When Stablecoin L1 Plasma goes live, billions in liquidity follow, putting new pressure on XPL’s first-month trading range.

Plasma, a Bitfinex-backed Layer 1 blockchain built for stablecoins, launched its mainnet beta and native token XPL on Sept. 25. The rollout included integrations with major DeFi protocols and immediate listings on leading exchanges, signaling a strong market entry.

The new global financial system is here. pic.twitter.com/pkpXia30FS

— Plasma (@PlasmaFDN) September 25, 2025

At launch, XPL traded just above $1, but price action showed sharp swings as early buyers tested liquidity.

Stablecoin inflows on the chain picked up quickly, spreading activity across Uniswap, PancakeSwap, and centralized exchanges such as Binance, OKX, Bitget, and Bitfinex.

Plasma’s positioning is precise: it wants to be a high-throughput, low-cost “money chain” designed to host stablecoin activity at scale. By securing both DeFi and centralized exchange partners on day one, the project set the stage for rapid adoption.

Plasma’s mainnet debut came with heavy backing from the stablecoin sector. The project says billions in liquidity are already committed through partners like Aave, Ethena, Fluid, and Euler.

At the same time, tokenomics set a clear framework: There is a total supply of 10 billion XPL, with about 1.8 billion circulating at launch. Public-sale buyers who paid $0.05 earlier this year briefly saw 20x paper gains as trading opened.

On-chain data highlights how Plasma is leaning into a “liquidity first” strategy. DefiLlama shows roughly $2.05Bn in stablecoins active on the network, while decentralized exchange activity remains light.

Daily fees were modest, around $4,200, underscoring that usage beyond stablecoin rails will take time to develop.

To widen its appeal, the ecosystem launched products designed to create demand. Swarm, a regulated DeFi platform, plans to list nine tokenized equities, including Apple, Microsoft, Tesla, and MicroStrategy, for 24/7 trading against stablecoins.

Plasma also introduced Plasma One, a “stablecoin-native neobank” targeting regions such as the Middle East, where dollar-backed digital assets already see heavy use.

Introducing Plasma One: the one app for your money. pic.twitter.com/5IgcCon5g8

— Plasma (@PlasmaFDN) September 22, 2025

Still, valuation and float remain key points of debate. The launch implied a $10Bn fully diluted value, but not all reported circulating tokens will be available immediately.

US sale participants, for example, won’t receive allocations until July 2026, meaning the near-term float is tighter than headline figures suggest.

Analysts say the project’s focus on stablecoins positions it as a proxy for broader market trends.

“Large crypto opportunities like stablecoins always draw attention,” one Delphi Digital researcher noted, adding that traders view Plasma as a way to tap into Tether’s growing role in digital finance.

Tomorrow $XPL goes live with almost poetic timing

(Tether raising $20B at a $500B valuation, lots of onchain runners, and speculative capital apeing into new launches despite a shaky broader market.)

I think Plasma has a chance to be a massive cook.

Let me break down why I…

— Simon (@simononchain) September 24, 2025

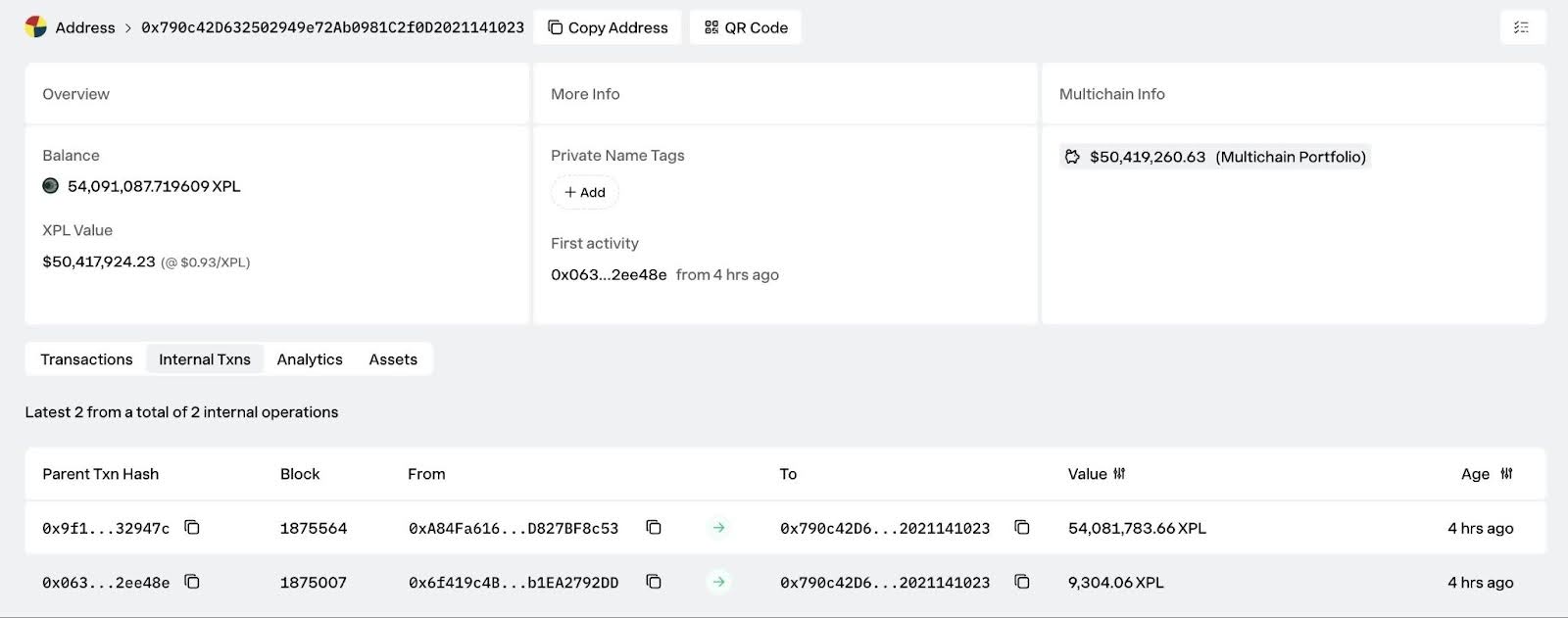

A crypto whale has booked one of the fastest gains of the year on Plasma’s debut. On-chain data from Lookonchain shows that wallet 0x790c deposited $50M in USDT during the project’s public sale, securing a $2.7M allocation at $0.05 per token.

Whale 0x790c deposited 50M $USDT into #Plasma and secured a $2.7M public sale allocation.

He bought 54.09M $XPL($50.4M now) at $0.05 and is now sitting on an unrealized profit of over $47.7M!

Address:

0x790c42D632502949e72Ab0981C2f0D2021141023 pic.twitter.com/PHV45xKpKs— Lookonchain (@lookonchain) September 25, 2025

The investor received 54.09M XPL, now worth about $50.4M with the token trading between $0.93 and $1.14, an unrealized profit of $47.7M within hours of launch.

The windfall highlights the surge of capital into Plasma as stablecoin liquidity flows into the network. Analysts say whale-sized entries can drive sharp price swings and reflect early institutional interest in the chain.

XPL’s perpetual contract chart shows why traders are paying attention. Price broke out from the $0.70 zone to $1.16 in a single session, with buyers stepping in around $0.75–$0.80.

R4ped by my other longs. Rescued by $XPL. Because of this I think $3-5 $XPL seems fair. https://t.co/BEuFgYi7GE pic.twitter.com/Y5H7iP54kz

— VikingXBT (@VikingXBT) September 25, 2025

Each resistance level at $0.90 and $1.00 gave way after short consolidations, a textbook sign of bullish momentum. Volume spikes near the $0.90 breakout suggest large players were involved, echoing the earlier $50M whale deposit.

The move above $1.00 carried weight as a psychological barrier, confirming trend strength. If momentum continues, chart targets are $1.50 and $2.00, with speculative talk of $3–$5 in the medium term. Trader VikingXBT wrote on X: “Rescued by $XPL… I think $3–$5 seems fair.”

Still, vertical rallies rarely run unchecked. Profit-taking could spark pullbacks, with immediate support at $1.00 and then $0.90. Holding these zones would keep bulls in control.

For now, XPL’s breakout reflects a mix of whale backing, fresh liquidity, and speculative hype around Plasma’s mainnet launch. Volatility is expected, but the broader trend remains firmly upward.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Plasma TVL Erupts After Mainnet: XPL Price Prediction For October? appeared first on 99Bitcoins.

Also read: Marina Protocol Quiz Answer Today 26 September 2025: Earn Coins