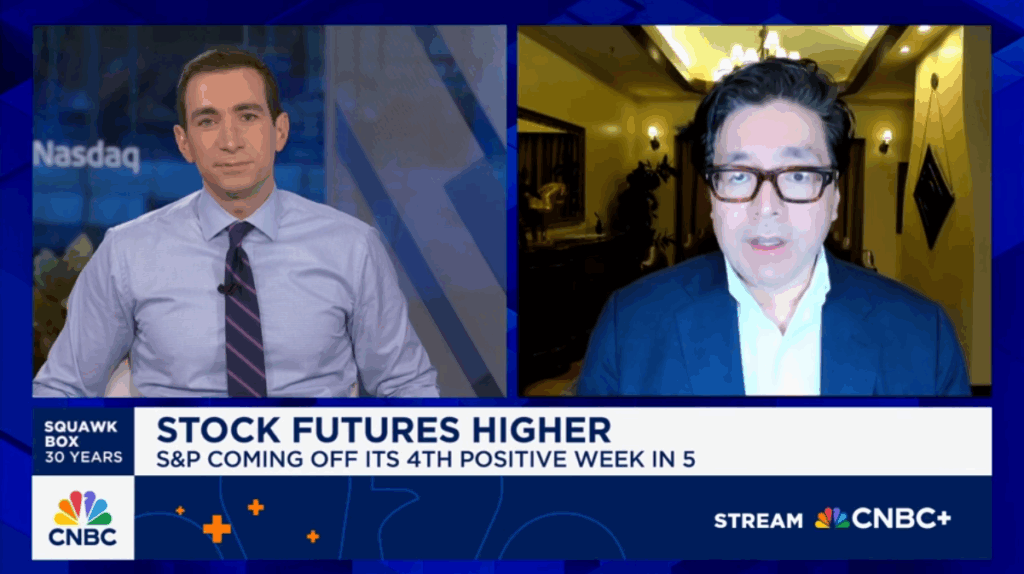

Financial analyst Tom Lee told CNBC that Bitcoin could hit $200,000 by the end of 2025, pointing to the U.S. Federal Reserve’s expected interest rate cut as a big driver.

With the Fed’s next meeting on September 17, 2025, Lee said looser money policies tend to enhance cryptocurrencies like Bitcoin and Ethereum. As of September 9, 2025, Bitcoin’s trading at $112,776, according to CoinGecko.

Lee’s bold call comes as President Donald Trump pushes the Fed to lower rates, which are currently between 4.25% and 4.50%. Analysts at Standard Chartered expect a half-point cut next week. Lower rates often help assets like stocks and crypto by putting more money into the market.

Lee’s banking on this trend, though he’s been off before, in 2018, he predicted Bitcoin would reach $125,000 by 2022, but it only hit $48,222 before crashing to $16,300 after a 2021 peak of $69,044. Still, Bitcoin’s been strong this year, overtaking Alphabet’s market cap in June at $2.128 trillion, making it the sixth most valuable asset globally. Other experts agree with Lee’s optimism.

Bitwise’s Matt Hougan also predicted a $200,000 Bitcoin by year end back in May, citing big institutional buying and ETF investments. Robert Kiyosaki, the Rich Dad Poor Dad author, said in April that Bitcoin could land between $180,000 and $200,000, thanks to growing interest from big investors and economic shifts.

While Lee’s track record isn’t perfect, the expected rate cut and strong market trends have many thinking Bitcoin’s got room to climb.

Also read: Will BlackRock’s 58% Bitcoin ETF share dictate BTC’s next move?