The token, which has experienced sharp swings between highs and lows throughout the year, is now showing resilience by consolidating above key support ranges.

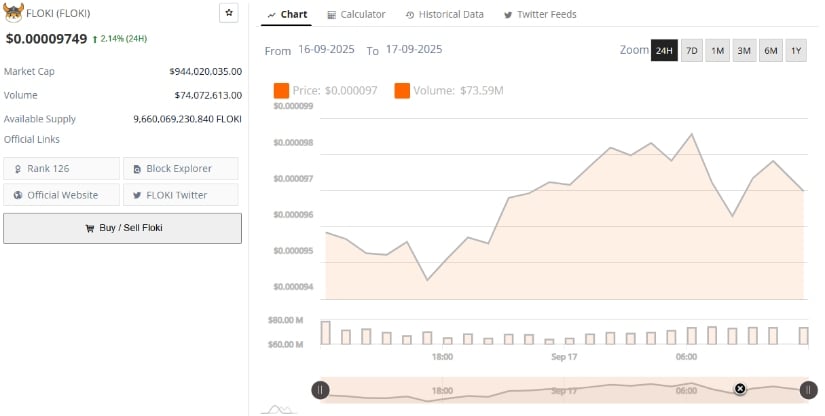

Market sentiment remains cautiously optimistic as buyers aim to build on recent gains and prepare for a potential rally toward the $0.00025 target before year’s end. At the time of writing, the token trades at $0.00009749, marking a 2.14% increase in the past 24 hours.

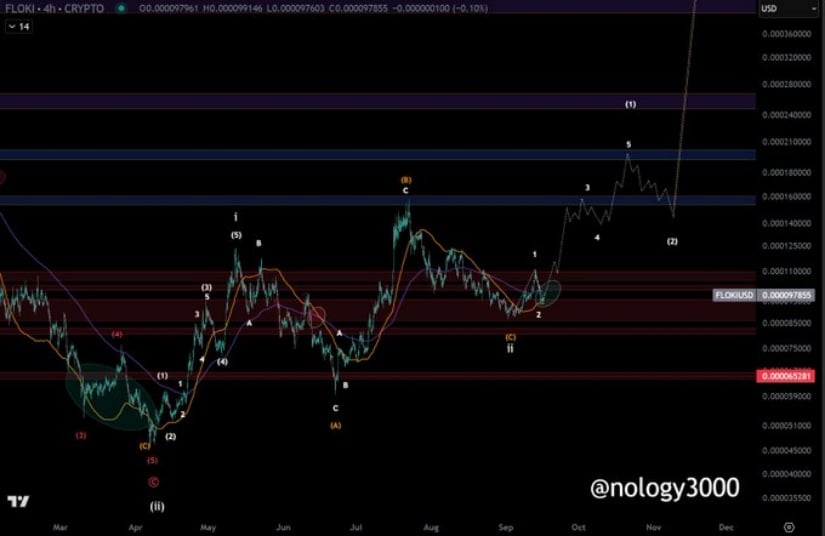

Earlier expectations of an extended impulse wave for the coin did not fully materialize, with the token instead entering a corrective cycle. This shift in structure has not erased bullish potential, as buyers successfully defended critical retracement zones in recent weeks. The price floor established between $0.000075 and $0.000085 has provided stability, giving the coin a chance to reset its structure and maintain upward potential.

Source: X

Market observers note that sustained defense of this range is essential, as losing it could force a broader reassessment of the trend. By continuing to respect these thresholds, Floki crypto has managed to hold investor confidence and retain a constructive outlook. Momentum rebuilding from current levels would allow the token to establish higher lows and keep the door open for renewed upside pressure.

This cautious recovery underscores the importance of short-term support zones, as they provide the foundation for any extended rally. If momentum strengthens further, price targets beyond $0.00012 and toward $0.00014 may become achievable in the near term, paving the way for the $0.00025 objective highlighted by market watchers.

Current market data shows Floki crypto trading at $0.00009749 with a market capitalization of approximately $944 million, ranking it 126th overall. Trading volumes in the past 24 hours reached $74 million, highlighting sustained liquidity despite broader market volatility. The circulating supply stands at 9.66 trillion tokens, reflecting wide distribution and consistent participation across exchanges.

Source: BraveNewCoin

Consolidation below the $0.00010 mark has created a balancing zone where both buyers and sellers are actively competing for control. This phase of accumulation indicates that market participants are positioning themselves for the next significant move. Liquidity inflows suggest that demand remains steady, preventing deeper retracements and allowing the coin to stabilize around current levels.

On TradingView, FLOKI trades near $0.00009654 after a mild intraday decline of 1.47%. The broader trend over recent months highlights high volatility, with swings from lows near $0.000045 to highs above $0.000157. This dynamic illustrates both the potential upside and the challenges in sustaining long-term rallies without significant consolidation.

Source: TradingView

Technical indicators show cautious improvement. The Chaikin Money Flow (CMF) registers a modestly positive reading at 0.06, reflecting slight net inflows that suggest accumulation is underway. Meanwhile, the MACD remains close to its signal line, with a small positive histogram, pointing to tentative bullish momentum that is not yet fully developed.

Also read: Bitcoin (BTC) Price Prediction: Bitcoin Eyes $210K as Fed Rate Cut Echoes 80% Rally History