With Bitcoin price trading around $116,325 on September 17, 2025, market watchers are debating whether the cryptocurrency could follow historical patterns and surge toward $210,000 in the months ahead.

In September 2024, Bitcoin experienced an 80% rally in the aftermath of a Fed rate cut. If history repeats, similar momentum could propel the BTC price to unprecedented levels. A recent post circulating in crypto circles highlighted this trend, noting, “A similar move would take Bitcoin to $210K per coin.”

Bitcoin soared 80% after the 2024 Fed rate cut—could history repeat and send BTC toward $210K? Source:@Bitcoinsensus via X

Research from the Kobeissi Letter, which analyzed 20 rate cut cycles since 1980, found that stocks typically gained an average of 14% in the year following such decisions. While Bitcoin is not directly tied to equities, its performance has historically shown correlations with risk assets like stocks and gold during periods of monetary easing.

Institutional demand continues to strengthen Bitcoin’s bullish outlook. On September 16, 2025, a single wallet reportedly acquired $680 million worth of BTC, adding to optimism that deep-pocketed buyers see value at current levels.

A massive $680M Bitcoin purchase signals big-money confidence in what’s ahead for BTC. Source: @Vivek4real via X

At the same time, U.S.-listed Bitcoin ETFs have seen consistent inflows, signaling confidence from traditional finance. These developments suggest that institutional adoption could act as a catalyst, potentially accelerating Bitcoin’s path toward new all-time highs.

However, analysts also caution that historical volatility following rate decisions remains a risk. Out of 22 rate cuts studied, 11 were followed by monthly stock declines—highlighting that short-term turbulence could still test investor sentiment.

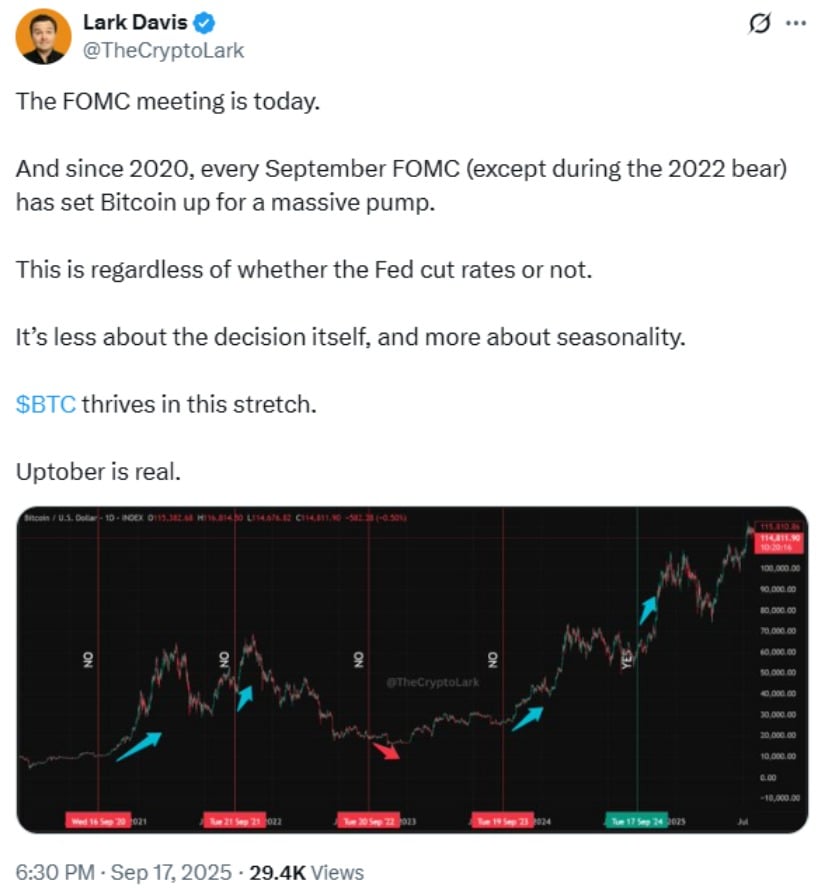

Well-known crypto analyst Lark Davis pointed out that Bitcoin has shown a pattern of strong gains during the September FOMC and subsequent October trading sessions since 2020, with the notable exception of 2022’s bear market. According to his analysis, BTC climbed from $10,000 in 2020 to $64,000 in 2024, often during the post-September window.

Since 2020, September FOMC meetings have fueled Bitcoin rallies—seasonality proves Uptober is real. Source: @TheCryptoLark via X

Beyond Fed policy, Davis emphasized the role of “Uptober” seasonality. Historically, Bitcoin has delivered an average return of +22.9% in October, fueled by year-end liquidity flows and reduced selling pressure. This seasonal boost could complement the Fed-driven narrative, reinforcing the bullish setup.

Not all experts agree that the Fed’s rate cuts are the primary driver of Bitcoin’s price action. A 2019 peer-reviewed study in Finance Research Letters found that FOMC announcements had only a modest +0.26% average effect on Bitcoin. Instead, the study suggested that market psychology, cyclical liquidity patterns, and broader adoption trends play a more significant role.

This view highlights the intricate ballet of variables determining the price of Bitcoin today. While macroeconomic policy creates the environment, mood and habit patterns typically determine the magnitude of crypto booms.

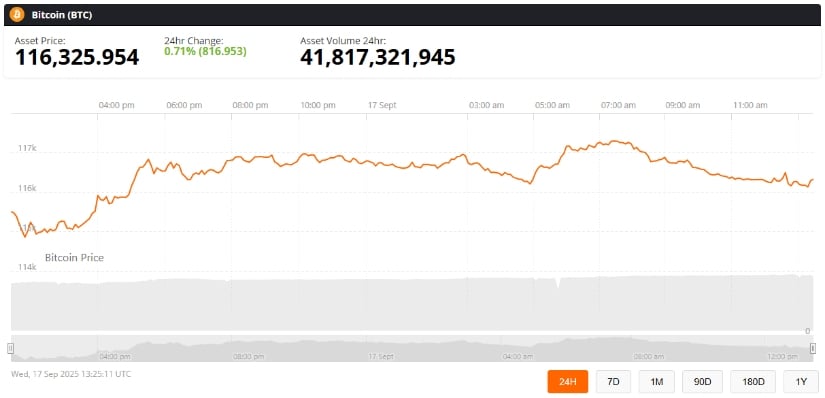

The price of Bitcoin at present, according to Brave New Coin, is $116,325 with a modest 0.71% growth in the last 24 hours. The trading volume has crossed over $41.8 billion, which indicates sustained strong market action.

Bitcoin (BTC) was trading at around $116,325, up 0.71% in the last 24 hours at press time. Source: Bitcoin Price via Brave New Coin

With institutional buying, seasonality bullishness, and macroeconomic tailwinds all in sync, the next Bitcoin movement may be decisive. As much as short-term volatility risks testing investors, the long-term case for Bitcoin remains intact, with analysts not ruling out a rally to $210,000 if historical trends are anything to go by.

Also read: Bitcoin’s Price Recovery Revives Profit Margins For Short-Term Whales, Rally To Extend?