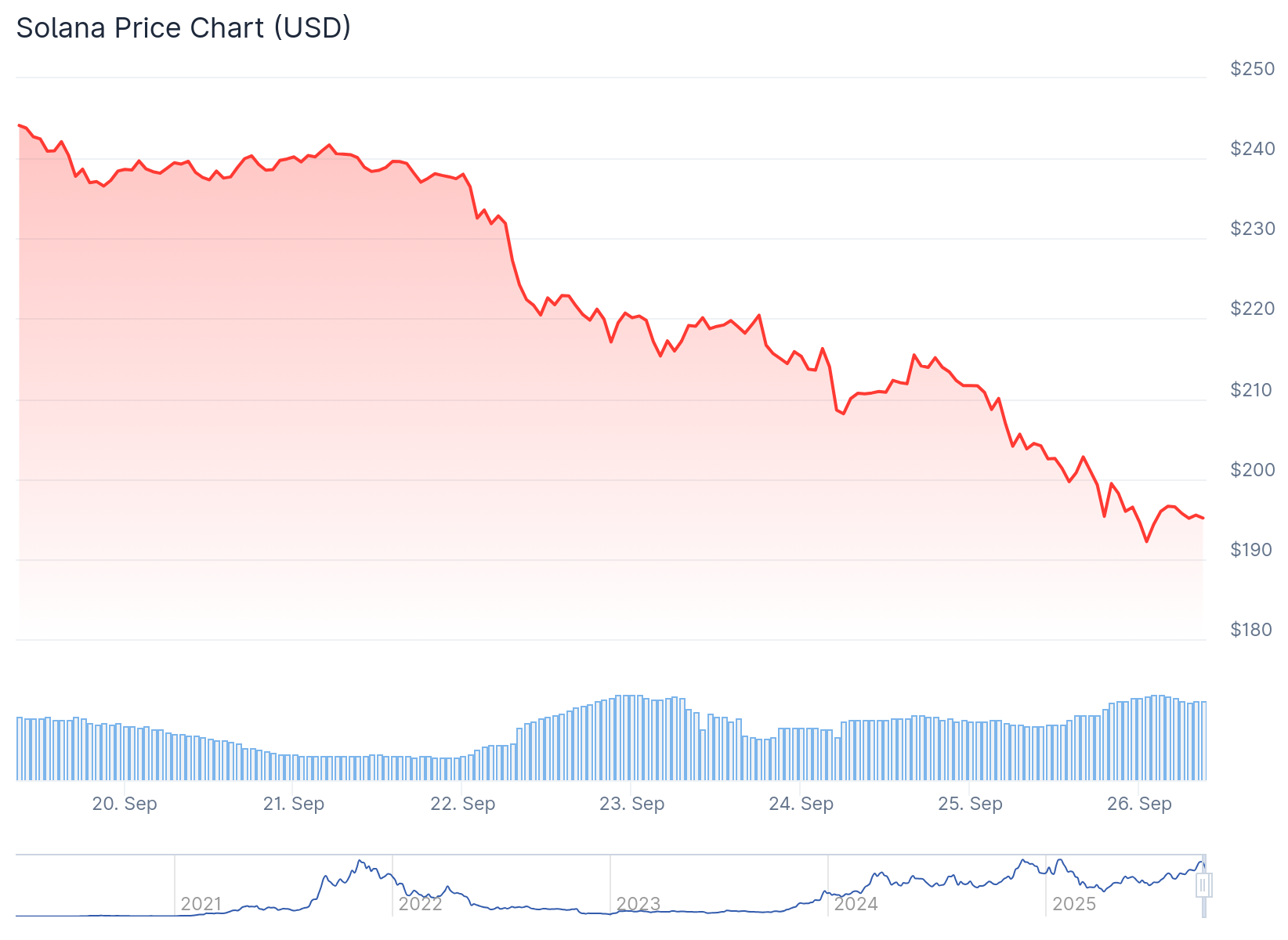

Solana dropped to $192 on Thursday, sliding below the psychologically important $200 level. The move erased gains from a recent rally that pushed SOL to an eight-month high of $253.

The 19% decline happened in just one week. The rapid reversal has shifted market attention to upcoming catalysts that could influence price direction.

A key date approaches on October 10. Grayscale’s spot SOL exchange-traded fund faces its first approval deadline from the Securities and Exchange Commission.

The decision could determine whether institutional capital begins flowing into Solana. This would mirror the pattern seen with Bitcoin and Ethereum over the past year.

The REX Osprey Staking SOL ETF launched in July but offers a different structure. A pure spot product from Grayscale would allow more direct institutional participation.

Five other applications await review by regulators. Bitwise, 21Shares, VanEck, Grayscale, and Canary have proposals with a final deadline of October 16, 2025.

The lineup shows growing institutional interest in bringing SOL into mainstream investment vehicles. Asset managers see potential in the current market positioning.

Pantera Capital recently called SOL “next in line for its institutional moment.” The firm pointed to under-allocation relative to other major cryptocurrencies.

Institutions hold around 16% of Bitcoin’s supply and 7% of Ethereum’s supply. Less than 1% of SOL’s supply is institutionally owned.

Companies like Stripe and PayPal have expanded their Solana integrations. This infrastructure development could support institutional adoption if ETF approval occurs.

Prediction markets show mixed sentiment about SOL’s prospects. Polymarket assigns just a 41% probability of SOL reaching a new all-time high in 2025.

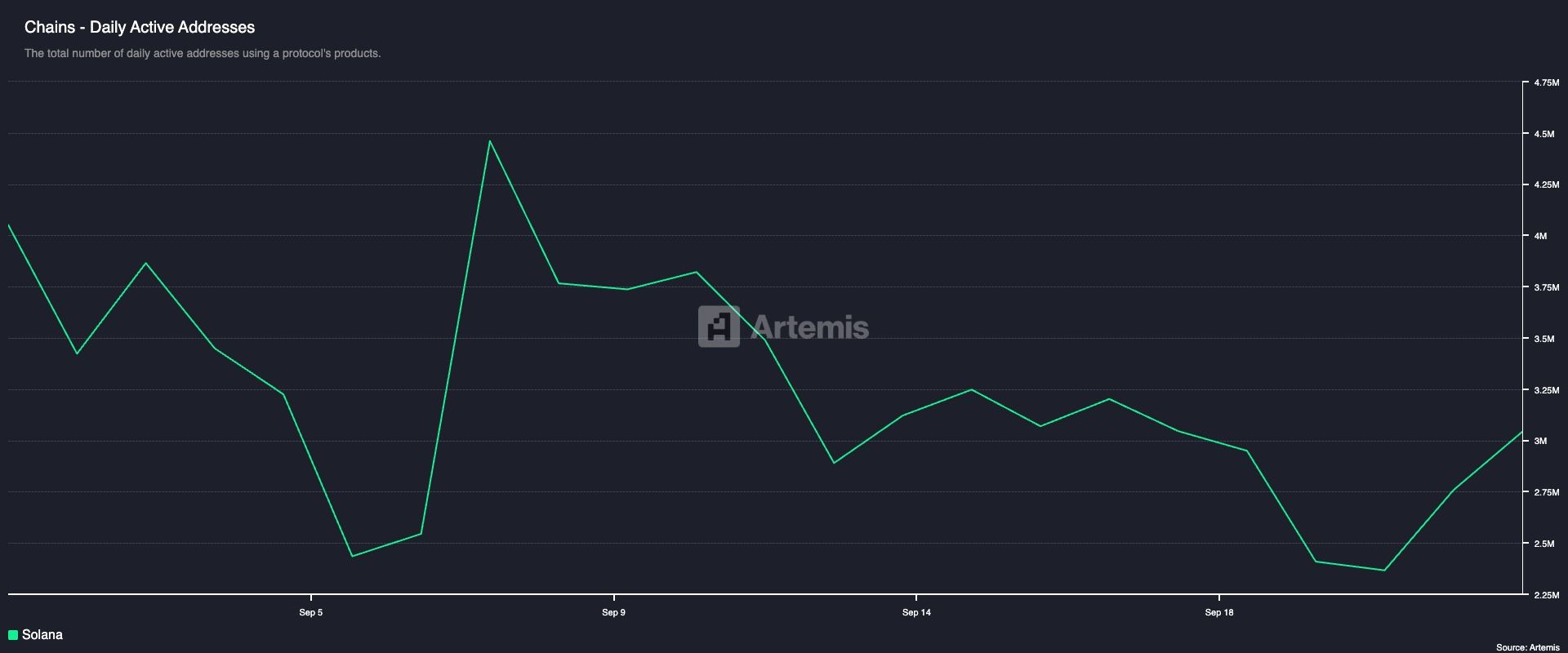

On-chain data reveals concerning trends for network usage. Daily active addresses interacting with Solana protocols dropped 25% this month to 3.04 million.

Daily active addresses represent unique wallets sending, receiving, or interacting with applications. A decline signals weaker user engagement and lower network activity.

SOL historically performed well in September over the past four years. The token gained 29% in 2021, 5.38% in 2022, 8.22% in 2023, and 12.5% in 2024.

This year breaks that pattern. SOL peaked at $253.51 on September 18 but has since fallen roughly 17%.

Technical indicators confirm the bearish momentum. SOL’s Relative Strength Index sits at 40.54 on the daily chart.

RSI readings above 70 suggest overbought conditions while readings below 30 indicate oversold levels. The current reading shows selling pressure outweighs buying momentum.

However, the RSI level has historically marked turning points for SOL. Since April 2025, similar readings below 30 on the four-hour chart have preceded recoveries four out of five times.

SOL continues to form higher highs and higher lows on longer timeframes. The current correction is testing the demand zone between $200 and $185.

This area overlaps with the 0.50-0.618 Fibonacci retracement band. Technical analysts often watch this region for potential bounces.

If SOL loses the $185 level, the next support zone sits between $170 and $156. Such a move would weaken trend strength and likely invite deeper selling pressure.

The October ETF decision deadline approaches as SOL tests key technical levels at $195.55 support, with potential further declines to $171.88 if bearish pressure continues.

The post Solana (SOL) Price: Drops Below $200 Ahead of October ETF Decision Deadline appeared first on CoinCentral.

Also read: PS5 Pro : un nouveau modèle arrive (très) bientôt