VivoPower International has announced plans to expand its XRP treasury through a mining swap strategy. The company will use its proof-of-work mining unit, Caret Digital, to mine assets that will be directly swapped into XRP tokens.

VivoPower has expanded its mining fleet and will swap tokens into $XRP at a 65% discount. Full Story Below 👇https://t.co/xDozUc5Dm2

— Blockonomi (@blockonomi) September 17, 2025

This approach allows VivoPower to accumulate XRP at a favorable cost basis. The company secured bulk discounts on additional mining rigs to scale its operations.

VivoPower first announced XRP treasury plans in May 2025. The firm became one of the first publicly traded companies to adopt this strategy. It raised $121 million for its initial entry into XRP holdings.

The company has pledged to dynamically manage allocations between direct purchases, mining swaps, and equity exposure. This multi-pronged approach positions VivoPower as a potential major corporate holder of XRP.

XRP open interest has recovered following recent institutional activity. Derivatives data shows open interest rose to $8.45 billion from $7.7 billion.

The rebound comes after a sharp 30% decline in August that brought open interest down from previous highs. Rising open interest typically indicates renewed speculative activity and trader conviction.

VivoPower has established multiple partnerships to maximize returns on its XRP holdings. The company unveiled plans to purchase $100 million worth of Ripple shares last month.

The equity acquisition would give VivoPower an effective cost of $0.47 per XRP token. This represents a discount to current market prices.

The firm announced a $30 million pilot program with Doppler Finance earlier this month. This partnership deploys XRP into structured yield strategies designed for institutional investors. The deal could scale up to $200 million depending on performance results.

A Nasdaq-listed XRP treasury company, @Vivo_Power , will deploy $30M with Doppler Finance as the first stage of its planned $200M XRP treasury yield program.

Doppler Finance is setting the institutional standard for XRPfi.

Stop Holding, Start Earning

Use Doppler, Earn Yields pic.twitter.com/HcsJUXquCo

— Doppler Finance (@doppler_fi) September 2, 2025

VivoPower also secured a partnership with Flare Networks. This collaboration involves deploying $100 million worth of XRP onto the layer-1 blockchain. The partnership aims to use Flare’s decentralized finance protocols to generate additional revenue streams.

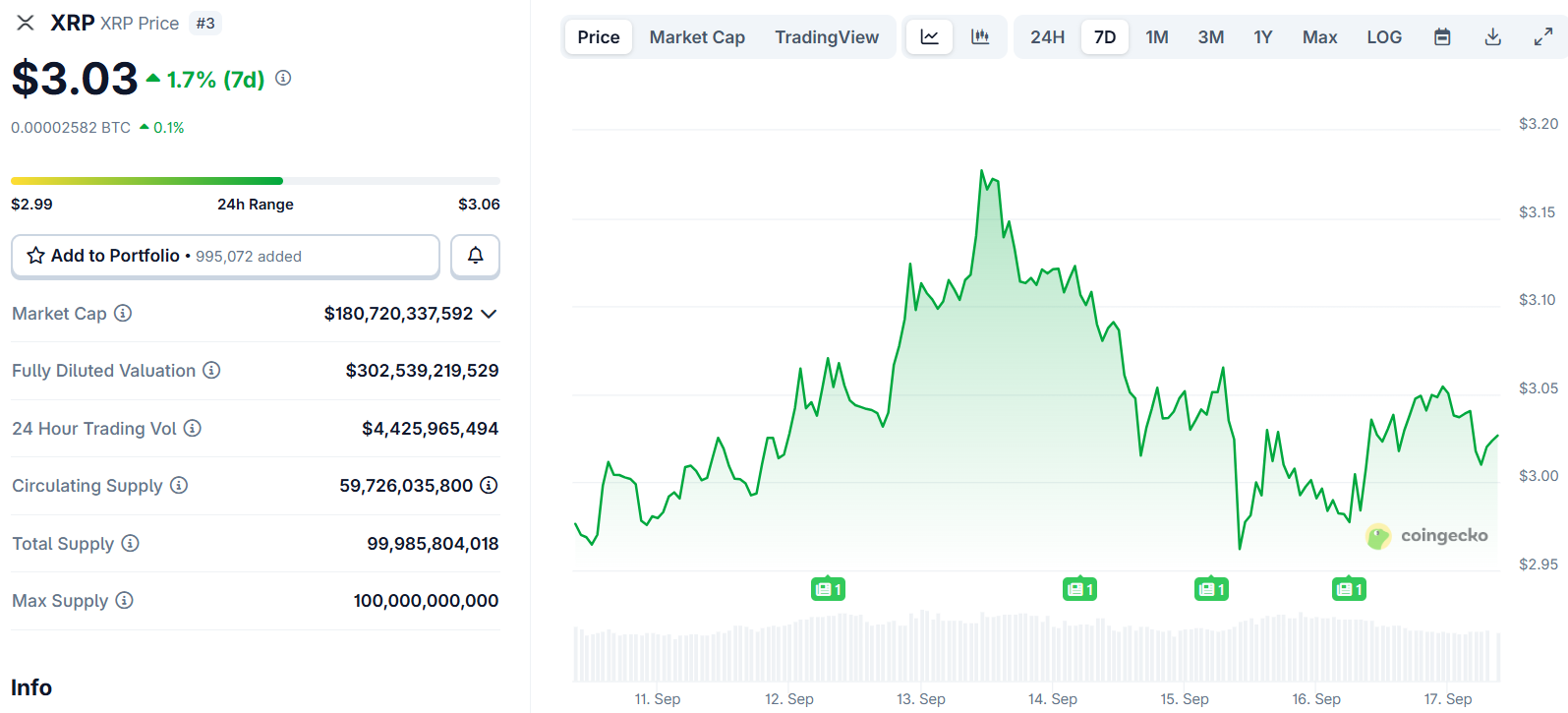

XRP currently trades at $3.04 and holds above key support levels. The token maintains support at $3.00 with deeper support near $2.74.

Trading data shows XRP consolidating between $2.98 and $3.10. The price remains above the 200-day moving average at $2.51, indicating long-term strength.

The MACD indicator recently turned bullish, suggesting potential momentum building. However, XRP continues to struggle below the 50-day moving average.

Volume remains moderate, indicating buyer presence without full market commitment. A breakout above $3.10 could target the $3.50 level.

Failure to hold the $3.00 support level might result in a decline toward $2.74. Price predictions suggest minor movement toward $2.98 before potential recovery attempts.

Community sentiment remains overwhelmingly positive with 88% of 1.5 million voters expecting further upside. Only 12% of voters maintain a bearish outlook on XRP’s near-term prospects.

September performance shows 9.55% gains for XRP, indicating recovery from August’s 8.15% decline. The monthly gains suggest the token is emerging from its consolidation phase as long as it maintains the $3.00 support level.

The post XRP Price: VivoPower’s $200M Plan Sparks Institutional Interest appeared first on CoinCentral.

Also read: 8.3 Million Bitcoin Will Be Considered ‘Illiquid’ By 2032: Fidelity Report