World Liberty Financial began burning tokens this week as its cryptocurrency continued sliding from launch day highs. The Trump family-backed project removed 47 million WLFI tokens from circulation on Wednesday.

🦅 New Governance Proposal is live

We’re proposing that 100% of fees earned by WLFI’s protocol-owned liquidity (POL) be used for buyback & burn of $WLFI.

This means every trade = fewer tokens in circulation.

Read the full proposal 👉 https://t.co/k8JPGySRoH

— WLFI (@worldlibertyfi) September 1, 2025

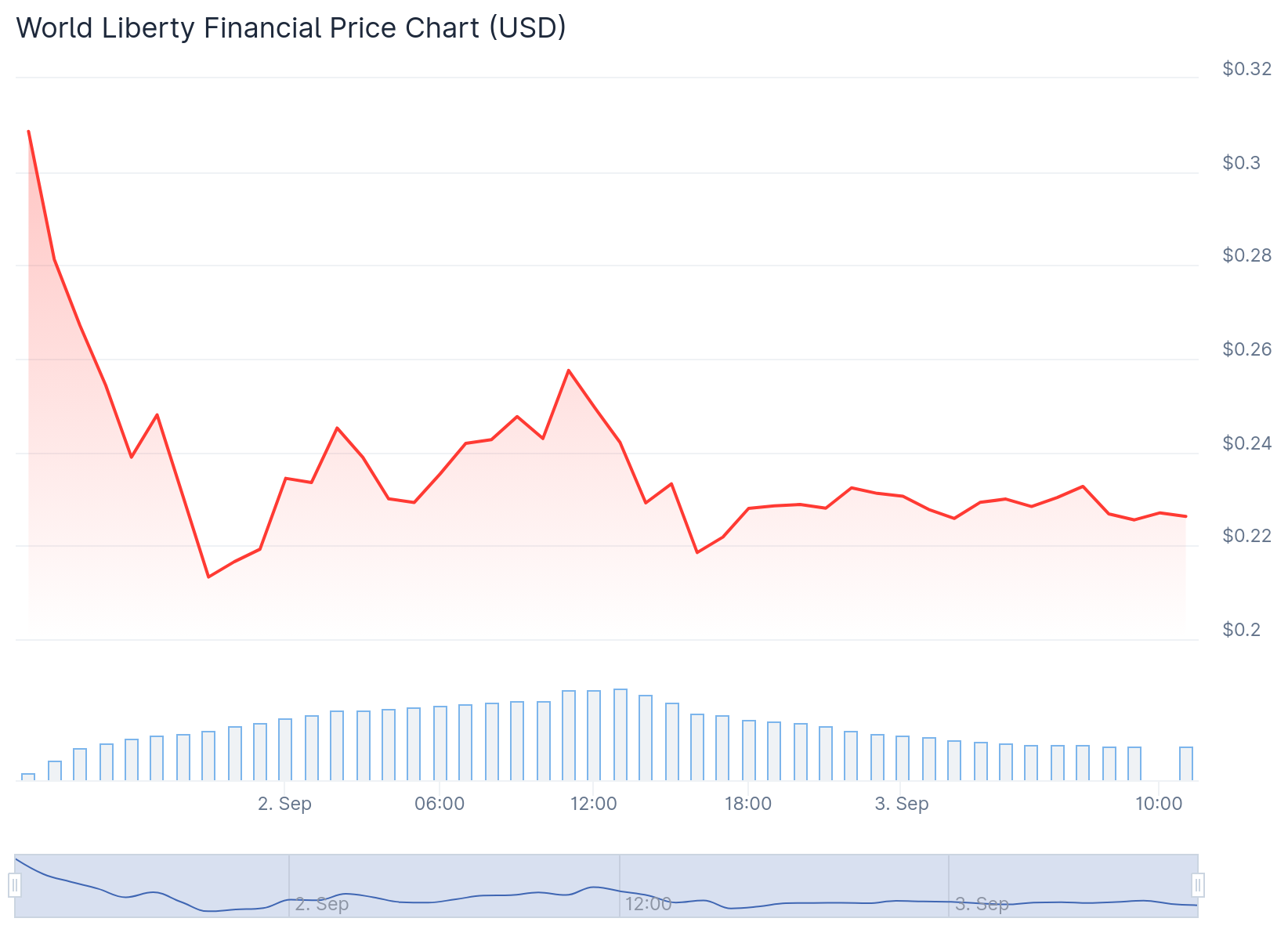

The burn comes after WLFI’s rocky public trading debut on Monday. The token hit a peak of $0.331 but has since dropped to around 23 cents.

Onchain data from Lookonchain confirmed the burn transaction. The 47 million tokens were sent to a burn wallet on September 2nd.

WLFI(@worldlibertyfi) burned 47M $WLFI($11.34M) 8 hours ago.https://t.co/6RFU5aD933 pic.twitter.com/Jd0M3qgvY0

— Lookonchain (@lookonchain) September 3, 2025

The burned tokens represent 0.19% of WLFI’s circulating supply. Around 24.66 billion tokens are currently unlocked from the original 100 billion total supply.

Token burns permanently remove coins from circulation. Projects use this method to tighten supply and potentially boost remaining token values.

World Liberty Financial proposed a formal buyback and burn program on Tuesday. The plan would use fees collected from Ethereum, BNB Chain, and Solana liquidity pools to purchase WLFI tokens.

The project claims this approach would increase ownership percentages for long-term holders. It would also remove tokens from circulation that are “held by participants not committed to WLFI’s long-term growth.”

The proposal has received approval from 133 respondents in early comments. An official governance vote has not yet occurred.

Short sellers contributed to WLFI’s price decline after launch. The token dropped about 36% from its high to a low of $0.210 before recovering slightly.

Some traders flagged potential insider activity around WLFI’s launch. A user called StarPlatinumSOL posted wallet analysis suggesting certain holders sold tokens before the broader market downturn.

Critics also targeted Eric Trump on social media. Commenters accused him of promoting a project that quickly lost value after launch.

One trader moved $3 million in USDC to Hyperliquid specifically to short WLFI. The large short position was tracked by onchain analytics and shared widely on social platforms.

Multiple users described WLFI as a “pump and dump scam” in social media replies. The World Liberty Financial team has not directly addressed these accusations.

Andrew Tate showed continued confidence in WLFI despite earlier losses. His previous long position was liquidated for $67,500 on Tuesday.

Tate immediately opened another long position after the liquidation. Blockchain analytics firm Lookonchain confirmed the new trade.

The token launch also drove Ethereum gas fees higher. A $200 transfer cost around $50 in fees during peak trading activity.

Industry observers see WLFI’s volatile debut as evidence that crypto markets still need maturation. Kevin Rusher from RAAC said celebrity tokens and short-term hype damage trust in cryptocurrency.

WLFI currently trades at $0.229 according to recent data. The token remains down over 31% from its launch day peak.

The post World Liberty Financial (WLFI) Price: Drops as Project Burns 47 Million Tokens Following Launch appeared first on CoinCentral.

Also read: Crypto et aviation : Emirates choisit le XRP pour 2026