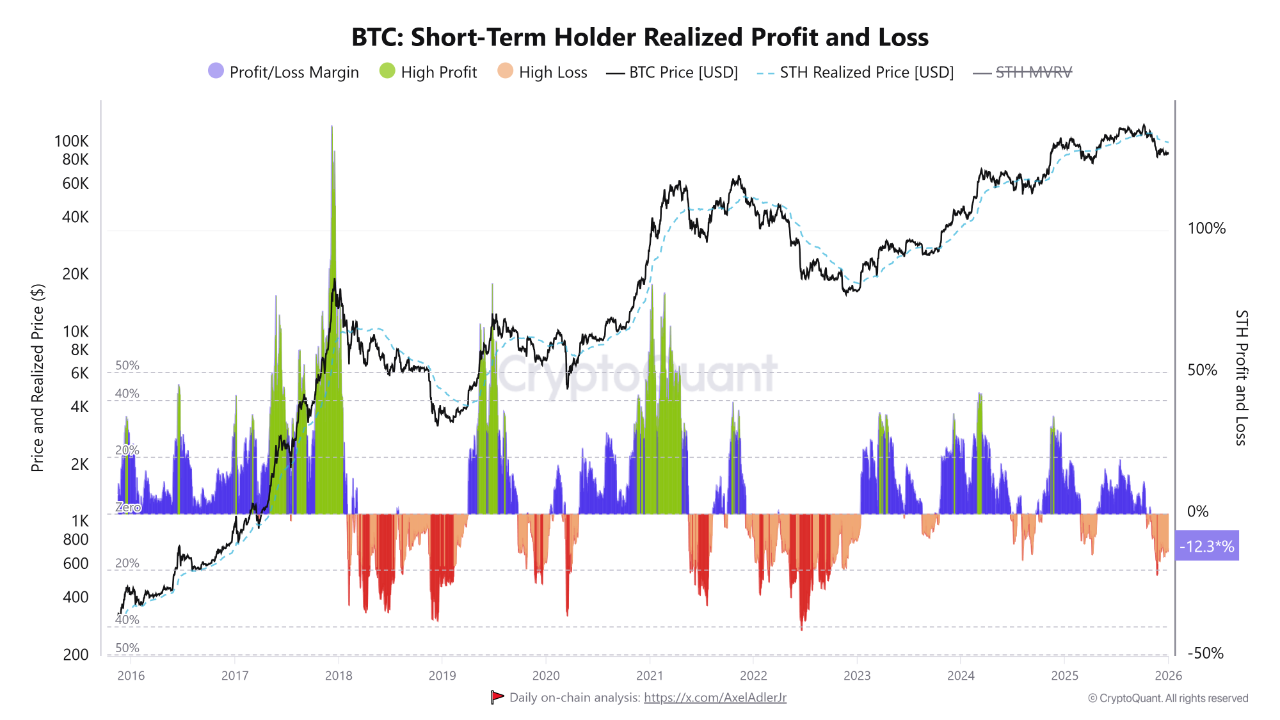

Bitcoin short-term holders have returned to negative profitability territory as aggregate losses reach approximately -12%.

The current market structure shows newer participants facing renewed pressure despite Bitcoin maintaining relatively elevated price levels. On-chain data reveals that the short-term holder realized profit and loss margin continues to deteriorate.

This development marks a critical juncture for market participants who acquired Bitcoin at higher price points. The price remains near the short-term holder realized price, testing a key behavioral support zone that could determine the next directional move.

The aggregate short-term holder position has shifted back into loss territory after a period of relative stability.

Current data shows newer market entrants operating at a -12% loss margin. This metric captures the financial position of investors who purchased Bitcoin within recent months.

Bitcoin price continues trading close to the short-term holder realized price level. This proximity creates a crucial testing ground for market sentiment and participant behavior.

Source: Cryptoquant

Historical patterns show that such price-to-cost basis convergence often precedes heightened volatility.

Rising sell-side pressure emerges from participants who entered positions at elevated levels. These newer holders demonstrate increased sensitivity to short-term price movements. Their underwater positions create potential for accelerated selling if prices decline further.

The current loss levels remain contained compared to previous cycle extremes seen in 2018 and mid-2022.

This distinction suggests that structural market damage has not reached critical levels. However, the persistence of negative margins indicates vulnerability in near-term demand dynamics.

Sustained periods of short-term holder losses typically coincide with late-stage corrections or consolidation phases.

These periods can either flush out weak positions or mark transitional phases before trend continuation. Market observers note that the absence of extreme loss levels provides some stability.

The next directional move depends on whether short-term holder profitability recovers or continues deteriorating.

A deepening of losses could amplify downside volatility and selling pressure. Conversely, a recovery in profitability metrics might stabilize market conditions and reduce immediate downside risks facing newer participants.

The post Bitcoin Short-Term Holders Face Renewed Pressure as Losses Hit -12% Margin appeared first on Blockonomi.

Also read: Mutuum Finance Crypto Price Forecast: MUTM Potential Three Years From Now