TL;DR

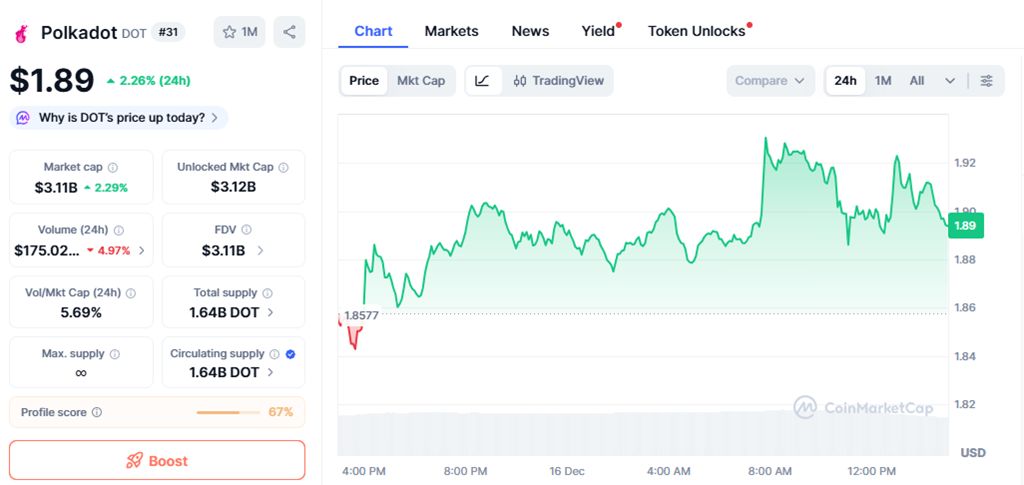

Polkadot showed renewed traction on Tuesday after Coinbase activated native USDC deposits and withdrawals on the network, a move announced on December 15. The update linked one of the largest U.S. exchanges directly to Polkadot’s stablecoin rails, supporting a gradual and orderly price advance. DOT held near $1.89, outperforming several peers as investors responded to more direct access to dollar-denominated liquidity within the network.

Market indicators pointed to a stable trading environment. Prices remained above key technical areas, signaling consistent buying interest without abrupt swings. Price action stayed controlled, with DOT respecting recent support while tracking broader market conditions.

The introduction of native USDC transfers from Coinbase reinforced Polkadot’s position as an interoperable network built for financial applications. Users can now move USDC directly between Coinbase and Polkadot-based protocols, removing extra steps tied to bridges or wrapped assets. This structure supports faster settlement and predictable transaction costs, features relevant to developers building DeFi, payment, and treasury tools.

Network data shows more than $150 million in USDC issuance across the Polkadot ecosystem. The Coinbase connection broadens reach by offering U.S. customers a direct on- and off-ramp, a factor that often shapes liquidity access and operational efficiency. Nicolas Arevalo, CEO of Velocity Labs, said the update reduces onboarding friction and strengthens liquidity rails, underscoring the coordination between Coinbase and ecosystem teams.

After the announcement, DOT moved toward the $1.91 area while maintaining a structure of higher lows. Analysts monitoring intraday behavior noted steady buying on pullbacks, a pattern typically linked to accumulation strategies. Despite early volatility, prices consolidated near session highs, reinforcing the view of sustained and methodical demand.

From a technical standpoint, support formed in the $1.87 to $1.88 range after multiple tests, while resistance emerged just below $1.94. This range-bound behavior helped keep price stability as the market assessed the implications of the integration.

Looking ahead, Polkadot’s ability to support USDC for payments, fees, and cross-chain transfers positions the network for broader use tied to stable-value assets.

Also read: Solana Withstands One of Its Biggest Network Attacks to Date