings reports and delayed economic data. The Presidents Day holiday closes markets Monday before a busy week of corporate results and inflation numbers.

Walmart takes center stage Thursday with its quarterly earnings report. The release marks the first under new CEO John Furner following his recent promotion. The retail giant recently crossed $1 trillion in market capitalization, becoming the first big box store to reach that milestone.

#earnings for the week of February 16, 2026https://t.co/hLn2sKQhEY$HL $WMT $PANW $KGC $OPEN $CVNA $ADI $CDE $PAAS $ET $RIG $NEM $AG $CDNS $DASH $DVN $FIG $MDT $PWR $RGLD $EQT $TOL $DE $SSRM $RNW $LMND $AKAM $EQX $EBAY $FIX $KLAR $LYV $RELY $SXC $SEDG $SFM $TXRH $SON $OXY… pic.twitter.com/fnltw1qIDA

— Earnings Whispers (@eWhispers) February 13, 2026

In its previous report, Walmart posted a 4.2% increase in comparable sales. The company also raised its full-year sales forecast. Investors will watch closely to see if consumer spending remained strong through the holiday season.

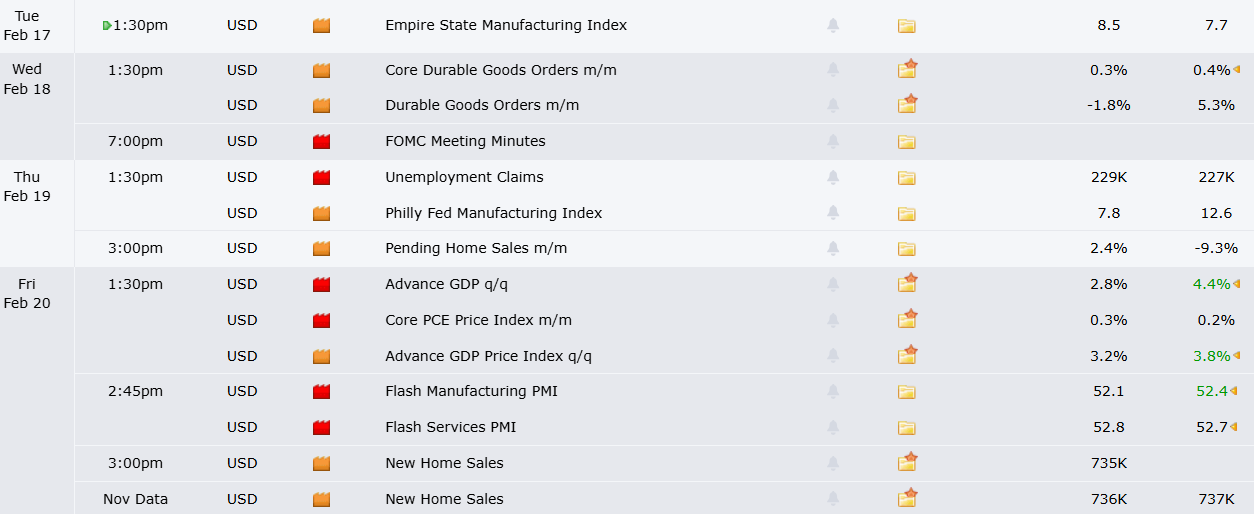

Friday brings the Personal Consumption Expenditures price index for December. The PCE report is the Federal Reserve’s preferred inflation measure. Recent Consumer Price Index data showed inflation remained unchanged in December, and the PCE numbers could influence the Fed’s rate policy decisions.

Thursday’s GDP release will show fourth quarter economic growth for the first time. The Bureau of Economic Analysis previously reported 4.4% growth for the third quarter. The new data will reveal whether that momentum continued into year-end.

Housing market data delayed from last year’s government shutdown will also arrive this week. Both November and December figures for housing starts and new home sales are scheduled for release. Pending home sales for January will offer a forward-looking view of the market.

January’s Federal Reserve meeting minutes will provide insight into officials’ economic views. The minutes come as markets try to gauge when the central bank might adjust interest rates. Fed Vice Chair Michelle Bowman and other officials are scheduled to speak throughout the week.

Recent market action has been dominated by AI-related selling pressure. Software stocks initially led the decline, followed by financial services, retail, and logistics companies. Investors are dumping stocks at the first sign that AI tools might disrupt traditional business models.

The Nasdaq Composite fell 2.1% last week while the S&P 500 dropped 1.4%. The Dow Jones Industrial Average declined 1.2%. These index moves masked sharper swings in individual stocks across various sectors.

A logistics company announcement this week triggered double-digit declines in freight stocks. CH Robinson Worldwide fell 12% and Universal Logistics dropped 10% after a karaoke machine maker unveiled an AI-powered logistics platform. The platform claims to scale freight volumes by 300% to 400% without adding staff.

Major tech stocks also slid despite rising AI spending projections from large corporations. Nvidia, Alphabet, and Amazon all fell on Friday. AppLovin stock dropped 18% after disappointing earnings while Pinterest tumbled 21% following its results.

January’s jobs report surprised markets with 130,000 additions, double economist estimates. However, revisions cut 400,000 jobs from 2024’s total. The adjustments brought 2024’s monthly average to roughly 15,000 jobs added per month.

Friday’s CPI data showed inflation cooled more than expected in January. Core CPI, excluding food and energy, rose at the slowest annual rate since December 2021. Some categories that improved most, including non-vehicle goods and non-shelter services, matter most for long-term inflation trends.

Traders are pricing in just over 50% odds of a quarter-point Fed rate cut by June. That would bring the target rate to 3.25%-3.5%. Fed Chair Jay Powell’s term ends in May, with Kevin Warsh expected to bring a fresh perspective to monetary policy.

The post Daily Market Update: Walmart Earnings and Key Economic Data Set the Tone for Shortened Week appeared first on CoinCentral.

Also read: Study Suggests WLFI Could Act as an Early Warning Signal for Crypto